The Telegraph

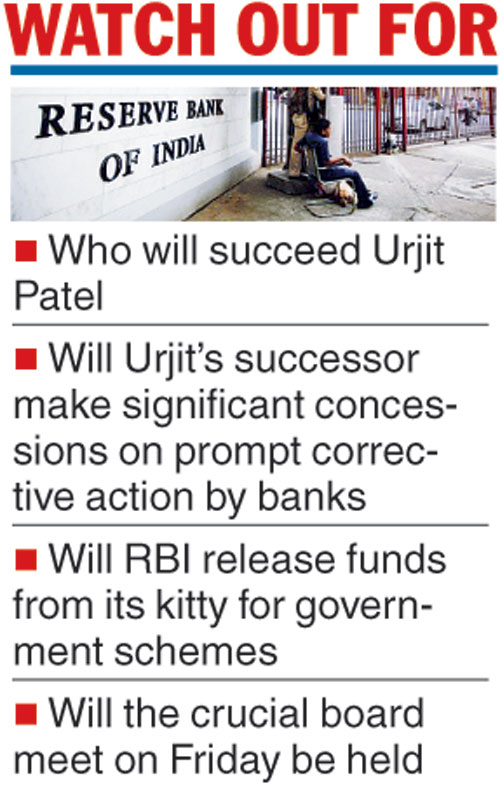

Urjit Patel’s resignation on Monday as the RBI governor has thrown up crucial questions on who will be his successor, whether the Centre will appoint an interim boss and, more importantly, if the December 14 meeting of the RBI central board will be held as scheduled.

Banking circles said while the Centre could now set up a panel to recommend the next governor, this process could take some time.

An interim official from within the RBI may be nominated till a successor is chosen. This is clearly specified in the RBI Act, 1934.

While this indicates that the interim appointment should come from within, central bankers said it is the senior most deputy governor who could be appointed.

The RBI now has four deputy governors. They are: N.S. Vishwanathan, Viral V Acharya, B.P. Kanungo and M.K. Jain. Among them Vishwanathan is the senior most as he took over as the deputy governor on July 4, 2016. Acharya was appointed as the deputy governor in December that year.

Patel’s surprise resignation on Monday led to speculation that Acharya may also follow suit. This arose as the RBI deputy governor, in a speech in October, had strongly defended the autonomy of the central bank.

However, an RBI spokesperson said the reports of Acharya resigning were not correct and that he does not intend to quit.

While there are a few optimists who are rooting for Acharya to be the next governor, Subir Gokarn’s name has also cropped up.

“All eyes are now on who will be the replacement to Patel and what happens to all the contentious issues between the Centre and the RBI. If they appoint a friendly bureaucrat as the RBI governor, who then proceeds to rubber-stamp whatever the government comes up with, whether it is relaxation of prompt corrective action norms or releasing excess capital from the RBI balance sheets, then it will seriously impinge on the independence and the credibility of the RBI,’’ Ananth Narayan, professor at the SPJIMR, told The Telegraph.

He added that while in this case the reaction from the foreign investors will be negative, the government can salvage the situation if it appoints a person who is as credible as Raghuram Rajan or Patel.

Though the development comes just four days ahead of the central board meeting of the RBI, sources feel it is likely to take place as scheduled.

Moody’s observation

Moody’s Investors Service on Monday said the independence of a country’s central bank is an important consideration while assessing its institutional strength and any attempt by the government to curtail it would be credit negative.

“However, our assessment of institutional strength ultimately focuses on the quality and policy outcomes of the institutions themselves, not on the individuals leading them,” it added.