The Pradhan Mantri Shram-Yogi Maandhan, billed as a mega pension plan, is patterned along two similar attempts by successive governments, including the Modi dispensation, at providing a social security net to the unorganised sector that did not find much traction primarily because of their contributory nature and long gestation.

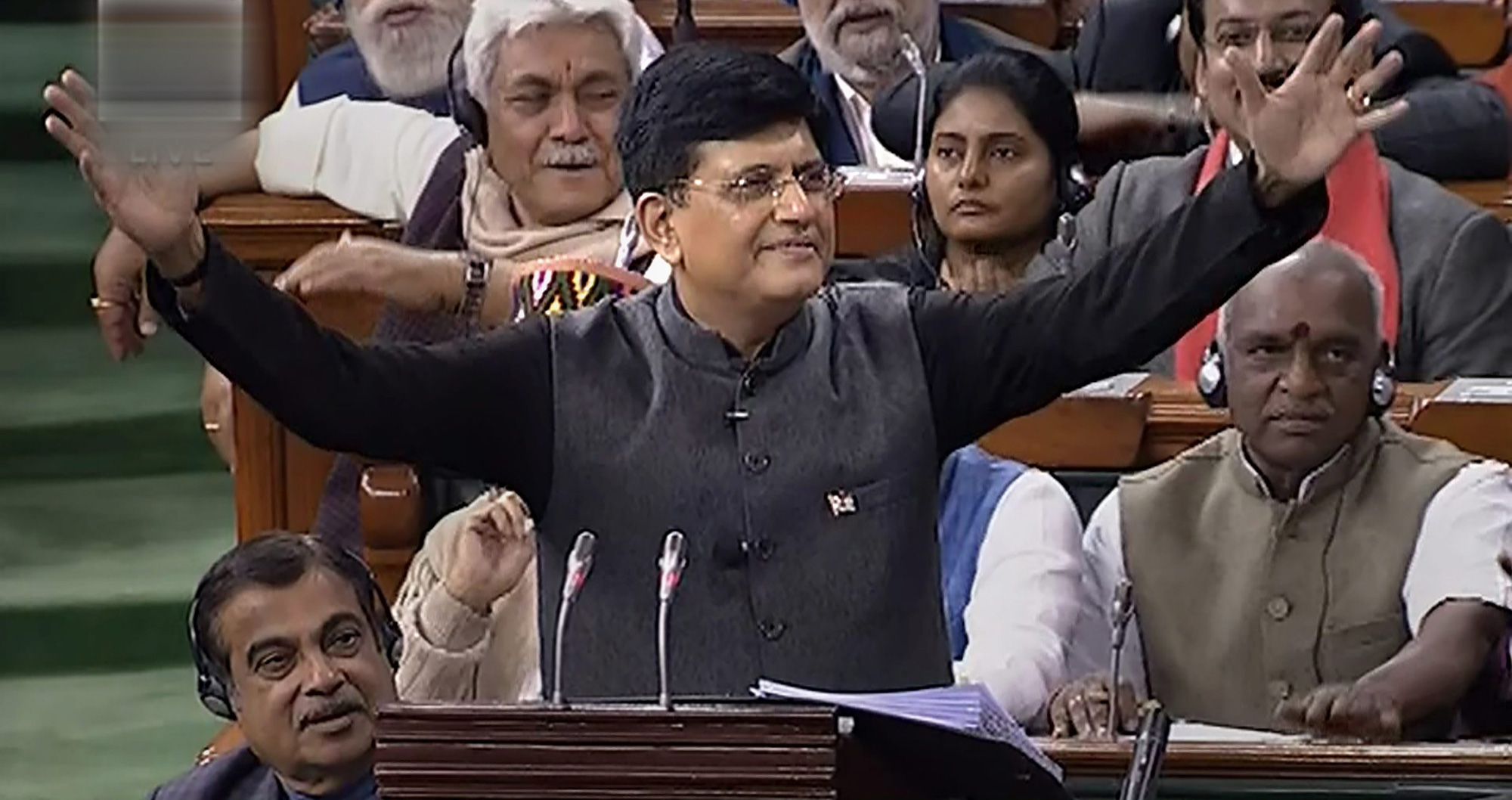

According to finance minister Piyush Goyal, the new pension plan is for unorganised sector workers with a monthly income of up to Rs 15,000. It will provide them an assured monthly pension of Rs 3,000 from the age of 60 on a monthly contribution of an “affordable” amount during their working age.

“An unorganised sector worker joining the pension yojana at the age of 29 years will have to contribute only Rs 100 per month till the age of 60 years. A worker joining the pension yojana at 18 years will have to contribute as little as Rs 55 per month only. The government will deposit equal matching share in the pension account of the worker every month,” Goyal said while presenting the budget.

The government’s estimate is that at least 10 crore labourers and workers in the unorganised sector will benefit. The allocation for what the government is pegging as “one of the largest pension schemes in the world” is Rs 500 crore. And, the scheme will be implemented from the ongoing fiscal though there is no clarity from which month.

Development economist Jean Dreze said the new pension plan appeared to be a “repackaged version” of the Atal Pension Yojana (APY) announced in the 2015-16 budget. The APY was also contributory, with workers entitled to different slabs of pension depending on their contributions. The one difference was that in the APY the government’s contribution is half of what the beneficiary puts in, subject to an annual limit of Rs 1,000 for five years.

The scheme did not have many takers though it was supposed to be an improvement on the UPA’s Swavalamban Scheme, also a contributory pension plan.

The contributory pension does not serve the purpose of the poor, Dreze pointed out, underscoring the long gestation period.

The CPI-ML’s Dipankar Gupta pointed out that Rs 3,000 would be worth nothing to a 30-year-old worker after three decades. “A 29-year old worker today has to go on paying Rs 100 per month to become eligible for Rs 3000 pension in 2050! #JumlaBudget,” Gupta tweeted.

Activists pointed out that while the budget only allocates Rs 500 crore this year for the “mega pension scheme”, it has simultaneously slashed the allocations for the National Social Assistance Programme for old-age and widow pensions by Rs 300 crore each.

“The pension of Rs 3,000 for unorganised workers is another exercise in deceit without there being any scheme. The allocation of a meagre Rs 500 crore itself is an indication of the lack of seriousness and honesty in covering the more than 40 crore unorganised workers in the country,” the Centre of Indian Trade Unions said in a statement.

“And they will receive this pension only by contributing continuously up to the age of 60, which most of them cannot do. The real fraudulent intention behind the announcement of this programme becomes clear when cow protection receives a bigger allocation of Rs 750 crore,” the statement added.