Relaxation of FDI norms

The government will examine suggestions of further opening up of FDI in aviation, media (animation, AVGC) and the insurance sectors in consultation with all stakeholders. The budget allowed 100 per cent FDI for insurance intermediaries. Sitharaman also said that local sourcing norms will be eased for FDI in the single-brand retail sector.

The minister said FDI inflows in 2018-19 remained strong at $ 64.375 billion, marking a 6 per cent growth over the previous year.

Customs duty on petrol, diesel

The special additional excise duty and road and infrastructure cess has been increased Re 1 each per litre on petrol and diesel. The total increase is Rs 2 a litre.

PAN and Aadhaar interchangeability

Is the PAN card on its way out? An Aadhaar card can be used for the same purpose as a PAN number is used, the finance minister said.

'Mr Speaker, Sir, more than 120 Crore Indians now have Aadhaar,' Sitharaman said. 'Therefore, for ease and convenience of taxpayers, I propose to make PAN and Aadhaar interchangeable and allow those who do not have PAN to file Income Tax returns by simply quoting their Aadhaar number and also use it wherever they are required to quote PAN.'

Sitharaman also proposed issuing an Aadhaar Card to NRIs with Indian passports after their arrival in India without waiting for 180 days.

The highlights of the Union Budget:

Surcharge on the rich

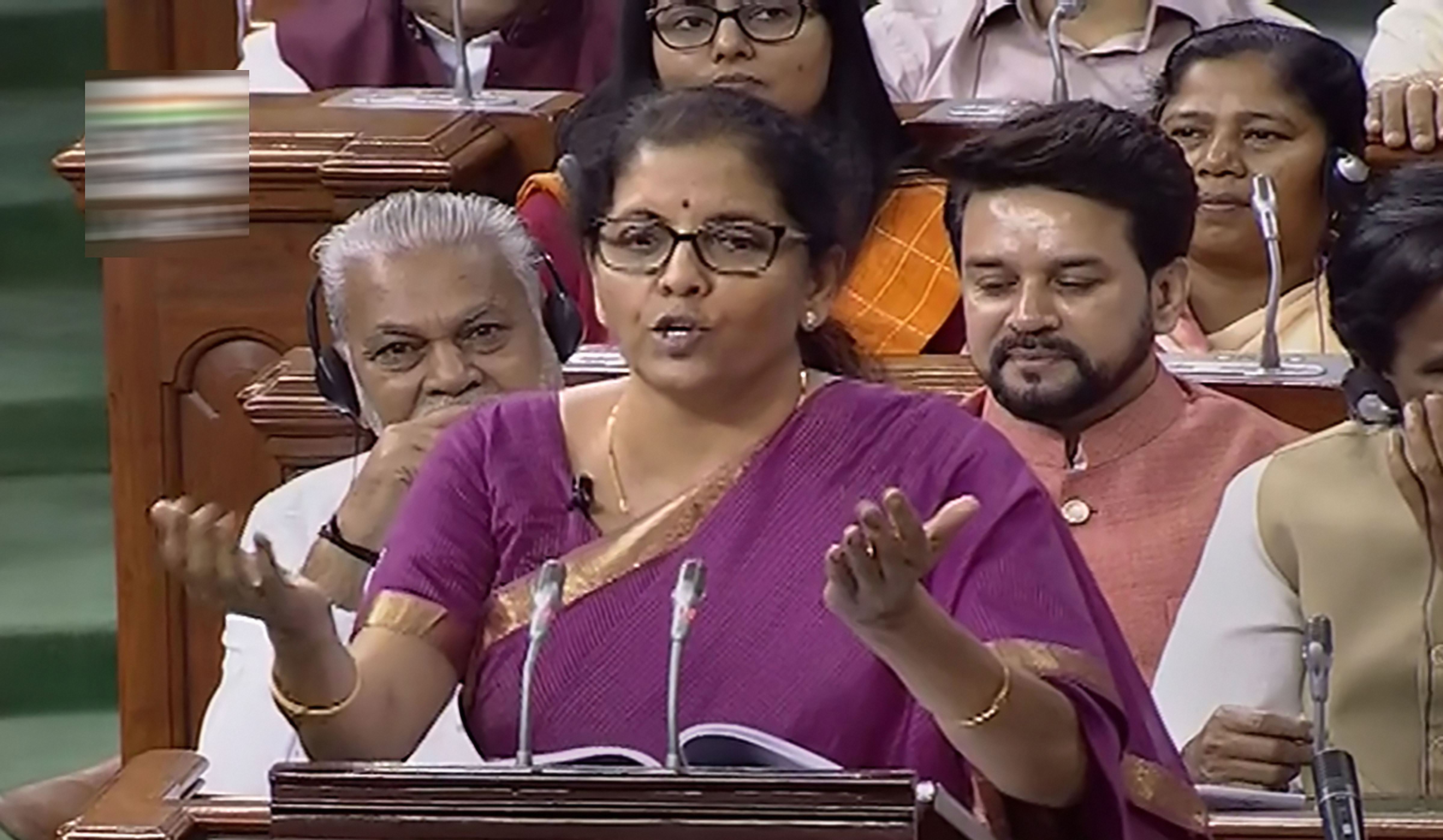

Finance minister Nirmala SItharaman said that in view of rising income levels, those in the highest income brackets need to contribute more to the nation’s development. 'I, therefore, propose to enhance surcharge on individuals having taxable income from `2 crore to `5 crore and `5 crore and above so that effective tax rates for these two categories will increase by around 3 % and 7 %, respectively.

Sitharaman did not announce any tax changes for the salaried class.

In the interim budget, Piyush Goyal had said that individual taxpayers with an annual taxable income up to Rs 5 lakh will get a rebate.

Public infrastructure land

Sitharaman said large public infrastructure can be built on land parcels held by central ministries and central public sector enterprises across the country. 'Through innovative instruments such as joint development and concession, public infrastructure and affordable housing will be taken up,' she said.

Corporate tax deduction

The government will look at a phase-wise reduction on corporate tax. 'Currently, the lower rate of 25 % is only applicable to companies having annual turnover up to Rs 250 Crore. I propose to widen this to include all companies having annual turnover up to Rs 400 crore. This will cover 99.3% of the companies. Now only 0.7% of companies will remain outside this rate,' the finance minister said.

'Angel' tax

Start-ups and their investors who file requisite declarations and provide information in their returns will not be subjected to any kind of scrutiny on valuations of share premiums, the budget said. The issue of establishing the identity of the investor and source of his funds will be resolved by putting in place a mechanism of e-verification. Funds raised by start-ups will not require any kind of scrutiny from the Income Tax Department, Sitharaman said.