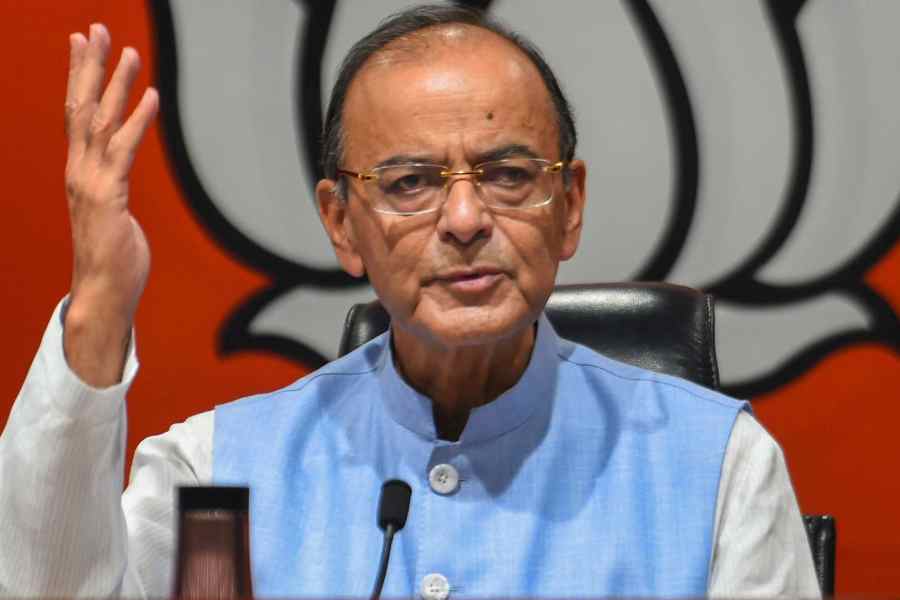

A delicious irony is embedded in the flaming political row over inheritance tax, or its like — the most recent proposal approximating it came from Arun Jaitley, the late finance minister, in 2017.

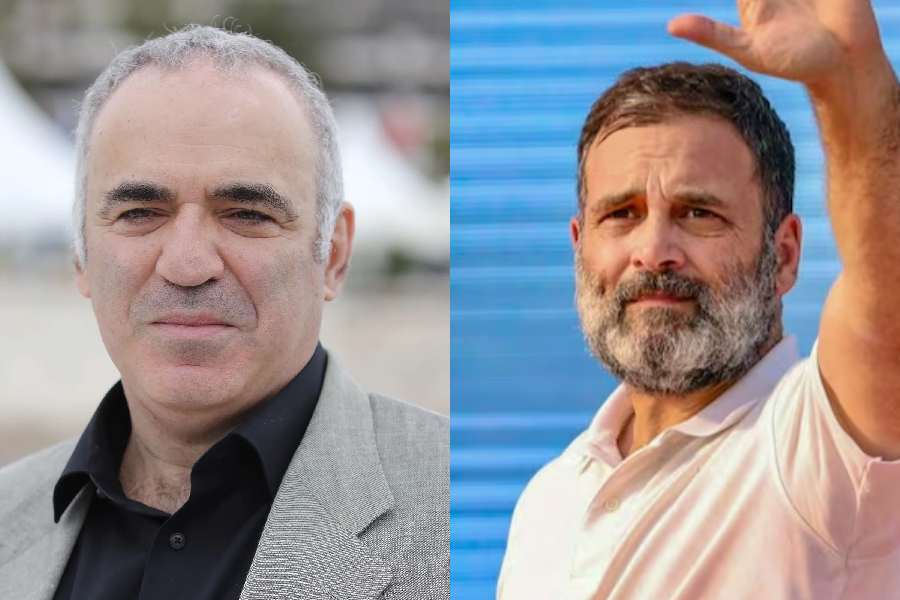

Inheritance tax — the bogeyman of the super-rich — has triggered a war of words with Prime Minister Narendra Modi accusing the Congress of trying to foist a dreaded American levy on the Indian middle class.

Sam Pitroda — the technocrat-turned adviser to the Congress — dropped a clanger during a recent television interview when he suggested that the policymakers in India could consider the option of imposing an inheritance tax on the rich in order to redistribute wealth to the poor and the marginalised.

Pitroda said as a result of the levy in the US, the rich could pass on only 45 per cent of their wealth to their heirs while the rest went to the government to be used for people’s welfare.

Modi and his minions seized on Pitroda’s supposed gaffe and sounded the alarm that the Congress intended to deny parents in India the right to pass on their wealth to their children. “As long as you are alive, the Congress will impose higher taxes and when you are no longer alive, it will burden you with inheritance tax,” Modi thundered.

Under the 2017 amendment, any person receiving a sum of money or property in excess of Rs 50,000 would become chargeable to tax under the head “income from other sources”.

The amendment threatened to wreck succession planning and tear down the tax shields that the country’s fat cats had traditionally used to pass on their estates to

their heirs without diminution of value.

The move sparked howls of protest and an immediate clamour to roll it back.

Cyril Amarchand Mangaldas, the Mumbai-based law firm, had dubbed the move “the dreaded re-introduction of inheritance tax… which (hopefully) was not the legislative intent”.

The firm was aghast that Jaitley’s proposed amendment was seeking to extend anti-abuse provisions — which were only applicable to individuals, HUFs, and firms or companies in certain cases — “to cover genuine gifts and transfers essential for tax-efficient succession planning”.

The big beef was over the fact that the proviso would also cover private trusts — a key element of any succession planning by the super-rich.

The resulting caterwaul forced the Modi government to back down. It was forced to work in an exemption in the proviso that specifically stated that it would not apply to sums of money given by an individual to a trust that was “created or established solely for the benefit of a relative of the individual”.

As the recriminations flew on Wednesday, Jairam Ramesh, the Congress general secretary in charge of communications, was quick to set the record straight. He said Jayant Sinha, then minister of state for finance, had lobbied hard for an inheritance tax in 2014. Three years later, Jaitley actually tried to push through a barely disguised inheritance tax. Even after the provision was watered down, he said the Modi government had not completely abandoned the idea and floated trial balloons every now and then.

Estate duty abolition

India abandoned the concept of a tax on inheritance — in the form of estate duty tax — in 1985 when V.P. Singh was the finance minister in the Rajiv Gandhi government.

At that time, there were two types of taxes on the rich: wealth tax and estate duty.

In his budget speech of 1985, Singh explained why he was doing away with the estate duty tax.

“As both wealth-tax and estate duty laws apply to the property of a person, the former applying to his property before death and the latter after his death, the existence of two separate laws with reference to the same property amounts to procedural harassment to the taxpayers and the heirs of the deceased who have to comply with the provisions of two different laws,” Singh said.

“Having considered the relative merits of the two taxes, I am of the view that estate duty has not achieved the twin objectives with which it was introduced, namely, to reduce unequal distribution of wealth and assist the states in financing their development schemes. While the yield from estate duty is only about Rs 20 crore, its cost of administration is relatively high. I, therefore, propose to abolish the levy of estate duty in respect of estates passing on deaths occurring on or after 16th March, 1985,” he added.

The wealth tax was abolished by Jaitley in February 2016. But he replaced it with an additional surcharge of 2 per cent on the super-rich, that is, people with a taxable income of more than Rs 1 crore a year.

Good or bad

There is still a raging debate among tax practitioners on the benefits of an inheritance tax. Some argue that because of rising income inequalities and the concentration of wealth in the hands of a few high networth individuals and business families, there is a need for such a tax. Others, however, riposte that any such move could negatively affect entrepreneurship and complicate family succession strategies.

“Today the incidence of tax is already high on people in the higher tax brackets. So, there is no need to impose the burden of tax on inheritance,” said Narayan Jain, national president of All India Federation of Tax Practitioners.