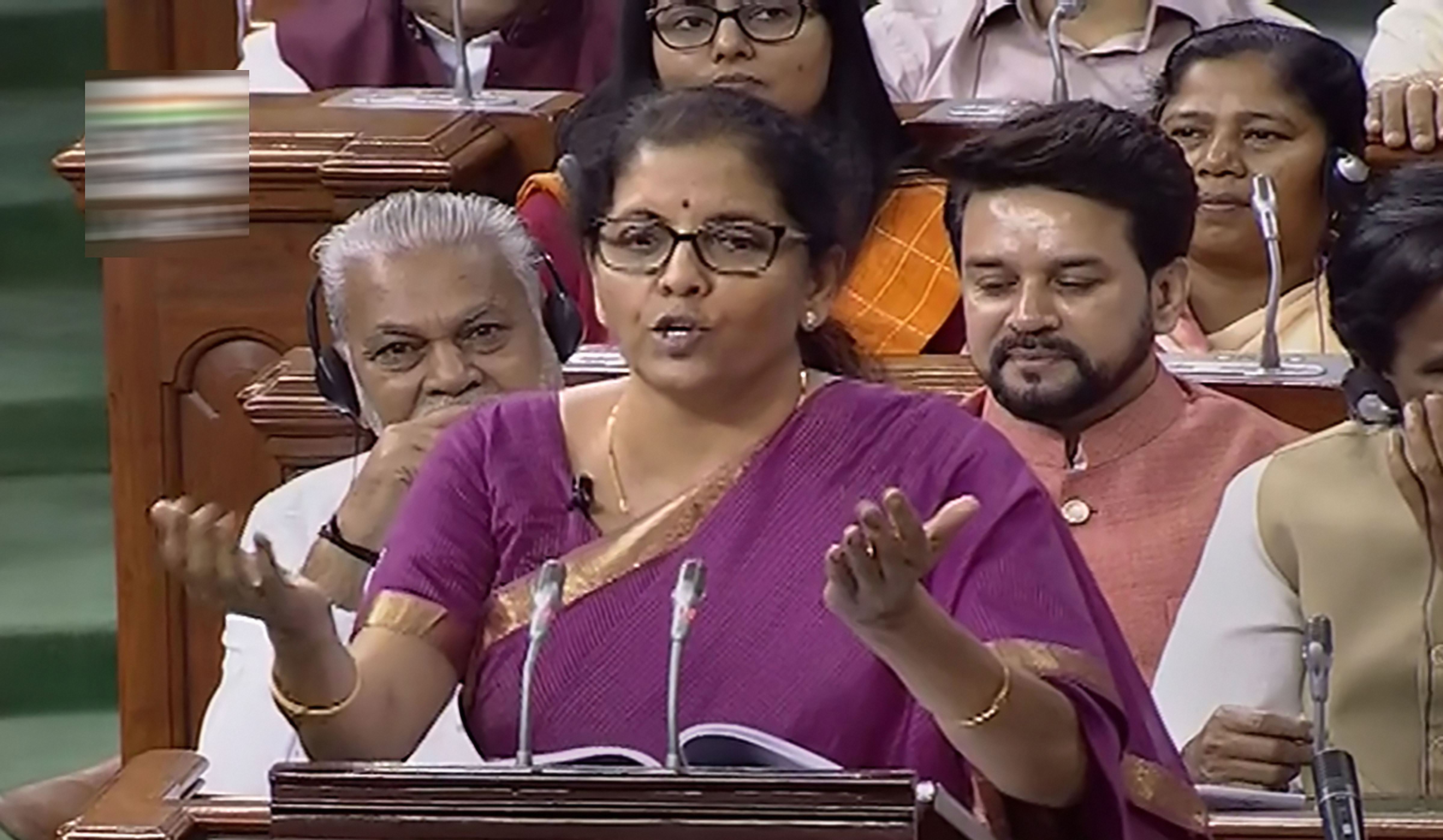

Finance minister Nirmala Sitharaman made an impressive debut in her new portfolio, unveiling a Budget which clearly seeks to address a number of pain points in the economy, while setting out a broad road map for the future. Sitharaman made quite a break from the past, replacing the traditional suitcase which contains the Budget papers with a smart red folder—the traditional ‘bahi-khata’—prominently displaying the national emblem. The FM’s Budget speech was lengthy, lasting over two hours, and attempted to touch upon several areas as it became clear that the Modi 2.0 government also wanted to lay down a broad vision statement for what the speech suggested was a “stable New India” brimming with hope and desire.

Sitharaman’s Budget focussed on both urban and rural India and sought to address the growing concerns around the banking sector and the non-banking financial companies (NBFC) crisis. Alongside, there were quite a few sops for the affordable housing sector, a focus on infrastructure, initiatives on disinvestment (including a higher target of ₹1.05 lakh crore for FY20), steps around the capital markets, the bond markets, boosting startups and a big push for the electric vehicles segment in line with the government’s agenda. The fiscal deficit target for FY20 was also lowered to 3.3%.

But the markets, which tanked sharply as the minister finished her speech, were clearly left unimpressed, particularly because of a major hit for high net-worth individuals. The Budget hiked the surcharge on individuals having taxable income from ₹2 crore to ₹5 crore, and ₹5 crore and above. Consequently, the effective tax rates for these two categories would increase by around 3 per cent and 7 per cent respectively. The markets fell sharply as a result, and at one stage the S&P BSE Sensex was down over 300 points.

Sitharaman also struck another blow, increasing duties on petrol and diesel in a move that is bound to be seen as hurting consumers. “Crude prices have softened from their highs. This gives me a room to review excise duty and cess on petrol and diesel,” the minister said in her speech, announcing an increase in special additional excise duty and road and infrastructure cess each by ₹1 a litre on petrol and diesel. She also announced an increase in the customs duty on gold and other precious metals from 10 per cent to 12.5 per cent.

This article was originally published at `www.fortuneindia.com`. Republished here with permission.

Our economy was at approximately $1.85 trillion when we formed the government in 2014. Within 5 years it has reached $2.7 trillion. Hence, it is well within our capacity to reach $5 trillion in the next few years

Nirmala Sitharaman, Finance Minister

On the macro front, however, the FM’s maiden Budget does contain some bold and important steps. On the capital markets side, the minimum public shareholding for listed companies is being sought to be raised from the current 25 per cent to 35 per cent, the know your customer (KYC) norms for foreign portfolio investors (FPIs) are to be streamlined and made simpler to make foreign investments hassle-free, and a separate trading platform—a social stock exchange—is to be set up under Sebi to facilitate fund-raising by social sector enterprises and voluntary organisations working for a particular social objective. The NRI portfolio scheme route is also being harmonised with the foreign portfolio investment route.

While there was intense speculation about what the Budget would do for the beleaguered banking and financial sector, the FM announced a hefty ₹70,000 crore recapitalisation plan for public sector banks. The banks, the minister said, were being recapitalised since legacy issues had been addressed. Credit growth was at 13.8 per cent now and the financial gains from cleaning of the banking system are now “amply visible”. Non-performing assets (NPAs) of commercial banks, Sitharaman pointed out, have reduced by over ₹1 lakh crore over the last year, and record recovery of over ₹4 lakh crore due to the Insolvency and Bankruptcy Code (IBC) and other measures have been effected over the last four years, provision coverage ratio is now at its highest in seven years, and domestic credit growth has risen to 13.8 per cent. The government has smoothly carried out consolidation, reducing the number of public sector banks by eight. At the same time, as many as six public sector banks have been enabled to come out of the Prompt Corrective Action framework, she said. The minister said the regulations around NBFCs will also be tightened so that the Reserve Bank of India (RBI) has better oversight on them. The regulation of housing finance companies will also move to the RBI.

The Budget speech also focussed on the infrastructure sector (with a ₹100 lakh crore spending target over five years), talked about strengthening the corporate bond market and accessing overseas markets to fund the government’s borrowing requirements (an announcement which immediately sent bond yields crashing). On disinvestment too, apart from the increased target for the year, the minister said the government was considering bringing down its holding in select non-financial public sector companies to below 51 per cent in cases where it would retain control. Besides, the 51 per cent government holding level would include the stakes of government-controlled entities as well, going forward.

The tax proposals, the minister said, were aimed at stimulating growth, incentivising affordable housing, and encouraging startups by releasing entrepreneurial spirits. “It will also be geared towards promoting digital economy. I aim to simplify tax administration and bring greater transparency,” she said. One important step towards an easier and more transparent regime was the interchangeability of the PAN and Aadhaar cards which the minister announced, for filing of tax returns. The are other steps towards demonstration of India’s soft power through initiatives like Study in India, where overseas students would be invited to study in Indian educational institutions.

The Budget’s overall thrust is that of creating the foundations for a New India. Sitharaman’s maiden effort works well as a vision document, but the 3.3 per cent fiscal deficit target will serve as a reality check and entail a tight control on spending and, consequently, revenue generation. How that plays out will determine whether Budget 2019 was a statement of intent or something more than that.