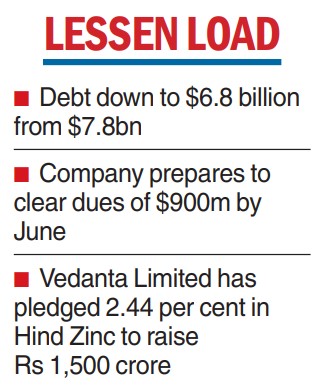

Vedanta Resources on Monday said it has paid all its maturing loans and bonds due in April and has reduced its gross debt a further $1bn to $6.8 billion from $7.8 billion in March.

The Anil Agarwal-company had announced its plans to reduce debt by $4 billion within three years in February 2022. “Vedanta has thereby achieved 75 per cent of its committed reduction in just 14 months,” the company said in a statement.

“During the balance of FY24, we believe that strong operational performance from our world-class asset base coupled with robust commodity prices will lead to further deleveraging at Vedanta,” the statement said.

Mining mogul Agarwal had last month in an interview with a British paper stated his aim to make Vedanta Resources a “zero debt company”. Becoming “a zero-debt company is not a distant dream, but a medium-term, achievable goal,” he said.

Though Vedanta did not disclose from where it got the funds to pay the $1 billion in April, Indian subsidiary Vedanta Limited last week pledged 2.44 per cent of its stake in group company Hindustan Zinc to raise Rs 1,500 crore, with the sum to beused for general purposesincluding the repayment ofexisting debt.

Rating agency Crisil had said Vedanta Resources has annual debt maturities of about $3 billion each in FY24 and FY25, with high near-term maturities of $1.7 billion in the first quarter of fiscal 2024. There are also reports that Vedanta is in advanced negotiations to raise $1.5-2 billion from US hedge fund Farallon Capital Management.

Vedanta had earlier proposed to sell its global zinc assets to Hindustan Zinc for nearly $3 billion. However, the government, which owns 30 per cent of Hindustan Zinc, has opposed the move.

Hindustan Zinc CEO Arun Mishra has said the plans to buy the overseas assets has not been called off yet.

The CEO made the remarks during an earnings call with analysts after its Q4 results released last week.

“Unless we the board passes a resolution withdrawing this, till that time, it is not called off.”