The Sensex on Thursday crossed the 70500 mark for the first time as investor spirits soared after the US Federal Reserve signalled three interest rate cuts next year.

Accompanying the 30-share gauge was the broader Nifty which too put up a record show as it closed at a new high of 21182.70.

During the session, it zoomed 284.55 points or 1.35 per cent to 21210.90, a lifetime intra-day peak.

As for the Sensex, it rallied 929.60 points or 1.34 per cent to close at 70514.20. During intra-day trades, it shot up by 1018.29 points or 1.46 per cent to hit 70602.89.

The fresh fervour was led by IT stocks which soaked under Fed chief Jerome Powell’s dovish remarks after a two-day meeting of the central bank on Wednesday.

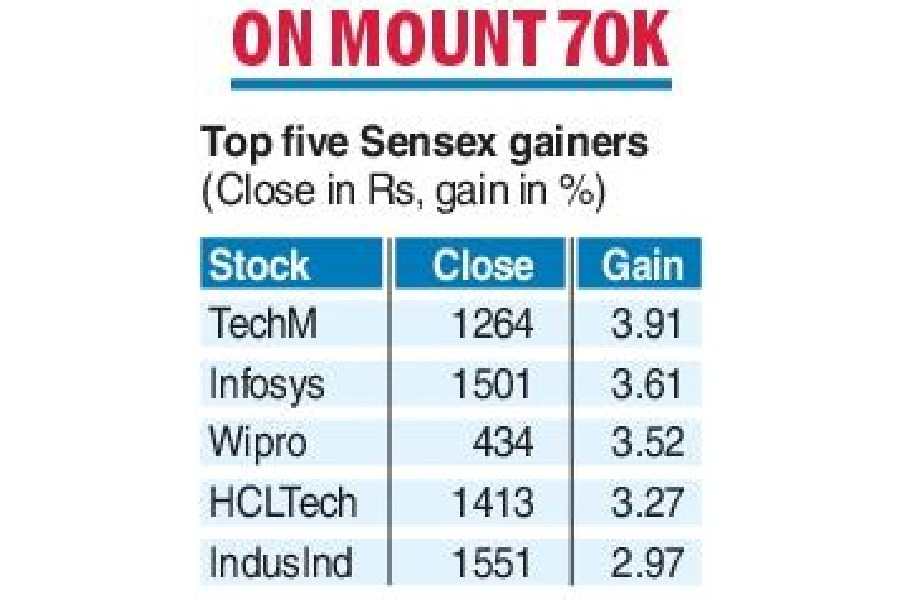

His guidance on interest rate cuts next year generated optimism that it would positively impact the sector as the US economy would receive a growth impetus. In the Sensex pack, the top four gainers were from the IT services segment, with Tech Mahindra leading the list.

While the stock gained 3.91 per cent, it was followed by Infosys, Wipro and HCL Technologies which rose to 3.61 per cent. IndusInd Bank, Bajaj Finance, Bajaj Finserv and Mahindra & Mahindra were the other major gainers.

On the NSE, the Nifty IT index edged up 3.50 per cent on the back of brisk buying in mid-tier firms such as Mphasis and Coforge which rose up to 7.60 per cent.

On Wednesday, the Fed went along expected lines when it kept interest rates steady.

However, in a pleasant surprise to those chasing risky assets, Fed chair Powell indicated that interest rate hikes were nearly over as it is “not the base case anymore’’. Moreover, the central bank’s summary of economic projections showed that Fed officials expected 75 basis points of interest rate cut in 2024.

“A confluence of domestic and global factors is driving a Goldilocks scenario in the Indian equity market. Unwavering political stability, a robust macroeconomic backdrop with healthy GDP growth and subdued inflation, and weakening dollar and US bond yields amid expectations of a 2024 rate cut have fuelled bullish momentum.

Moreover, a recent slump in crude oil prices has eased inflation pressure, further boosting investor confidence,’’ Parth Nyati, founder of Tradingo, said.

He added that foreign institutional investors (FIIs) are exhibiting signs of FOMO (fear of missing out) and are eager not to miss out on the potential multi-year bull run.

“The Indian market looks poised for further gains, with Nifty’s immediate upside target sitting at 21315. This rally has the potential to extend towards the 22000 mark, though downside support lies at 20770,’’ Nyati said.

The Fed’s dovish tone also led to a rally in the rupee which closed at 83.33 against the dollar against the previous finish of 83.39 to the greenback.

However, a rise in crude oil prices and dollar buying by PSU banks capped the gains in the rupee.