Finance minister Nirmala Sitharaman has proposed in her second budget an alternative personal income-tax regime, making a half-hearted attempt to please individual taxpayers.

The minister has said the decision is aimed at providing significant relief to individual taxpayers and to simplify the income-tax law.

But there is a catch. If the taxpayer wants to move to the new regime, exemptions have to be forgone.

Does it make sense to move to the new tax regime?

The exemption limit has been retained at Rs 2.5 lakh a year but the slabs have been reoriented.

Individuals having annual income up to Rs 5 lakh will not be required to pay any income tax as they will continue to get a tax rebate of Rs 12,500 under Section 87A.

Under the optional new regime, an individual will be required to pay tax at the reduced rate of 10 per cent for income between Rs 5 lakh and Rs 7.5 lakh, against the current rate of 20 per cent.

For income between Rs 7.5 lakh and Rs 10 lakh, he or she will pay at the reduced rate of 15 per cent against the current rate of 20 per cent. For income between Rs 10 lakh and Rs 12.5 lakh, the taxpayer will pay tax at the reduced rate of 20 per cent against the current rate of 30 per cent.

Income between Rs 12.5 lakh and Rs 15 lakh will be taxed at the reduced rate of 25 per cent against the existing 30 per cent.

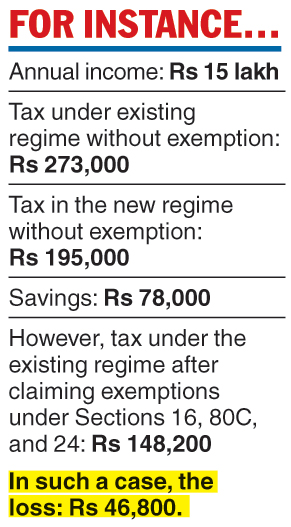

For an individual earning an income of Rs 15 lakh, the proposed tax structure will provide a relief of Rs 78,000 as he will be paying a tax of Rs 195,000 against Rs 273,000 under the existing regime.

But note the exemptions that you have to forgo. There will be no benefit of standard deduction from salary, no set-off for the payment of interest on a housing loan and no tax exemption for insurance premiums, payment of school fees or deposits in a public provident fund -– which used to be lumped together under the benefits flowing from Section 80C up to a limit of Rs 1.5 lakh a year.

The Telegraph

The axe has also fallen on the Rs 10,000 exemption on interest earned from deposits in savings bank or post office deposits under Section 80TTA. Senior citizens who opt for the lower tax regime will also have to forgo the benefit of up to Rs 50,000 on interest earned from their bank deposits under Section 80 TTB.

Likewise, taxpayers opting for the new tax rates will not get deduction for eligible donations made under Section 80G, or for rent up to Rs 5,000 a month under Section 80GG.

They will also lose out on the deductions under Chapter VIA as well as various exemptions under Section 10 of the Income Tax Act.

Now consider a situation where the taxpayer with an income of Rs 15 lakh opts to stay under the old regime.

He will be able to claim the benefit of standard deduction up to Rs 50,000, exemption of Rs 1.5 lakh under Section 80C, and interest on housing loan for Rs 2 lakh under Section 24 (though it will require a big loan amount). As a result, his taxable income will come to Rs 11 lakh and his tax liability will amount to Rs 148,200. This is less than what he will have to pay under the new tax regime.

Thus, taxpayers need to compare their tax liabilities under the two different tax regimes and choose wisely before filing their returns.

An individual who is currently availing more deductions and exemptions will most likely benefit more by staying in the old tax regime.

The people were hoping for a substantial relief in tax as also simplicity in compliance. But it remains to be seen what implication the exemption-free tax regime has on the propensity to invest in provident funds, insurance or tax savings deposit schemes in the long run.

Finance Bill 2020 contains as many as 104 amendments to the income-tax law, which becomes more complicated every year. It’s time we have a stable tax system for at least five years.

Narayan Jain is a tax advocate. The views expressed are personal