US-based investment firm Kora Management is investing Rs 850 crore ($125 million) in the Edelweiss group.

Kora, which focuses on the financial and technology sectors across emerging markets and is an existing investor in Edelweiss, will put Rs 525 crore, or $75 million, in the advisory business, Edelweiss Global Investment Advisors (EGIA).

EGIA includes the businesses of asset reconstruction, wealth and asset management and institutional client group, which together contributes to nearly 50 per cent of the group’s profit.

Kora also plans to make another investment of $50 million (Rs 350 crore) in Edelweiss, the timing and structuring of which is being finalised.

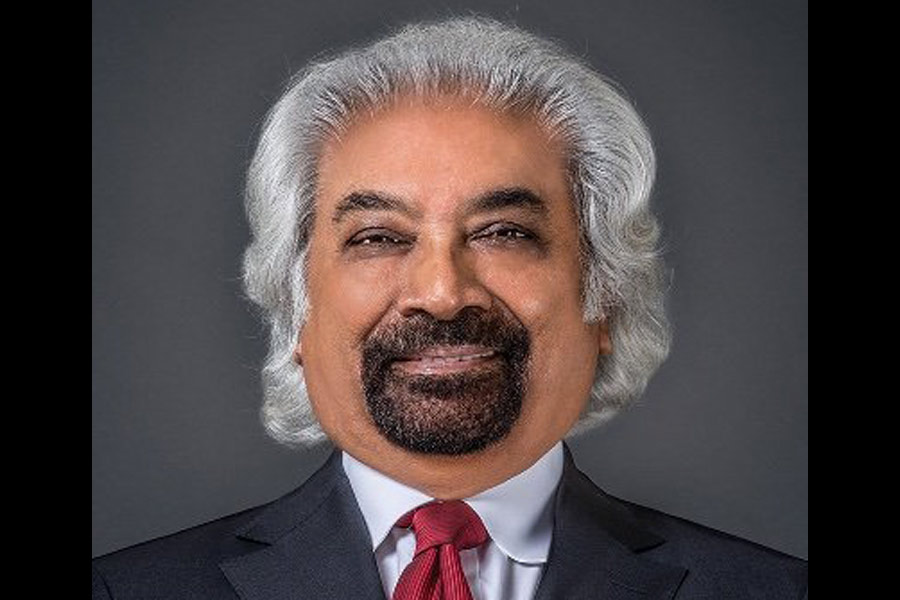

“Our customers will benefit immensely from Kora’s acumen in technology and financial services across emerging markets, and their investment will help us scale our businesses in a competitive market environment,” Rashesh Shah, chairman and chief executive officer of the Edelweiss group, said.

The Edelweiss group is also in talks with investors to join the first round of external investment in EGIA, which will be limited to $200 million (Rs 1,400 crore).

Kora’s founder and chief investment officer Nitin Saigal said, “Over the years, the group has built a diversified financial services franchise in India. Today, EGIA is well-positioned in asset and wealth management and distressed debt, two exciting sub-segments in Indian financial services.”

HDFC Life

Standard Life, the foreign partner in HDFC Life Insurance Company Ltd, on Wednesday sold a 3.3 per cent stake in the insurer for Rs 3,220 crore. Standard Life Mauritius Holdings held 23.02 per cent stake in HDFC Life as on June 30, 2019, while HDFC had 51.48 per cent stake in the company.

Yes Bank QIP

Yes Bank on Wednesday said it has raised Rs 1,930.46 crore through a qualified institutional placement (QIP) to fund its business expansion. The QIP opened on August 9 and closed on Wednesday, the bank said in a regulatory filing.