There is something rotten in the central government’s accounts — and the situation has been allowed to fester for a very long time with no real attempt to sort out the mess.

Last month, the auditor of the Centre’s accounts — the Comptroller and Auditor General (CAG) — came out with a report that revealed just how the Narendra Modi government and its accountants have carved out nooks that serve as secret repositories of public money.

The money has been diverted from some well-funded programmes and

Parliament-approved cash troves for purposes that the government refuses to reveal even as it continues to cock a snook at the CAG, which has made several caustic comments about the government’s bookkeeping practices in earlier reports.

A 27-page chapter titled “Quality of Accounts and Financial Reporting Practices” in the CAG’s report number 21 of 2023 — pertaining to the central government’s accounts for the financial year 2021-22 — shines a light on accounting shenanigans that will leave any private conglomerate and its auditors aghast at the sheer audacity of the sharp practices in central government accounts.

Levies and cesses collected by the Centre — which it is not obligated to share with

the states — lie idle or are spirited away to other causes, violating the terms under which the cesses were supposed to be collected in the first place.

A cess is an additional tax levied by the government for a specific purpose and initially flows into the Consolidated Fund of India (CFI).

There are numerous instances of improper accounting, funds being parked outside the government’s accounts, and the payment obligations of the Centre being deliberately suppressed to show lower liability or hidden in a forest of footnotes.

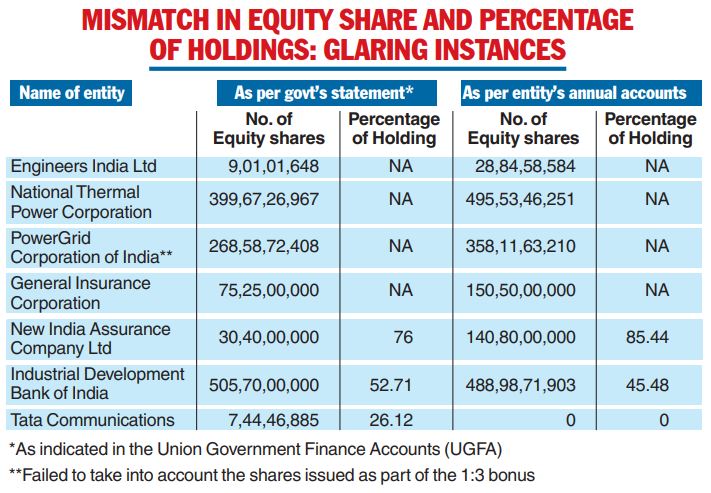

The government does not know — or does not feel obliged to reveal — how much it actually invested in the equity of state-owned companies and collected by way of dividends from them in the documents that it has presented to the CAG.

There is also a startling mismatch between the number of equity shares that the government holds in state-owned enterprises as revealed in the Union government’s financial accounts statement presented to the CAG and the annual accounts presented by the very same entities, many of which are listed on the stock markets.

The report reveals how one ministry shoves out another when they sup at the same cash trove that they are expected to share on a proportionate basis.

It is important to remember that the government follows a cash-based accounting system which means a transaction is recognised only when cash is paid or received — quite unlike the accrual-based system that private companies follow where income recognition happens quickly. The 12th Finance Commission had recommended that the government switch to the accrual-based system, which the government has committed to adopting.

The cash-based system has its own infirmities but that still doesn’t explain the heightened level of deception in the government’s accounts.

Chartered accountants approached by this newspaper have been loath to comment on the way the government maintains its books or captures details of its investment in state-owned companies.

One former president of the Institute of Chartered Accountants of India (ICAI) said on condition of anonymity: “The CAG has the power to seek a supplementary audit under section 143(6)(a) of the Companies Act and its comments, including any critical observations, can be laid before Parliament along with the annual report of the (public sector) company. The Opposition may then take up the matter and seek a government response,” he said.

The smokescreen

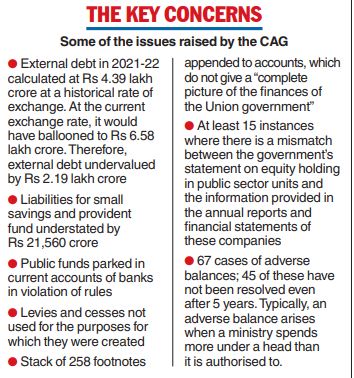

The fudge in the government’s accounts starts with the external debt which was calculated at Rs 4.39 lakh crore at a historical rate of exchange — which runs contrary to the definition spelt out in the Fiscal Responsibility and Budget Management (FRBM) Act of 2003.

The FRBM Act spells out clear objectives for fiscal austerity. Under its provisions, the government is mandated to cap fiscal deficit at 3 per cent of the GDP by the end of March 2021. It must also try to limit the general government debt (i.e. Centre plus states) at 60 per cent of the GDP. Within that ceiling, the central government debt must not top 40 per cent of the GDP by March 31, 2025.

No government till date has come close to the fiscal deficit target, which is expected to be capped this year at 5.9 per cent. In 2021-22, it came in at 6.7 per cent.

The CAG says if the government had stuck to the FRBM definition and valued external debt at the current exchange rate, it would have ballooned to Rs 6.58 lakh crore. This meant that external debt was undervalued by Rs 2.19 lakh crore in the government’s accounts for financial 2021-22.

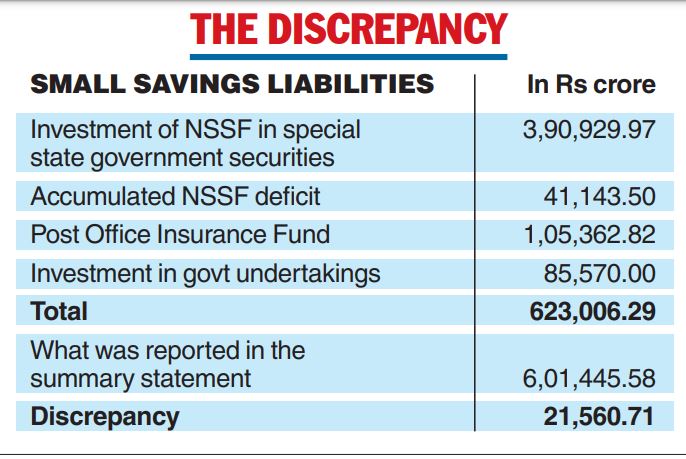

The CAG has also rapped the government for not presenting “an appropriate picture of (its) public account liabilities” — and drew attention to the fact that in its summary of its debt position, it showed liabilities at Rs 6.01 lakh crore when the figure actually amounted to Rs 6.23 lakh crore.

This hocus-pocus meant an understatement of its small savings liabilities by Rs 21,560 crore.

Hidden troves

There is one inflexible rule in government accounting: you cannot park public funds outside government accounts.

There are three funds in which government receipts are parked and from where disbursements go out: the Consolidated Fund of India which houses all its revenues, loans and receipts arising from loan recoveries. There is a small contingency fund that deals with unforeseen expenditure from certain exigencies with the current corpus limited to Rs 30,000 crore. Finally, there is the public account where the government holds money in trust. These are funds that do not actually belong to the government like provident funds and small savings collections.

But the department of space — which falls within the Prime Minister’s bailiwick — did the unthinkable. It parked a sum of Rs 154.94 crore in 16 current accounts with banks.

When the CAG raised the issue with the department of space, it said it would close all these accounts immediately. The CAG wasn’t satisfied since it had raised the issue in the previous year as well. In September 2021, the department of space sought post facto approval from the Controller General of Accounts (CGA) — the government’s bookkeeper — to operate these bank accounts.

These accounts were being used by Isro to make customs duty payments and credit receipts from the sale of scrap. In November 2021, the department said it would close these accounts when it was able to make customs payments through NEFT/RTGS — the inter-bank settlement systems that enable instantaneous transfer of money. But these accounts were not closed despite these promises.

Irregularities showed up in the department of telecom as well. In 1999, the government had created a universal service obligation fund (USOF) which would incentivise telecom operators to provide services to people in rural and remote areas at affordable and reasonable prices even though it was uneconomic to do so.

Telecom operators pay a revenue share licence fee of 8 per cent of their adjusted gross revenue to the government. Of this, 5 per cent goes to the USOF and 3 per cent to the general exchequer.

The CAG found that the government had collected Rs 10,376 crore from the telecom levy but transferred only Rs 8,300 crore to the USOF. Where did the rest go? The government wouldn’t tell.

“There was short transfer of the universal access levy (UAL)… to the USO Fund amounting to Rs 2,076 crore. This amount was retained in the Consolidated Fund of India and was available for use for purposes other than for which it was levied,” the report said.

The budget division of the department of economic affairs argued with the government’s auditor and said the “purpose of such funds is… to ensure utilisation for the earmarked purpose over a period of years, but not necessarily, within each financial year”.

The CAG didn’t agree with this view. “Keeping funds idle in Public Account without productive application is not desirable”, the CAG said, contending that the short transfer was not in accordance with the provisions of the act under which the levy was imposed.

It went on to assert: “The provision of the (Telecom) Act shall prevail over the accounting procedure.”

In 2021-22, the government collected a sum of Rs 52,732 crore through the health and education cess slapped on individual and corporate taxpayers. Sixty per cent of this fund — or Rs 31,788 crore — was transferred to the Prarambhik Shiksha Kosh, a non-lapsable fund meant to promote elementary education.

The rest was supposed to go to the Madhyamik and Ucchatar Shiksha Kosh (MUSK) and the Pradhan Mantri Swasthya Suraksha Nidhi (PMSSN).

MUSK was cleared by the Union cabinet in July 2017 and the PMSSN in March 2021. Neither was in operation at the end of March 2022.

In May this year, the finance ministry told the CAG that these funds would be operationalised in 2022-23. It is still not clear whether they are up and running.

The report also reveals how the ministry of drinking water and sanitation (MoDWS) cornered the proceeds from the Rashtriya Swachhata Kosh, which was created out of the proceeds from the 0.5 per cent Swachh Bharat cess imposed in November 2015.

The MoDWS is supposed to share the funds from the Kosh on an 80:20 basis with the ministry of housing and urban affairs (MoHUA). In 2015-17, the Kosh had Rs 12,400 crore. The MoDWS cleaned out the fund. The MoHUA incurred an expenditure of Rs 159.42 crore on the Swacch Bharat Mission. But since the fund had been cleaned out, it ended up with an adverse balance in its books. The MoHUA wanted the adverse balance reversed to the water and sanitation ministry but its pleas were not heeded.

In May this year, the MoDWS said it would “adopt” the adverse balance of the housing and urban affairs ministry. It isn’t clear whether the reversal of the sum has occurred.

Referring to the brouhaha over the cess pools, N.R. Bhanumurthy, vice-chancellor of the Bangalore-based Dr BR Ambedkar School of Economics University, said: “The cesses are created for a limited purpose and time-frame, and not for perpetuity. Unfortunately, that has not been the case in our country. This has also been pointed out by various Finance Commissions in their reports. The cess, so collected, should be parked in separate heads and used for that purpose alone. Otherwise, it negates the very purpose for which the cess was imposed.”

Accounting trick

The government and the CAG have been at loggerheads over the persistent use of what is known as Minor Head 800.

This has served as the government’s hidey-hole for all kinds of transactions that it cannot adequately explain or label.

Theoretically, the rubric used to describe this minor head is “other receipts and other expenditure”. It is broad enough to cover a wide range of transactions that are not routine or properly pigeonholed.

In its report on government accounts for 2019-20, the CAG had bluntly said: “Repeated use of Minor Head 800 results in opaqueness in accounts and, hence, needs to be curtailed.”

It complained in that report that despite repeated suggestions for a comprehensive review of the structure of government accounts, the government had chosen not to address this issue.

Two years later, the CAG has noted that the problems with Minor Head 800 persist.

In its latest report, the government auditor said 60 per cent of the expenditure under nine major heads ranging from medical and public health to land reforms, and flood control, was lumped under the ubiquitous Minor Head 800.

The total expenditure under these nine major heads amounted to 78,878.54 crore. Of this 60.41 per cent, or Rs 47,651.96 crore, was treated as “other expenditure” under Minor Head 800.

The government also uses a stack of footnotes to its accounts which, the CAG claims, do “not disclose the complete picture of the finances of the Union government”.

In 2021-22, the government used 258 footnotes. Two years before this, in 2019-20, it had used 254.

“Some of the footnotes are crucial in nature and need a significant disclosure rather than through a footnote,” the CAG said, adding that it had raised this concern in previous years as well.

It has been stonewalled every single time.