Uco Bank has chalked out a capital raising plan of ₹4,000 crore in 2024-25 in a bid to bring down the shareholding of the government from the current 95.39 per cent and comply with the 25 per cent minimum public shareholding norms.

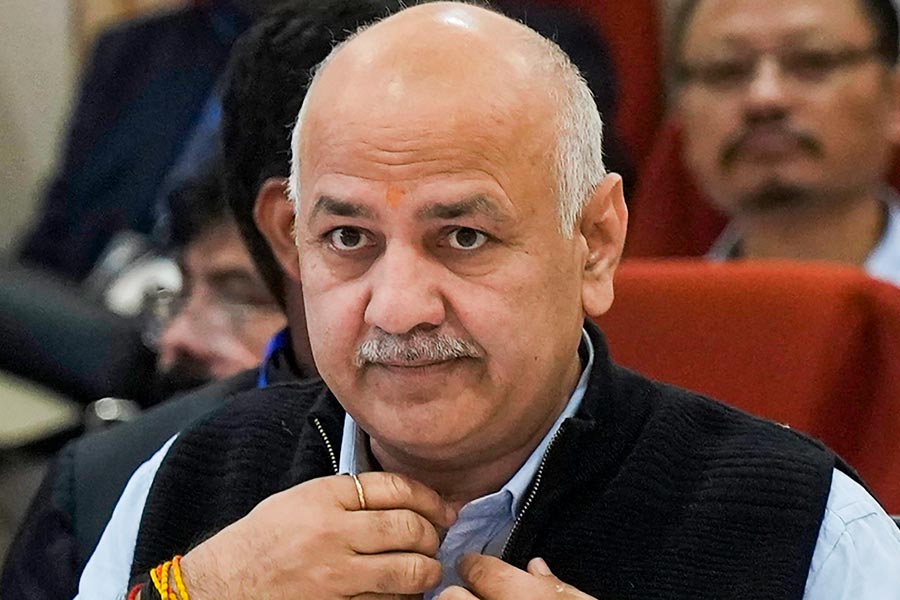

“Our capital adequacy ratio is 16.98 per cent (as of March 31, 2024). We do not need any capital for growth. But our government holding is around 95 per cent and we have to bring it down to 75 per cent,” Uco Bank MD and CEO Ashwani Kumar said on Tuesday.

“To take care of this, we have taken approval of the board for issuance of 400 crore equity shares of face value ₹10. As of now we have not yet planned the exact date or time but it will be in tranches as per the requirement and at the opportune time,” Kumar said.

The public sector lender has time until August to comply but there could be a further extension of time for compliance.

The bank’s board on Monday approved the capital raising plan which includes various modes of fund raise such as qualified institutional placement and follow on public offer.

Speaking about the credit growth outlook, Kumar mentioned that the bank is expecting a growth of 12-14 per cent in 2024-25, and corporate lending is expected to remain robust during the fiscal.

Amid a challenging environment for deposit raising, the bank aims to reach a credit-deposit ratio of 75 per cent. As of March 31, 2024, the bank’s CD ratio was at 71.02 per cent.

The bank has also decided to expand its branches to deepen its footprint. It plans to open 130 branches this fiscal year in areas with little or no representation.