The Reserve Bank of India (RBI) on Monday proposed to bring banks on par with larger non-banking finance companies (NBFCs) on provisioning against loans that could turn sour.

In its discussion paper on expected loss (EL) based-approach for provisioning against loans, the RBI said it would keep smaller co-operative banks based on a threshold and regional rural banks out of the framework.

A key feature of the new system are the three account categories — Stage 1, Stage 2 and Stage 3 — depending upon the assessed credit losses on them at the time of initial recognition as well as on each subsequent reporting date. Provisions will be made on the basis of the three categories, the paper said.

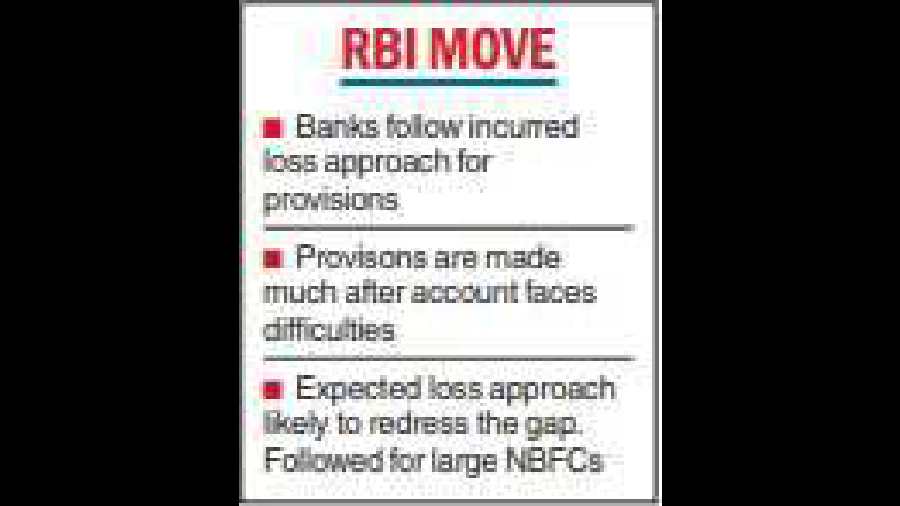

At present, banks follow the “incurred loss” approach while making provisions.

In this method, banks need to provide for losses that they have occurred or incurred. Its key drawback is that provisions are made by banks with significant delays after the borrower may have started facing financial difficulties thereby increasing their credit risk.

On the other hand, NBFCs who have a minimum net worth of Rs 250 crore are required to follow the EL method.

In September 2022, the RBI had announced that it will come out with a discussion paper for the adoption of EL approach regards loan loss provisioning.

According to the discussion paper, the EL will be measured as “a probability-weighted estimate of credit losses over the expected life of the financial instrument or the asset”.

The RBI said banks would be allowed to design and implement their own models for measuring expected credit losses.

The central bank will issue broad guidance while designing the credit risk models.