Vijay Shekhar Sharma on Monday resigned as the part-time non-executive chairman and a board member of Paytm Payments Bank Limited (PPBL) as the board of the beleaguered entity is reconstituted with the appointment of four independent directors.

The Reserve Bank of India has barred PPBL from accepting deposits and credits from any customer after March 15 for persistent non-compliance and continued material supervisory concerns in the bank.

PPBL is an associate of One 97 Communications Ltd (OCL). In a regulatory filing after market hours, OCL said PPBL has appointed former Central Bank of India chairman Srinivasan Sridhar, retired IAS officer Debendranath Sarangi, former executive director of Bank of Baroda Ashok Kumar Garg and retired IAS Rajni Sekhri Sibal to its board. OCL added they have recently joined as independent directors.

“OCL supports PPBL’s move of opting for a board with only independent and executive directors by removing its nominee,’’ the Paytm parent said.

Sharma has also resigned from the PPBL board to enable the transition, OCL said adding PPBL will start the process of appointing a new chairman.

While the RBI has placed major restrictions on PPBL, it still holds a payment bank licence.

There has been speculation its licence could be cancelled by the RBI after the March 15 deadline, but there are no comments in this regard from the banking regulator.

Paytm said Sridhar brings with him a strong career in banking spanning over 40 years. He is serving as the independent director at Jubilant Pharmova.

He has also held leadership positions at Export Import Bank of India and the National Housing Bank.

Sarangi is an independent director on the boards of several companies, including Southern Petrochemical Industries Corporation Limited and Voltas Ltd.

Sibal has served as secretary, Government of India.

Garg, who has 39 years of experience, held positions of the whole-time director at BoB, chief executive of the US operations of the bank in New York and managing director of Bank of Baroda (Uganda).

Stocks soar

Shares of OCL, the Paytm parent, were again locked at the upper circuit on Monday after the RBI asked the National Payments Corporation of India (NPCI) to consider OCL’s request to become a third-party application provider (TPAP) so that the bank’s customers can continue to use UPI.

Brokerage Morgan Stanley said the RBI’s move was a positive development though the NPCI was yet it to respond to the central bank’s proposal.

Morgan Stanley has maintained its “equal-weight’’ call on the stock and has a target price of Rs 555. It added that the development will also limit the potential impact on Paytm’s non-payment business operations.

Goldman Sachs said a seamless migration of the UPI account to other banks resolves a major unknown on the company.

If the company can smoothly transition most of its UPI users and resume lending with limited disruption, there could be an implied value per share of Rs 750, Goldman said.

FM-fintech meet

Finance minister Nirmala Sitharaman on Monday asked the financial sector regulators, including the RBI, to hold monthly meetings with start-ups and fintech firms to address their issues and concerns.

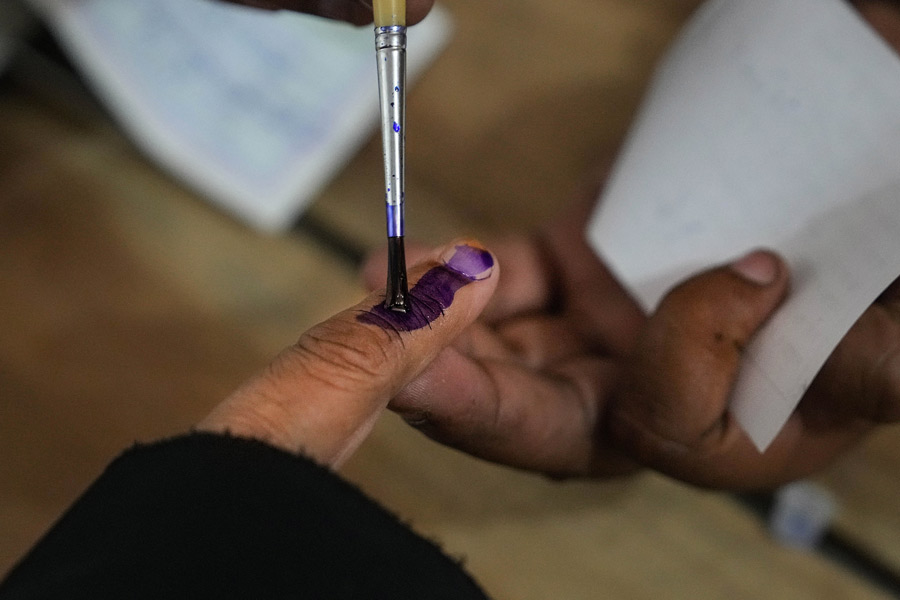

She also asked the Department of Financial Services to ensure simplification and digitisation of KYC across all fintech segments during a meeting with top executives of around 50 fintech firms to discuss regulatory issues being faced by them.

The meeting was attended by top executives of private sector fintech firms, including RazorPay, PhonePe, Google Pay and Amazon Pay.

With inputs from our Delhi Bureau