In today’s world, where healthcare costs are constantly on the rise, having adequate health insurance coverage is crucial for financial security and peace of mind. However, the increasing cost of healthcare often translates into higher health insurance premium, putting a strain on household budgets.

The good news is that with a little knowledge and proactive planning, you can effectively manage your health insurance premium and find ways to reduce the financial burden. Health insurance as a product has become more modular now and allows you to customise the kind of coverage you want, thereby reducing your premium.

For instance, you can choose to not have annual health check-ups included in your plan. You can even choose to opt for a deluxe room or shared room according to your requirements and comfort. This means health insurance can be personalised according to your needs and budget.

Insurers have also started offering a wide array of discounts to make the premium more cost-effective. Let’s look at some of them.

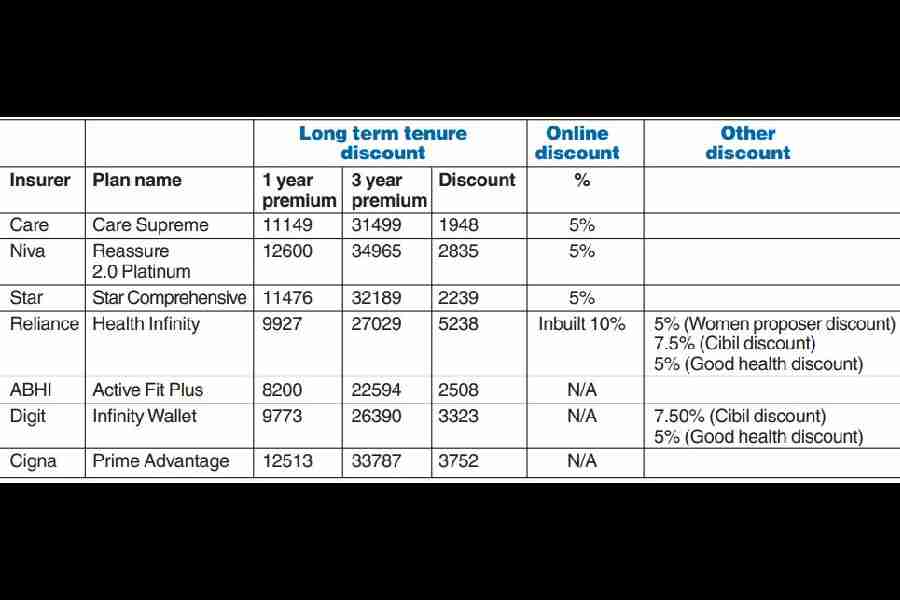

In the table above, we give a low-down on how much a 30-year-old, non-smoker, living in a metro city with no pre-existing conditions can save with these new-age discounts on health insurance plans with Rs 10 lakh as sum insured.

Avail online discounts

Buying a health insurance policy has become seamless with almost all the plans available online. To encourage customers to purchase online, many insurers offer 5-10 per cent discount on premium if you purchase a health insurance policy from online platforms.

Apart from discounts, a customer can easily compare plans from multiple insurance companies, clearly understand the policy terms and conditions and make an informed decision.

Use the wellness benefit

Adopting and maintaining a healthy lifestyle can significantly reduce your health insurance premium. Insurers often offer wellness rewards to policyholders who practice healthy habits such as walking 10,000 steps a day, exercising daily or maintaining a healthy weight.

Some insurers even provide access to free wellness programmes and discounted gym memberships. It’s worth noting that the wellness rewards can go up to 100 per cent, which can be used to pay the renewal premium. By taking care of your health, you not only save on your premium but also enjoy a better quality of life.

Go for new-age plans

Insurers are now going beyond the traditional coverage options by offering innovative features and attractive discounts. One such benefit is the consideration of credit score.

If your credit score exceeds 750, some insurers offer discounts of up to 7.5 per cent on your premium, rewarding you for maintaining a good credit history. There are also plans in the market that offer 5 per cent discount on premium if the proposer is a woman, and an additional 5 per cent if the health insurance policy covers a girl child.

Consider long tenure policies

Opting for long-term health insurance policies can provide stability and cost savings in the long run. Insurers offer discounts of up to 15 per cent if you purchase a policy for three years. In addition to discounts, customers can lock premium at the current rate and are insulated from any premium hikes during the policy tenure. More importantly, on purchasing a 2/3 year tenure policy, customers can choose to avail tax benefits either all in one year or proportionately claim tax benefit over two or three years.

Before committing to a long-term policy, ensure that it meets your coverage needs and consider any potential changes in your healthcare requirements over the policy duration.

Opt for a deductible

Another effective approach to reduce your health insurance premium is to opt for a deductible. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For example, if you choose a plan with Rs 20,000 as deductible, an insurer can provide up to 15 per cent discount on premium.

However, an important point to note is that in case there’s a claim of Rs 1 lakh, then the policyholder is required to pay Rs 20,000 while the insurer pays the rest.

As the deductible amount goes higher, customers can avail higher discounts on premium but also attain higher liability in case of a claim. Thus, it’s important to assess your financial situation and select a deductible amount that you can comfortably pay at the time of the claim.

Taking the time to assess your options and implement these strategies can result in significant savings in the long run. Remember, it’s essential to strike a balance between cost savings and the coverage you need to protect yourself and your loved ones.

Clarity on LTCG

In the financial year 2022-23, I have sold some equity mutual funds which were purchased in the year 2003 and 2012. My long term capital gains amount is below Rs 1 lakh. In which column of ITR2, the long term capital gains from mutual fund is to be shown that it will not be included in my total income.

A.K. De, Chandannagar

Following the Union budget of 2018, exemption under clause 38 of section 10 of the Income Tax Act was withdrawn and a new section 112A was introduced where long term capital gains arising from transfer of a long term capital asset being equity share of a company or a unit of a equity oriented fund is now taxed at 10 per cent if the capital gains amount exceeds Rs 1 lakh. However, a grandfathering clause was introduced whereby if the capital asset was acquired before February 1, 2018, then the cost of acquisition shall be deemed to be higher of —

a) The actual cost of acquisition and b) The lower of - (i) fair market value of such asset and (ii) full value of consideration received or accruing as a result of transfer of capital asset.

Scripwise details are required to be reported under schedule 112A of ITR2 for LTCG eligible for grandfathering clause. Once you provide the scrip wise details, the cost of acquisition and capital gains should be auto calculated by the tax portal.

Mutual fund switch

In FY2023, I have switched from regular to direct fund of the same mutual fund multiple times. I also hold stocks, some of which I sold and reinvested from the broker account. What type of ITR will be suitable for me to fill up?

Subhajit Surai, email

You may consider filing ITR 2 after checking the available information in AIS.