Tata Steel is believed to be in talks with Usha Martin’s promoter Prashant Jhawar to pick up close to a 19.5 per cent stake in the company.

Prashant, who is based in London, and his father Basant Jhawar, who had founded wire and wire rope maker Usha Martin, may offload much of their 25.5 per cent holding in the company, if the deal goes through.

However, the completion of the transaction is contingent upon the successful resolution of the dispute between Prashant and his cousin Rajeev Jhawar over the management and ownership of Usha Martin. Prashant and Rajeev are fighting cases in the National Company Law Tribunal.

Rajeev Jhawar, who is the managing director of the company and holds an identical stake in the company along with his father Brij and other family members, is likely to remain in the management even after the Tatas come on board.

Calls made to Prashant Jhawar were not answered. The Telegraph left a message on his voice mail and also sent a text to his mobile phone.

Later in the evening, his spokesperson said: “It is a rumour.”

Asked about the deal, a top Tata Steel official said: “No comments.”

The deal, which will require consent from Rajeev Jhawar and the lenders, is going to be over and above what Tata Steel is paying to buy out the steel division of Usha Martin.

Usha Martin received the shareholders’ nod last Saturday to sell the one-million-tonne steel plant located in Jamshedpur for Rs 4,525 crore to the Tatas.

Tata Steel subsidiary Tata Sponge Iron is also buying the captive power plant linked to it along with a developed iron ore mine and a coal mine which is under development.

Prashant and Basant Jhawar voted in favour of the resolution on slump sale in the extraordinary general meeting, which took place last Saturday, even as they raised questions on how the sale proceeds would be utilised to repay loans and the residual debt on Usha Martin’s books after the steel deal.

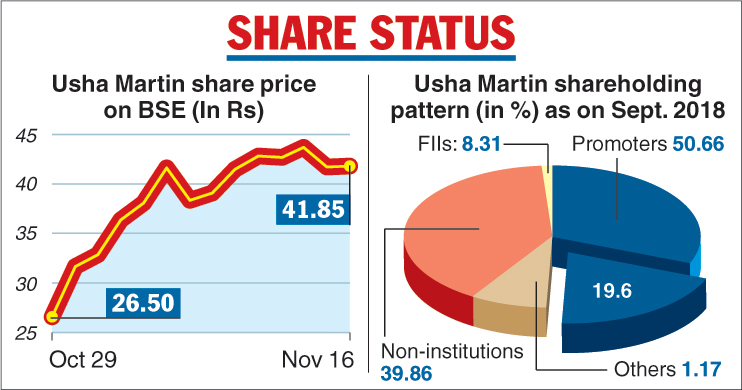

Telegraph infigraphic

Prashant’s moves

When the sale of the steel business was announced by Usha Martin on September 22, Prashant Jhawar had praised the Tatas saying the “Tatas are an excellent business house” and that “transaction with Tata Steel is overall a positive development”.

However, his statement was ambivalent whether he would vote in favour of the deal.

For the next one month, he raised several questions over the deal, seeking confirmation if the entire fund is being used to repay debt, which has caused continuous stress on the balance sheet of the company. It was also suggested by him that the entire company be sold to the Tatas instead of only the steel division.

On October 29, he informed lead lender — the State Bank of India — that his side will vote in favour of the transaction.

No explanation was given as to what changed in the interim period to swing the deal.

At Friday’s closing price, the deal would be valued at Rs 248 crore, unless the Tatas agree to a premium to buy the shares.

If the transaction goes through, the Tatas will have a significant minority stake — Rajeev Jhawar

and his father Brij will have tad over 25 per cent — in India’s largest wire and wire rope manufacturer which has several facilities in Asia and Europe.