Finance minister Nirmala Sitharaman on Saturday put out a budget that lacked vision and the firepower to ignite a faltering economy.

The finance minister unveiled plans to shovel funds into the farm and infrastructure sectors and carved out a confusing — and somewhat complex — personal income tax regime.

But it left industry and markets cold to her plans as the budget had few credible measures designed to kick-start an economy that is going through its worst slowdown in a decade.

The finance minister appeared to admit this truth by pencilling in a lowball 10 per cent growth in nominal GDP to Rs 224.89 lakh crore, the lowest projected growth rate since 2010.

The government allocated Rs 2.83 lakh crore for the farm and rural sectors and asked banks to funnel Rs 15 lakh crore worth of agriculture credit. It also announced plans to spend Rs 1.7 lakh crore in creating transport infrastructure, forcing it to abandon the tough fiscal deficit targets that it had set earlier.

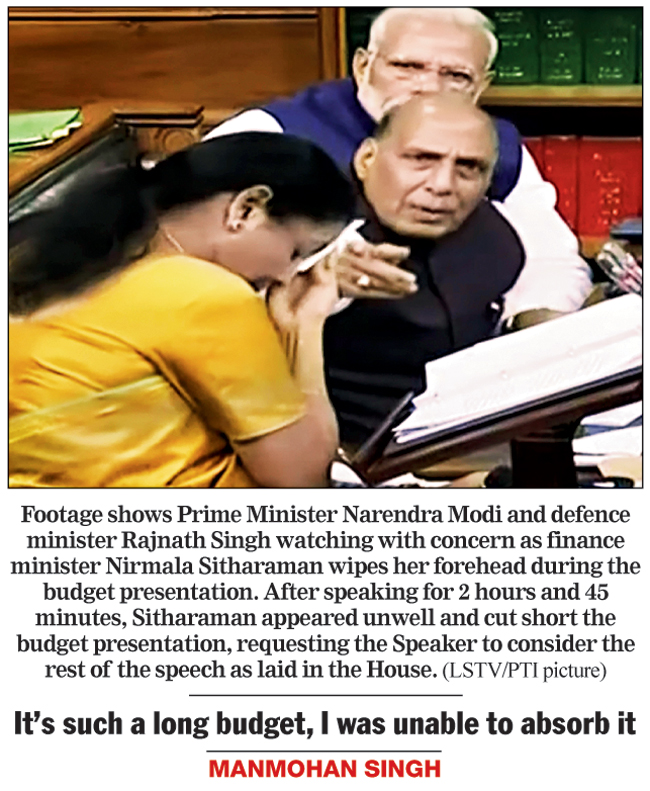

Sitharaman, who seemed to be out of sorts at the end of a long speech that she could not eventually complete, said the fiscal deficit would widen to 3.8 per cent of gross domestic product this year against a budgeted level of 3.4 per cent.

In 2020-21, it will be capped at 3.5 per cent — a deviation of 0.5 per cent from the target — by taking advantage of a trigger mechanism in the Fiscal Responsibility and Budget Management (FRBM) Act.

In an accompanying budget document, the government promised to yank fiscal deficit down to 3.3 per cent in 2021-22 and 3.1 per cent in 2022-23.

The departure from the fiscal course was blamed on structural reforms on both the demand and supply side and the decision to provide a roughly Rs 1 lakh crore stimulus to the economy through corporate tax rate cuts last year. However, she glossed over the fact that the gaping hole in the budget had widened because of poor indirect tax collections, especially goods and services tax.

The markets gave a huge thumbs-down to the budget with the Sensex tumbling by 987.96 points to close at 39,735.53. Investors lost around Rs 3.6 lakh crore of their paper wealth, which was ironical on a day the government reaffirmed its commitment to wealth creation in the economy.

The Economic Survey presented on Friday had also spoken glowingly about the bullish fervour in India’s stock markets that had spurred the bellwether index by 10,000 points to the 40,000-mark in just two years.

An unfazed Sitharaman told a television channel that the markets would recover on Monday after investors had time to pore over all her proposals.

“Prosperity to farmers can be ensured by making farming competitive. For this, farm markets need to be liberalised,” Sitharaman said, reaffirming the promise to double farmers’ income by 2022.

The government plans to help farmers to access solar options for their grid-connected pump sets. A scheme is also being drawn up to enable farmers to set up solar power generation capacity on their barren lands and sell it to the grid.

Taxpayer puzzle

Taxpayers were, however, left puzzling over a complicated, heavily layered tax regime that allowed them to opt for lower rates without the benefit of exemptions.

Sitharaman said a person earning Rs 15 lakh a year would save Rs 78,000 in taxes under the new regime. However, a deep analysis showed that people in the higher income brackets who usually take advantage of exemptions may be better off under the old tax regime. It is not known how long the two tax regimes — one with exemptions and the other without — will co-exist.

Blow to bosses

Chief executives and C-suite officers had good reason to groan about their retirement funds.

Employers’ contribution to their retirement funds — pension plans, superannuation funds and recognised provident funds — has been capped at Rs 7.50 lakh a year. Any amount above this limit will now become taxable as a perquisite because of a new combined upper limit set for contributions to such funds that will blunt the effect of the existing system that does not tax these amounts at the time of contribution, accretion or withdrawal.

The change will take effect from April 1 and will apply in relation to the assessment year 2021-22 onwards.

There were also serious misgivings about the budget which contained no measures to relieve stress in the shadow banking industry, real estate, and automobile sectors. There was no sign of a coherent strategy to create jobs in the manufacturing sector by pushing the Make in India scheme or the Assemble in India for the World plan — the two programmes that the Economic Survey had suggested should be melded to generate employment in the formal sector.

NRI rule

One big change was to tighten tax residency rules to stop tax dodgers and other fugitives who flit from one country to another. The new residency rules specify a maximum stay of 120 days in India in any year instead of 182 earlier that will make a non-resident Indian liable to tax at home.

The new rules will also cover Indian citizens who do not have a residency status in any jurisdiction, and will subject them to tax on their global income. It was not immediately clear how the government hoped to ferret out these tax dodgers.

Dividend tax

Sitharaman accepted the industry’s demand to abolish the dividend distribution tax on companies. Dividends will now be taxed in the hands of the recipient — a move that was widely anticipated by the markets and is expected to benefit the global multinationals the most since they could not set off the DDT against their tax burden in their home jurisdictions.

The government also raised taxes on a host of imports ranging from walnuts to automobiles and even smartphones.

Prime Minister Narendra Modi heaped praise on the budget for having both “vision and action”. BJP president J.P. Nadda hailed the budget as “visionary, futuristic, growth-oriented, transformative and all-inclusive”.