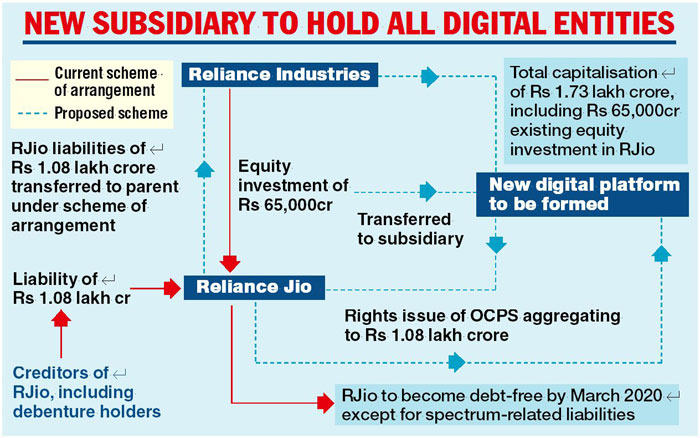

Reliance Industries Limited (RIL) made a big-bang announcement late on Friday evening of its decision to set up a wholly owned subsidiary that will house Reliance Jio

Infocomm and all its digital initiatives — accompanied by a bold financial restructuring exercise that seeks to transfer all of RJio's Rs 1.08 lakh crore liabilities to RIL, leading to RJio turning “virtually” net debt free by the end of this current fiscal.

The Reliance move caps a tumultous pre-Diwali week for the telecom industry that first witnessed the merger of MTNL and BSNL followed by a Supreme Court verdict on Thursday that hugely widened the scope of adjusted gross revenue of operators and saddled them with mammoth Rs 92,000-crore dues, dealing a huge blow to Vodafone Idea and Bharti Airtel even as RJio was left relatively unscathed. The apex court on Friday said the dues must be paid within three months.

A RIL statement said a wholly owned subsidiary would be created bringing all its existing digital platform initiatives under a single umbrella.

Besides, the current liabilities of RJio — at around Rs 1,08,000 crore — will be transferred to Reliance.

In lieu of this, an issue of optionally convertible preference shares (OCPS) will be made, which will be subscribed by the wholly owned subsidiary. RIL said the subsidiary would also acquire its investment of Rs 65,000 crore in RJio.

In other words, while the new entity will be a subsidiary of RIL, RJio will be an arm of the new entity.

With its debt being transferred to RIL, the statement said RJio would become a “virtually net debt free company” by March 31, 2020 with the exception of spectrum related liabilities, which are understood to be Rs 25,000 crore.

The Telegraph

Sources close to RIL said one of the key objectives behind this move was to form a digital services giants similar to Alibaba, Tencent or Google.

“Globally these companies have a valuation of anywhere between $400 billion and $800 billion. What RIL is effectively doing is to create a platform company which has the potential of commanding a similar valuation,” the source said.

The RIL statement said the digital platform company would have negligible debt, which will be a compelling investment proposition for both strategic and financial investors, many of whom have evinced interest in partnering the company.

According to RIL, the new structure has several advantages. Firstly, the structure is not expected to impact Reliance’s standalone credit profile given its strong cash flows.

Second, the consolidation of liabilities (in RIL) will create an efficient structure to manage debt and cash. At the consolidated level, too, the move would not lead to any rise in its debt.

Moreover, it will lead to monetisation opportunities, which will accrue to Reliance shareholders.

“This new company will be a truly transformational and disruptive digital services platform. It will bring together India’s top connectivity platform, leading digital app ecosystem and world’s best tech capabilities globally, to create a truly digital society for each Indian,” Reliance Industries chairman Mukesh Ambani said.

Given the reach and scale of our digital ecosystem, we have received strong interest from potential strategic partners. We will induct the right partners in our platform company, creating and unlocking meaningful value for RIL shareholders,” Mukesh D. Ambani, Chairman and Managing Director, RIL said while commenting on the development.

On the debt being transferred to RIL books, the source said that the company is confident of meeting Ambani’s plan of being a zero net debt firm by March 2021 given its strong cash flows. of over Rs one lakh crore, apart from other steps that are being planned.

RIL had reported a net debt of Rs 1,57,236 crore for the second quarter ended September 30, 2019.

Sources disclosed that the new entity will hold all its digital platforms including RJIL and other acquisitions such as Den Networks and Hathway.

According to RIL, the new structure has several advantages.

Firstly, the structure is not expected to impact Reliance’s standalone credit profile given its strong cash flows.

Second, the consolidation of liabilities (in RIL) will create an efficient structure to manage debt and cash. At the consolidated level, too, the move would not lead to any rise in its debt.

Moreover, it will lead to monetisation opportunities, which will accrue to Reliance shareholders.

The RIL statement said that the group has been developing a robust digital ecosystem through various digital applications, tools and platforms covering self-care, information, entertainment and chat among others. These include JioTV, MyJio, JioCinema, JioNews and JioSaavn. Sources added that healthcare and education are the new focus areas for the platform, apart from other areas like agriculture, gaming and commerce.

In March, the tower and fiber passive infrastructure assets of Rs 1,25,000 crore were demerged from RJIL in March 2019 to Infrastructure Investment Trusts (InvITs) and this led to RJIL becoming an asset light firm.