JSW Steel is looking for a partner to own and operate Bhushan Power & Steel Ltd (BPSL) once India’s judiciary approves the company’s resolution plan submitted under the bankruptcy process.

Sajjan Jindal-promoted JSW is open to a “similar” structure that it had forged with private equity partner AION Capital Partners to take over Monnet Ispat Ltd, also through the insolvency process.

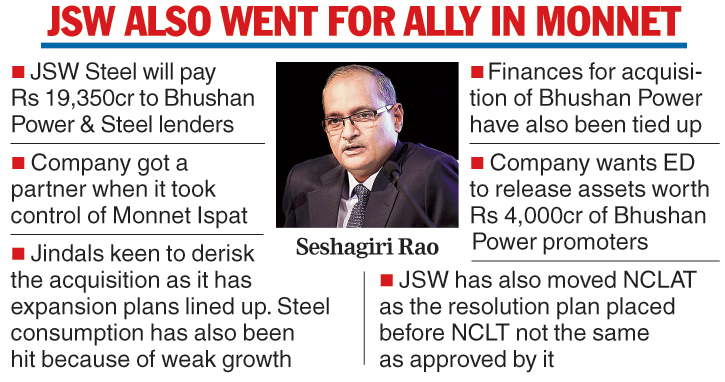

Seshagiri Rao, joint managing director and group CFO at JSW Steel, said he expected there would be interest from potential partners for BPSL as well.

“We are open to a similar structure, not necessarily the same,” Rao told The Telegraph, referring to the Rs 19,350-crore resolution plan it submitted with the lenders of Odisha-based BPSL under the Insolvency & Bankruptcy Code.

While acquiring Monnet, which at Rs 2,875 crore is a much smaller buy than BPSL, JSW took an effective stake of 23.1 per cent, where the majority is held by AION. Rao explained that inducting a partner, if and when that happens, would be an exercise to “de-risk” the business.

JSW’s strategy becomes all the more relevant when growth in India’s economy hit a 26-quarter low to 4.5 per cent in the quarter ended September 30, resulting in a sharp decline in steel consumption. This year, steel consumption is projected to grow at a mere 4 per cent, half of that recorded in the previous fiscal.

The Telegraph

JSW is also expanding its own steel-making capacity, especially at Dolvi, Maharashtra, where an additional 5-million-tonne (mt) plant will be commissioned in 2020. It will also put up a 4mt value-added downstream facility at the same location.

In the recent acquisition of Essar Steel, the world’s largest steel maker Arcelor Mittal partnered Japan’s Nippon Steel to establish a 60:40 joint venture to take over the asset for Rs 42,000 crore.

Nippon’s Japanese counterpart, JFE Steel, is already a partner of JSW Steel where it owns less than a 15 per cent stake. So far, JFE has not shown interest in BPSL, at least publicly.

Rao said JSW has fully tied up finance to take over BPSL when its concerns are allayed. It stumped up the offer for BPSL on its own, unlike in the case of Monnet. The company had dramatically upped the ante, raising its bid from Rs 11,000 crore, to knock Tata Steel out of the race.

Concerns

The Enforcement Directorate had attached assets worth Rs 4,000 crore under the Prevention of Money Laundering Act while pursuing a case against former BPSL promoter, Sanjay Singhal, and his family.

JSW made its stand clear that it would only acquire a clean asset as it did not want to be dogged by the alleged misdeeds of the erstwhile owners. The Centre has brought in an ordinance, which was notified on Saturday, which assured the new owners that they would not be held accountable for the misdeeds of the past.

“The asset of BPSL is attached by the ED. So now, the ED has to release the assets. That has not happened yet. After the ordinance is notified, the first step should be to release them. We need a clean asset,” Rao explained.

The resolution plan that JSW submitted is not what has been approved by the National Company Law Tribunal, Delhi. That’s why the company went in for an appeal before the NCLAT.

Moreover, the company is seeking resolution of one aspect in the NCLT order which said the profit generated during the corporate insolvency resolution process belonged to financial creditors.

However, there was no profit during the CIRP period even though the resolution professional of BPSL submitted that there was Rs 1,575 crore of EBIDTA as on March 31, 2019.

It appeared that the profits and EBIDTA were used interchangeably, even though they are fundamentally different. There was a positive EBIDTA but no net profit, Rao explained. If it is a net loss, the consideration goes down as it should be adjusted. But if it is EBIDTA, the consideration will go up if the order is strictly followed.

“I’m ready to pay the full amount of Rs 19,350 crore for a going concern. So, there is no closing adjustment involved as in the case of Essar Steel. But the NCLT order brings out this aspect that needs to be put to rest,” Rao added.

The NCLAT order is expected in January.