It always works, when you know what you’re doing

Richard Bach in Johnathan Livingston Seagull

The Reserve Bank of India’s decision to cut the policy repo rate by 35 basis points has unleashed a series of implications for the debt market, which no investor can afford to ignore. The apex bank’s latest stance, largely being billed as “accommodative”, comes at a time large sections of the economy are said to be ailing. Several key areas, including automobiles, financial services, capital goods and power, are displaying signs of weakness.

The two principal asset classes — debt and equity — are not yielding enough at this juncture; for investors, the situation has given rise to serious doubts about the near and mid-term prospects of both.

In the days ahead, investment circles will keep a close eye on the manner in which the latest repo rate adjustment influences the real economy. At least a couple of quarters need to pass before the impact can be assessed meaningfully.

The emerging inflation scenario is expected to be fairly benign, with some sections predicting it to be maintained at 3.5-3.7 per cent during the second half of the current fiscal. Meanwhile, the standard measures taken by the apex bank, including those related to the higher flow of funds to the NBFC sector, are likely to kick in.

The market, however, will continue to grapple with weak demand in select sectors, escalation in trade-related tension, and the tardy pace in which both investment and consumption are growing. These will drag the economy lower. Any scale-up in food prices, following a paucity of rainfall or an increase in international fossil fuel rates, will compound our woes.

Those are all realities faced by investors. What should they do now?

Any strategy to beat these problems must be based on a clear understanding of risks, especially those stemming from poor credit quality and adverse interest-rate movements. In the recent past, there have been several cases (including a few high-decibel ones) of default — the borrowers concerned have been simply unable to satisfy their lenders by way of interest and principal payments. Moreover, there is no guarantee that the story will not be repeated in the days to come.

Keeping these factors in mind, here is what I recommend.

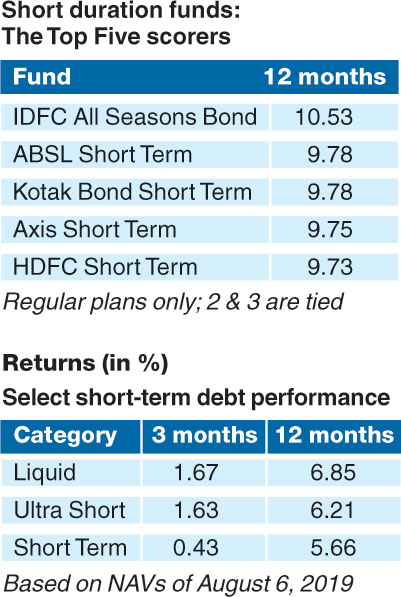

One, investors must adhere to short-term debt products. This is not the most ideal time for large-scale exposure to medium-term or long-term debt. The latter will be a lot riskier in comparison, especially because interest rates are expected to play the spoilsport. For the investor who is typically considering allocation to longer term debt, stability of yield may well be the biggest challenge.

Two, selection of the right sort of debt products will be very critical. As a general rule, the average investor (depending on his risk appetite, which will essentially determine his asset allocation) can pick his choices from among liquid, money market, low duration and ultra-short term debt funds. He, however, has to make sure that no compromise is being made on the credit quality of fund portfolios.

Three, investors need to tone down their expectations a bit. This actually means that they must not expect superlative returns from the debt market at all times. On the contrary, the general idea is to lower one’s predictions in so far as yields are concerned.

As everybody knows, only the most well-managed debt funds will be able to hold their nose above water. Plenty of storied names have already sunk in the world of debt. The pecking order is set to change again soon.

FD once more?

Yes, I know it is finally all a matter of perspective, but the current state of uncertainty in the actively-managed debt market is bound to drive some quarters to assured-return products like fixed deposits. The latter, after all, guarantee their returns, while debt funds are certainly unable to do.

At the same time, guaranteed-return options must be weighed from many angles. Are these tax efficient? Are these being pushed by corporate houses with a dubious track record? What are their credit ratings? Do they have financial services players, may be housing finance players or infrastructure funding companies, as promoters?

FDs, as it is famously pointed out, are for the relatively weak-hearted, while debt funds are for those who dare to challenge the status quo.

It remains to be seen how the investors will finally react, but the fact remains that many of them will consider FDs as the first and only option during uncertain times.

The checklist

Determine your risk profile accurately before you choose the funds. Remember, an understanding of your time horizon is the key. A money market fund, for instance, is not the most suitable storehouse of capital for, say, a full year. To meet such a purpose, do consider other categories.

Stick to open end structures only, avoid close end (or semi close end) choices as they seriously limit your exit strategies.

Go for smart, new-generation alternatives like low duration funds (LDFs). These can be the right parking zones for those who wish to keep lumpsum amounts for a few months or more. Systematic transfer plans (STPs) can be worked out with the help of such LDFs. The latter can also be seen as reservoirs to draw from during emergencies.

FMPs (or fixed income plans) are not the most appropriate vehicles for your surplus capital at this juncture. Weigh your options carefully before selecting FMPs.

Funds that have a built-in asset allocation and rebalancing style can be considered instead. Of course, this will lead to some exposure to equity, which, in turn, may increase your risk.

The writer is director of Wishlist Capital Advisors