The Congress on Tuesday said the Narendra Modi government’s mindset had been exposed in its hesitation to impose GST on casinos and horse racing while taxing items used by the poorest of the poor, such as wheat flour, jaggery and puffed rice.

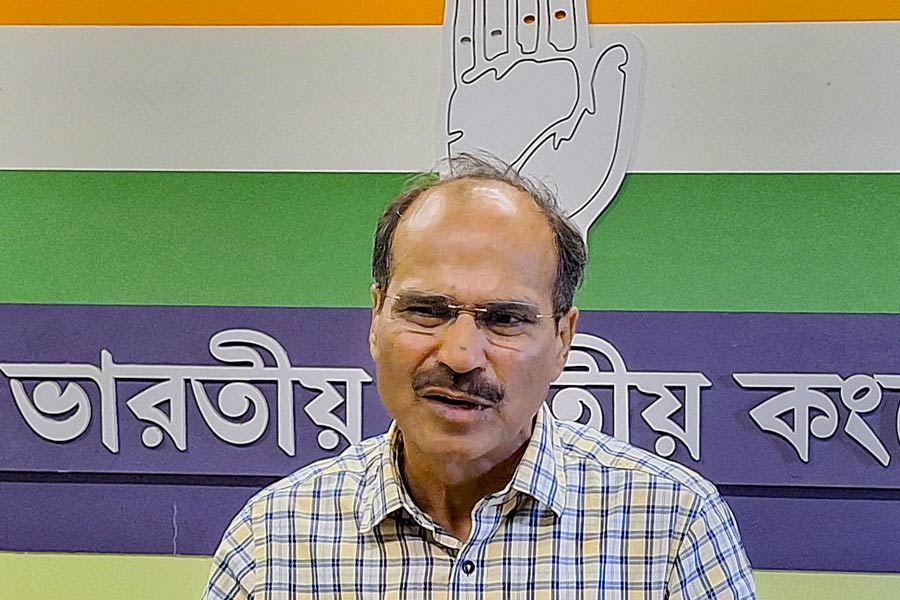

Expressing outrage, Congress spokesperson Gourav Vallabh said: “At the 47th GST Council meeting last week, exemptions were withdrawn for pre-packed and pre-labelled food grains, fish, paneer, lassi, honey, jaggery, wheat flour, buttermilk, unfrozen meat/fish, and puffed rice. These will now be taxed at 5 per cent, on a par with branded items. On the other hand, a group of ministers had finalised a uniform 28 per cent GST on casinos, horse racing and lottery. This GoM has been asked to review the decision.”

Recalling that the middle class and the poor were already struggling with abnormal inflation, Vallabh said: “Exemptions have also been withdrawn for hotel accommodation up to Rs 1,000 per day. These will now be taxed at 12 per cent. Tax rates have been increased from 12 per cent to 18 per cent on products such as printing, writing or drawing ink, knives with cutting blades, spoons, forks, paper knives, pencil sharpeners and LED lamps. While GST on a hospital room is 5 per cent, it is 1.5 per cent on diamonds.”

Vallabh added: “What is more important for the government — casinos or the common person? Why were taxes raised across the board with no review of the decision to remove tax exemptions? Is the government willing to jeopardise the living standards of the low- and middle-income group at a time of high inflation just to increase its revenues? What is the government hiding from the nation concerning the economic situation that it is so desperate to raise revenues at the expense of people’s welfare?”

Congress leader Rahul Gandhi tweeted: “GST on Health Insurance: 18%. GST on Hospital Room: 5%. GST on Diamonds: 1.5%. ‘Gabbar Singh Tax’ is a painful reminder of who the PM cares for. A single, low GST rate will reduce compliance costs, prevent the Government from playing favourites & ease burden on poor & middle class families.”

Although the government had claimed that the introduction of the GST regime will cut down the prices of essential commodities, Vallabh said: “Wheat flour was sold at Rs 23 a kg in 2017 and the price now is Rs 28. Curd costs Rs 24 for 400 grams in pre-GST 2017 and now it is Rs 40. (The price of) ghee jumped from Rs 505 to Rs 649. Bathing soap available for Rs 16 is now Rs 30, detergent from Rs 60 to Rs 100. Cooking oil price shot up from Rs 105 per litre to Rs 216.”

He said other items, from shirts and chappals to medicines, had also become costlier.