The net debt of Reliance Industries Ltd (RIL) is forecast to peak in this financial year and subsequently decline, with capex moderating and the private sector giant using more of its cash for expansion.

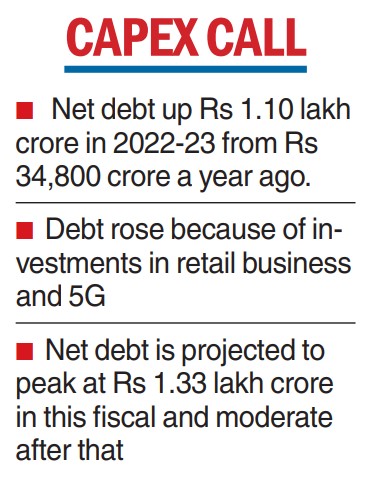

Net debt at RIL had shot up to Rs 1.10 lakh crore in 2022-23 from Rs 34,800 crore in the previous fiscal as capital expenditure rose to Rs 1.41 lakh crore from Rs 99,472 crore in 2021-22, an increase of 43 per cent.

A large part of the capex in 2022-23 was due to RIL’s investments in 5G and its retail business.

The rise in capex and net debt coupled with the lack of other triggers such as the news of potential listing of its digital services or retail business have weighed down the RIL stock. The share has fallen 2.60 per cent this calendar year, while the benchmark Sensex rose around 3 per cent.

While the Street will now look out for chairman Mukesh Ambani’s address to the shareholders at the forthcoming annual general meeting (AGM), analysts feel the net debt position could show an improvement from the next fiscal as capex moderates.

“The concerns on debt are overdone, in our view. We expect RIL’s net debt to peak in 2023-24 and decline gradually as capex will not only moderate but, importantly, be fully funded by a gradual increase in internal cash generation,’’ analysts at JM Financial said in a recent note.

According to the brokerage, their interactions with investors suggest limited triggers of an earnings upgrade have hit the Reliance stock.

A likely delay in the hike in telecom tariffs — possibly after the general elections — is an overhang on the stock.

An uncertain macro environment globally could cap the margins of its oil-to-chemical (O2C) business.

Besides, there is low visibility on event-based triggers in the near term such as the listing of digital and retail businesses or strategic stake sales in clean energy or O2C businesses.

JM Financial added there were concerns over the sharp rise in net debt because of aggressive capex in the digital, retail and clean energy businesses.

Reliance's net debt in 2022-23 at Rs 1.10 lakh crore was 0.8 times its EBITDA (earnings before interest, taxes, depreciation & amortisation) against 0.3 times in the preceding fiscal year.

Analysts now project RIL’s capex will peak at Rs 1.33 lakh crore in 2023-24 and moderate to Rs 1.10-1.20 lakh crore annually from 2024-25 onwards as expenditure in the digital services business could come down.

The brokerage said store additions could come down to 8-10 million square feet annually after the addition of 24 million square feet in the last fiscal that could reduce business capex. Reliance had chosen to front-load its store expansion plans in the last fiscal.

Gas to IOC

Indian Oil Corporation (IOC) has walked away with half of the natural gas that Reliance Industries Ltd and its partner bp of the UK offered in the latest auction of the fuel.

IOC got 2.5 million standard cubic meters per day out of the 5 mmscmd of gas auctioned last month, sources with knowledge of the matter said.

The oil refining and marketing company bid the volumes on behalf of seven fertiliser plants.