The Gangwals are once again looking to pare their stakes in InterGlobe Enterprises, the parent of budget carrier IndiGo.

They could reportedly sell 5-8 per cent in a transaction that could be worth up to Rs 7,000 crore next month when the lock-in period for further sale ends.

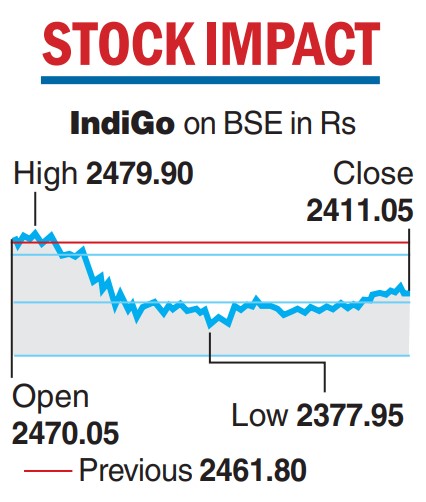

News of the potential sale led to the shares of IndiGo crashing on the bourses on Monday. The budget carrier settled at Rs 2,411.05 — a drop of 2.06 per cent or Rs 50.75 over the previous close on the BSE.

The development comes at a time airlines are reaping the absence of Go First which filed for bankruptcy in May. It led to a sharp increase in fares particularly during the peak season which would be reflected in their numbers for the first quarter that ended June 30. The IndiGo stock has risen around 23 per cent so far (as of last Friday) this year.

On Monday, a CNBC Awaaz report said Rakesh Gangwal and Shobha Gangwal who hold 13.23 per cent and 2.99 per cent, respectively, (for the quarter ended March 31, 2023), could sell part of their stakes for Rs 5000-7000 crore and that brokers have begun approaching certain funds to vet their interest in the potential block deal.

While this could not be confirmed, sources did not rule out the possibility of such a sale happening in the middle of next month. The Chinkerpoo Family Trust of the Gangwals holds 13.50 per cent of the company.

In September last year, Rakesh Gangwal sold almost 2.75 per cent of his stake in the airline through block deals on the NSE for Rs 2,005 crore.

Before the transaction, the family held 36.61 per cent of InterGlobe Aviation, while co-founder Rahul Bhatia and his family held 38.17 per cent. This sale by the Gangwals was undertaken across four transactions wherein they offloaded nearly 1.06 crore shares.

Rakesh Gangwal resigned as a director of InterGlobe Aviation in February 2022.

The founders were engaged in a long-running feud with Gangwal raising corporate governance issues in July 2019. It drew to a close in December 2021 when the shareholders voted in favour of a resolution that removed restrictions on the share transfer to a third party.