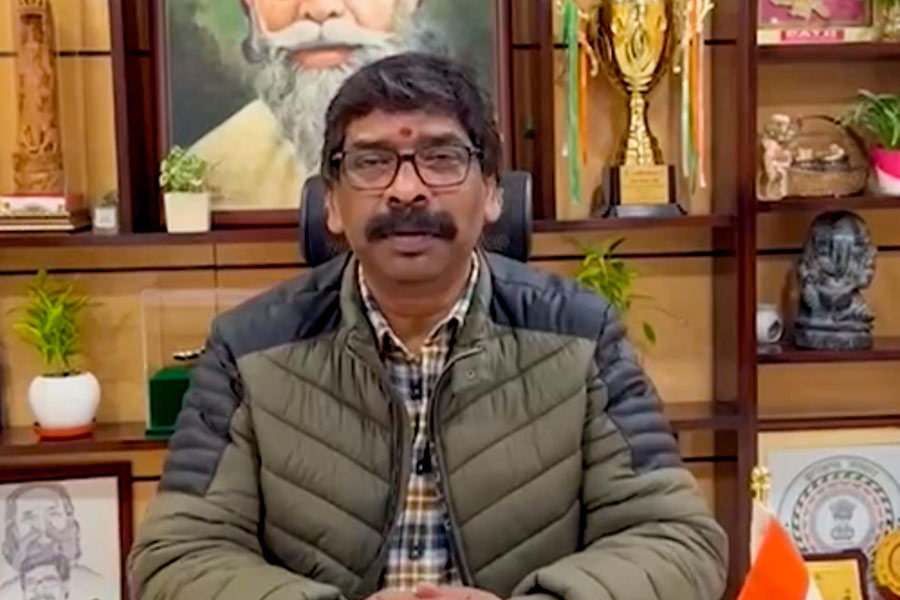

Stocks might be bullish but industrial growth, especially in Jharkhand, has been bearish for a while.

India’s industrial output growth slipped to 1.7 per cent in January this year, down from 7.5 per cent in the corresponding month a year ago, according to the Central Statistics Office data released on Tuesday.

In Jharkhand’s context, though the exact percentage is not available, various factors are at play. Mines and minerals have not seen a turnaround in recent years, forest resource-based firms have taken a big hit, housing and automobile sectors continue to be in the doldrums while growing unemployment has led to a dip in purchasing power, say experts.

The only silver linings in recent times are the profit posted by Tata Steel in the third quarter and a marriage season-fuelled growth in retail.

Prabal Sen, founder and former chair of entrepreneurship development centre at XLRI, explained no major sector — mines, automobile, housing — had optimistic tidings, which, coupled with fewer jobs, led to the decline in the index of industrial production (IIP). The IIP, which shows growth rates in different industry groups of the economy in a stipulated period, is computed and published by CSO on a monthly basis, he said.

Inder Agarwal, president of Adityapur Small Industries Association (ASIA), the largest and the oldest industry outfit of the state, agreed with Sen. “The automobile sector isn’t doing well these past few months. Sale of vehicles produced by Tata Motors and other manufacturers Ashok Leyland and Mahindra & Mahindra is down since December. Tata Motors even went for block closure for a few days in December as their inventory was not cleared. But, this is temporary, we believe things will change for the better in the new fiscal,” he said.

Agarwal went on to admit that industries in Adityapur were hit by the auto slowdown, as 80 per cent were ancillaries dependent on Tata Motors orders. “But, the situation is not alarming, otherwise the industrial area would have seen large-scale retrenchments,” he said.

Bharat Vasani, vice-president (trade and commerce) of Singhbhum Chamber of Commerce and Industry (SCCI), the largest trade body of Kolhan, said the economy was going through big swings propelled by global factors. “We see a good month followed by a dull one. Also, there is hardly any activity in infrastructure and housing sectors, in part due to extremely tight credit conditions set by banks with high rates of interest. The automobile industry is seeing a slowdown with high inventories,” he said.

He said all eyes were on Lok Sabha polls with a strong government ready to push economic activity and take risks.

Suresh Sonthalia, former SCCI president and national secretary of Confederation of All India Traders (CAIT), the apex trading community outfit, said the retail sector had seen some growth in the last couple of months, primarily due to the marriage season. But heavy vehicles, one of the economic mainstays of this region, had taken a hit after the Centre increased maximum load carrying capacity by 20-25 per cent last year, he said.

General secretary of Intuc-affiliated Tata Workers’ Union Satish Singh said steel business was doing good. “Tata Steel’s profit and productivity grew in the last quarter. The company is in sync with its annual business plan,” he said, but admitted Tata Motors had been hit.

“All nationalised banks have stopped financing heavy commercial vehicles because of existing huge non-performing assets,” he said.