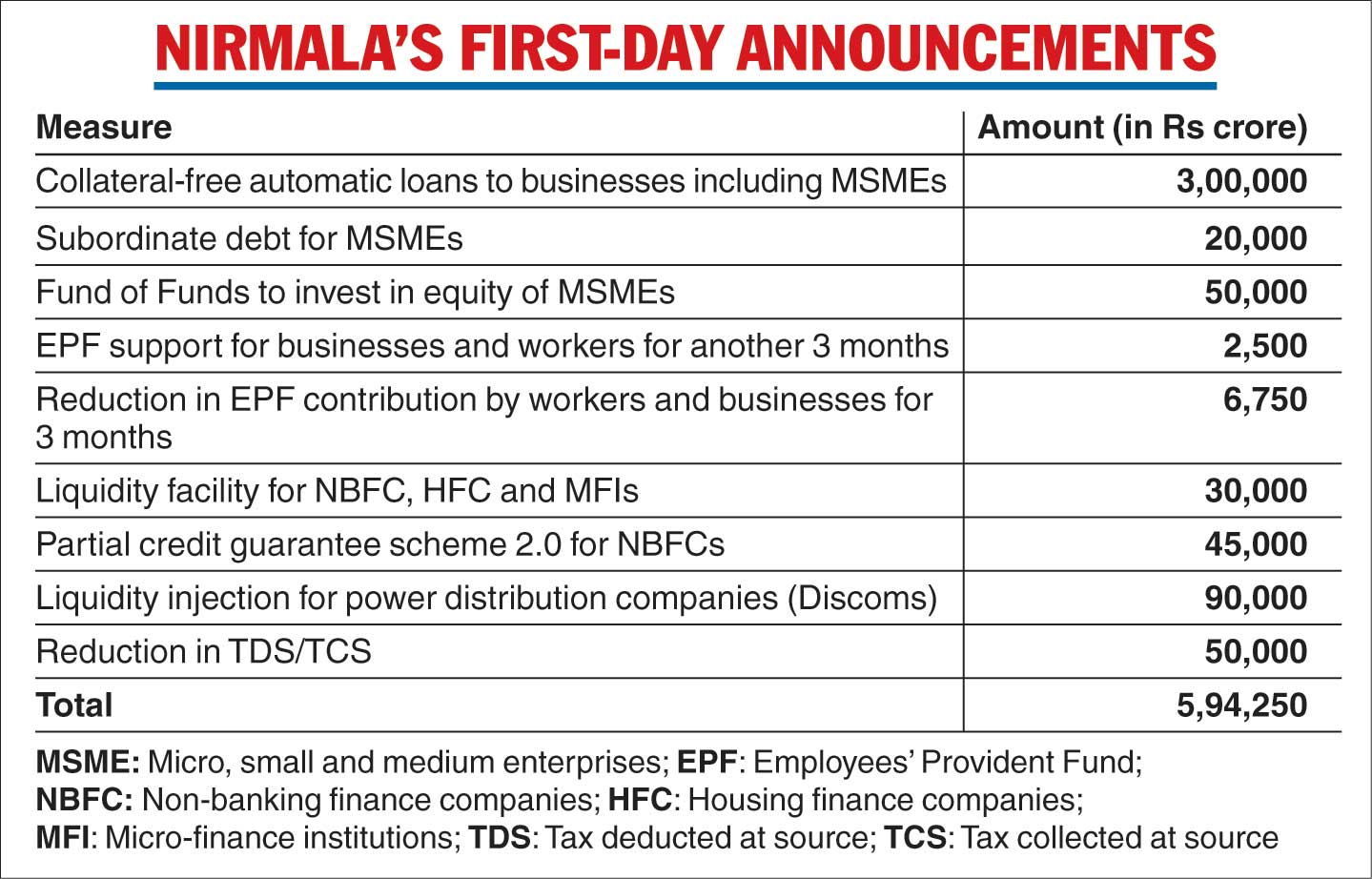

Union finance minister Nirmala Sitharaman on Wednesday chalked out a stimulus package of around Rs 6 lakh crore — the first of several announcements that are expected over the course of this week.

The announcements are designed to make good on Prime Minister Narendra Modi’s promise to spend 10 per cent of the gross domestic product to turn India into a self-reliant economy.

The first batch of proposals under the Atmanirbhar Bharat programme were primarily focused on helping micro, small and medium enterprises (MSMEs) to combat the withering effects of the coronavirus pandemic.

There were also some relief for taxpayers and the badly stressed power, real estate and shadow banking sectors.

Sitharaman’s plan included a Rs 3.6 lakh crore plan to provide a mix of collateral-free loans, subordinate debt and equity financing for the country’s small and medium businesses that contribute over 28 per cent of the GDP and create employment for about 111 million people.

Small businesses dissed the idea of mere collateral-free loans. “We are clearly disappointed. At the end, we are seeing that it is only a loan without a government guarantee. The rest is frivolous. In this kind of crisis with mounting losses and no business, we were expecting the government would provide direct support,” said Anil Bhardwaj, secretary-general of the Federation of Indian Micro and Small and Medium Enterprises (FISME).

The plans announced by Sitharaman also provide for a Rs 90,000-crore liquidity injection into power distribution companies through state-run power finance companies, a Rs 30,000-crore special funding facility for non-banking finance companies, housing finance companies and micro-lending institutions as well as a Rs 45,000 crore partial credit guarantee scheme to backstop loans to the shadow banking firms.

In an attempt to support small local businesses, Sitharaman said global tenders would no longer be floated for government procurement contracts up to Rs 200 crore.

The investment limit for MSMEs is being raised with the addition of a turnover criterion to make sure they do not lose out on benefits earmarked for the sector simply because they grow bigger in size and revenues.

The government has decided to extend the Vivaad Se Vishwas direct tax amnesty scheme till December 31. The scheme seeks to settle long-pending tax disputes that have been locked up in litigation. The Centre is hoping to fill up its parlous treasury by seeking to unlock a substantial portion of the Rs 9.32 lakh crore tax claims.

The stimulus plan also tries to foster the illusion of fatter pay packets over the next three months by reducing the statutory provident fund contributions of 6.5 lakh private establishments to 10 per cent by both the employer and the employee from the existing 12 per cent. This will create liquidity of Rs 6,750 crore for both employers and employees, the government said. This benefit is not being extended to central and state public sector units.

The Centre will also pick up a Rs 2,500-crore tab on behalf of employers and employees under the Pradhan Mantri Garib Kalyan Yojana to meet their PF contributions for another three months, that is, until August.

The deadline for filing income-tax returns for the financial year 2019-20 has been extended to November 20 and the Centre has promised to immediately clear the tax refunds of charitable trusts, non-corporate businesses and professions, including proprietorships and partnerships.

The rates on tax deduction at source (TDS) have been cut by 25 per cent from current levels in the case of payments for contracts, professional fees, interest, rent and brokerage.

Tax assessments that are supposed to become time-barred by September 30 this year will get a three-month extension till December 31. A similar deadline that ends on March 31 next year will become eligible for a six-month extension till September 30, 2021.

Real estate projects will get an automatic six-month extension for registration and completion if these dates were expiring on or after March 25. Regulatory authorities may grant a further three-month extension if required, the government said. A major relief for the sector is the decision to treat Covid-19 as a force majeure event.

Critics, however, tore into several elements of the programme, contending that it did not attempt to alleviate the distress of the poor by shovelling cash to the people at the bottom of the pyramid.

The government can address this issue in the coming rounds but the delay has stood out against the backdrop of the poor migrants’ misery, unfolding daily on India’s highways.

Questions were raised about the Modi government’s arithmetical artifice in trying to mash the monetary measures taken by the banking system with the fiscal-side elements of government spending to enhance the size of the stimulus.

“I refrain from commenting on liquidity-related measures. Such measures do not amount to fiscal measures of support and nowhere in the world are they included or counted in a fiscal stimulus package,” Congress leader P. Chidambaram said.

After her presentation, Sitharaman tried to duck when a reporter asked her pointedly whether the Centre was trying to count up the Reserve Bank of India’s monetary measures to create the Rs 20-lakh-crore stimulus that Modi had promised on Tuesday.

“You will know after we have announced all the measures,” she said tersely. “Borrowing is one of the ways we are hoping to finance the stimulus programme.”

The minister also refused to say what impact the stimulus would have on the country’s fiscal deficit, which several economists believe will balloon to over 5 per cent of the GDP.

“This government is a prisoner of its own ignorance and fears. The government must spend more but it is not willing to do so. The government must borrow more, but it is not willing to do so. The government must allow states to borrow more and spend more, but it is not willing to do so,” Chidambaram added.

Hocus pocus

The Centre has tried to show its concern for the small and medium firms by tom-tomming its Rs 45,000-crore partial credit guarantee scheme 2.0.

The original programme, unveiled in last year’s budget, had provided a Rs 1 lakh crore one-time credit guarantee for six months to NBFCs with a credit rating of AA or higher. Under the plan, the Centre had agreed to bear the first 10 per cent of the loss to persuade these entities to lend to MSMEs and individuals.

Last December, this programme was extended for another six months until June with a few modifications. It now seems — the government hasn’t explicitly said it — that the old programme will be given a quiet burial.

The new scheme is much smaller at Rs 45,000 crore and seeks to provide comfort to NBFCs and housing finance companies with low credit rating scores by promising that the Centre would bear the first 20 per cent of their loss.

Industry sources said the original guarantee scheme had been badly underutilised even after its scope was widened in Sitharaman’s budget this year to cover all securities issued by these entities. Sources added that many of the smaller NBFCs had continued to face difficulty in raising funds.