Criticism of the implementation of the demonetisation — more or less silenced for two years by the fear of retribution — is now trickling in from business folk who had been considered the Narendra Modi government’s most ardent supporters.

The latest to speak out is Uday Kotak, banker extraordinaire and corporate governance expert, who was recently asked by the government to head a group of independent experts to sort out the mess at shadow bank entity ILFS.

Kotak has now said the outcome of the demonetisation programme would have been “significantly better” had it been planned well.

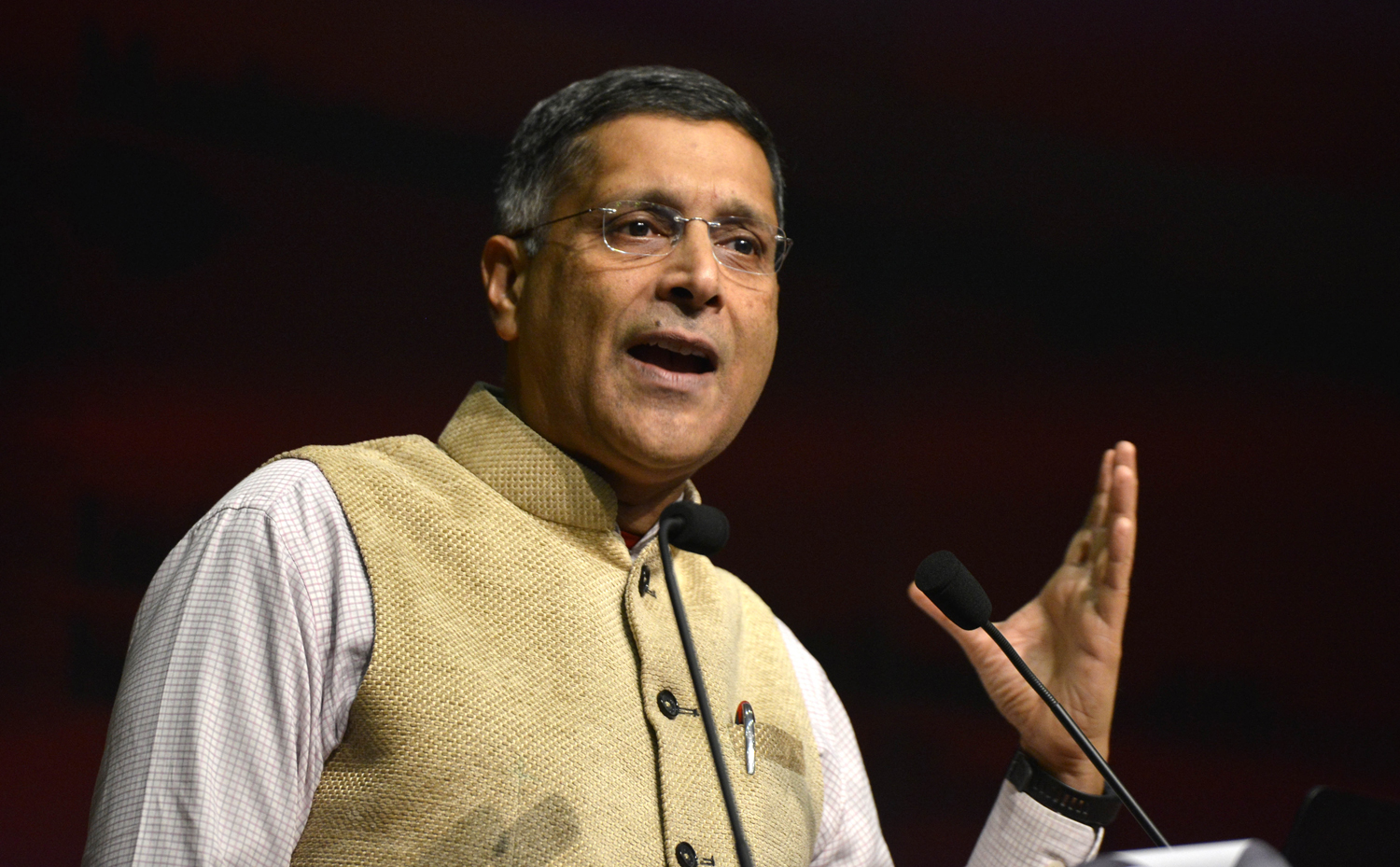

“I think we would have had significantly better outcomes if we had just thought about simple things. If you are taking out Rs 500 and Rs 1,000 notes, why would you introduce Rs 2,000 notes?” PTI quoted Kotak as saying at former chief economic adviser Arvind Subramanian’s book launch here over the weekend.

The same basic inconsistency that underpinned Modi’s surgical strike against black money was first pointed out by Kenneth Rogoff, former IMF economist and currently Thomas D. Cabot professor of public policy and professor of economics at Harvard University.

Rogoff had stirred a cauldron of ideas a couple of years ago with his best-selling book, The Curse of Cash, in which he urged the US government to scrap the $100 bill immediately and then gradually phase out the $50 and $20 bills, turning the world’s most advanced economy into a cashless society.

But Rogoff, who had never intended middle-income countries like India to shred their high-denomination notice, had written in a blog on November 17, 2016, just days after Modi’s shock announcement: “India’s approach is radically different, in two fundamental ways. First, I argue for a very gradual phase-out, in which citizens would have up to seven years to exchange their currency, but with the exchange made less convenient over time….

Kenneth Rogoff Twitter profile

“Second, my approach eliminates large notes entirely. Instead of eliminating the large notes, India is exchanging them for new ones, and also introducing a larger, 2,000-rupee note, which are also being given in exchange for the old notes.”

In August, the RBI had said in its annual report that 99.3 per cent of the scrapped high value notes had come back into the banking system, knocking a hole in the government’s expectations of shaking down “black money” worth at least Rs 3 trillion from the corners of India’s $2.25-trillion economy.

In his latest book, Subramanian has described the demonetisation as “a massive, draconian, monetary shock” that triggered a slowdown in growth.

Last month, former RBI governor Raghuram Rajan had said the demonetisation and a rushed implementation of the goods and services tax (GST) had whipped up headwinds that eventually throttled India’s economic growth last year.

Industry has generally been squeamish about attacking the demonetisation programme, although there were a few exceptions.

In July, Bajaj Auto chairman Rahul Bajaj had questioned the achievements of the demonetisation exercise. Rajiv Bajaj, son of the Bajaj group patriarch, was among the first to fire a broadside, saying the idea of demonetisation itself was wrong.

At the book launch, Kotak said that as part of the “execution” strategy, it was essential to ensure that a larger quantum of notes of the right denomination was made available.

If such things were undertaken, “we would have been talking very differently today”, he said.

But Kotak said that for the financial sector, the demonetisation had been a “huge boon”. The growth in financial savings has been “unbelievable”, which has also led to a challenge of risk management, he added.

Small businesses are in a difficult situation at present, Kotak said, welcoming the government focus on reviving the sector. “I believe that the SME (small and medium enterprises) sector has taken a significant amount of pain. Getting credit for them is tough even now,” he said.