Vedanta Ltd, the Anil Agarwal-led company, will seek shareholders’ approval on October 11 to transfer Rs 12,587 crore from its general reserves to retained earnings, which is likely to be used for dividends.

Earlier, companies had to transfer a certain portion of their profits to general reserves before declaring a dividend. The Companies Act, 2013 has dropped this provision.

In a notice to shareholders, Vedanta said the government has done away with the mandatory requirement to transfer funds from the profits or retained earnings of a company to its general reserves and the creation of general reserves in accordance with the erstwhile provisions of the Companies Act, 1956.

The company said there were no provision under the Companies Act which enables or restricts the transfer of funds lying in the general reserves to retained earnings.

According to Vedanta, in the absence of any spe cific provisions or guidance under the Act, various high courts and the National Company Law Tribunal (NCLT) have permitted companies to undertake such a transfer through a scheme of arrangement.

Over the years, the company has built up significant reserves through the transfer of profits to the reserves in accordance with provisions of the erstwhile Companies Act, 1956 and erstwhile rules notified under the Companies (Transfer of Profits to Reserves) Rules, 1975.

A steady growth in sales volume, balanced capital expenditure for continuing operations have helped the company to achieve a strong track record of generating cash flows.

With healthy business practices in place, this growth trajectory will continue and the business operations will keep generating incremental cash flow over the coming years, Vedanta said.

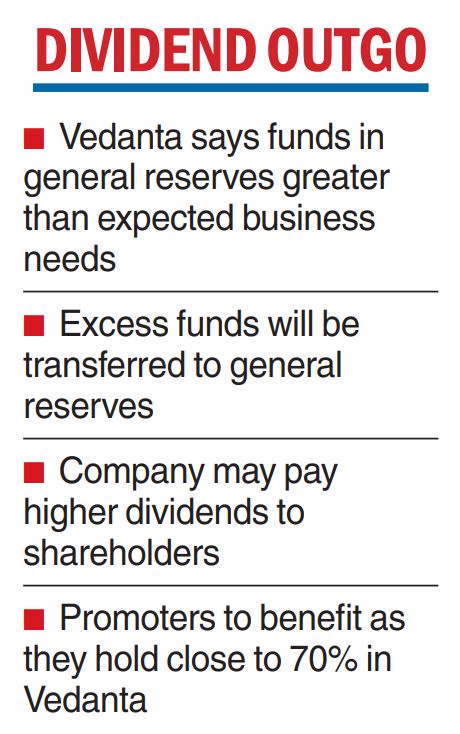

“The company is of the view that the funds represented by the general reserves are in excess of the company's anticipated operational and business needs in the foreseeable future."

“These excess funds can be utilised to create further shareholders' value, in such a manner and to such extent, as the board of the company inits sole discretion, may decide, from time to time and in accordance with the provisions of the Act and other applicable law. The scheme is in the interest of all stakeholders of the company,’’ it added.

The promoters hold close to 70 per cent in Vedanta Ltd and any dividend payment will flow to them as well.