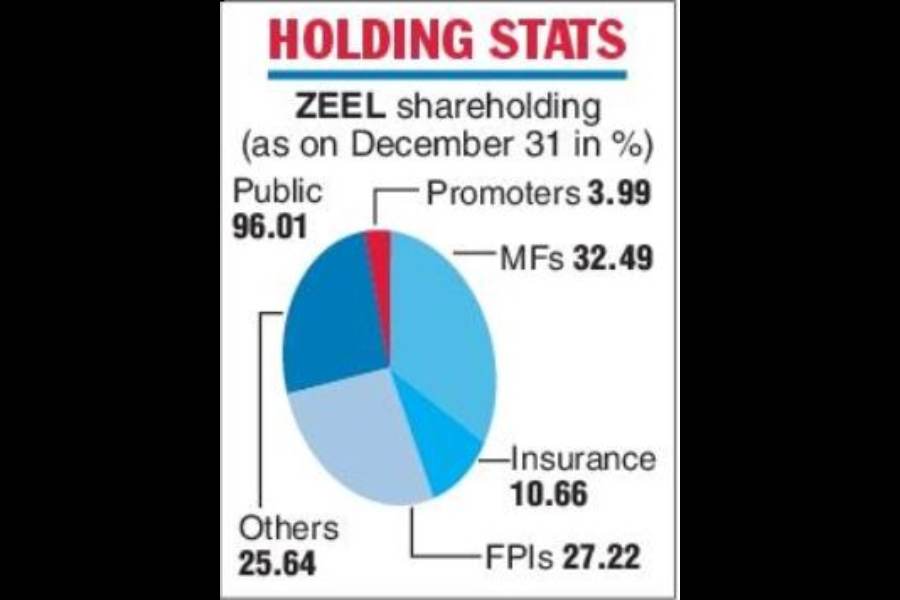

The collapse of the Sony deal will heighten the problems for Zee CEO Punit Goenka who will now have to fight off a move initiated by institutional investors such as LIC to unseat him from the board. LIC has a 5.12 per cent stake in Zee. Mutual funds hold 32.49 per cent.

The Goenkas are in a perilous position because they currently hold just 3.99 per cent in the company — and will therefore remain vulnerable to any concerted opposition.

Two years ago, they were able to fend off a challenge from activist shareholder Invesco which had tried to remove Goenka as MD and CEO because of weak leadership and poor corporate governance standards at Zee.

At the height of that battle, Zee had accused Invesco of fronting an unsolicited bid to mediate a merger with Mukesh Ambani’s Reliance Industries.

The Reliance group tried to distance itself from the escalating war when it admitted that it had been approached by Invesco to discuss a merger but claimed the discussions had broken down over Zee’s demand for the issue of preferential warrants to raise its stake in the merged entity.

Since then, Reliance has been close to sealing an agreement to take over the Indian assets of Walt Disney – with an announcement expected shortly.

It will be hard for Reliance to avoid anti-trust hurdles to a merger with Zee after the deal with Disney. This, therefore, sparks speculation that the Adanis may just move in to acquire Zee — furthering Gautam Adanis’s ambitions to build his own media monolith.

Adani controls NDTV, Quintillion Business Media (QBML) and India Abroad News Service. (IANS)

Market circles said the Adanis have focussed on the news segment, and whether he will move into general entertainment is a moot point.

Analysts said the Zee scrip is likely to crash Tuesday. “With the merger terminated, Zee’s valuation will likely decline to 12 times the price-to-earnings (PE) levels seen before the merger,” a CLSA note said.

Abneesh Roy, ED, Nuvama Institutional Securities, said it was risky to buy the stock even at the low price given uncertainties on a new partner and the legal case with Sony.

“A deal collapse will have a negative impact on both parties as they were looking at scaling up in the Indian market,” said Karan Taurani of Elara Capital.