Qatar’s sovereign wealth fund may pick up a token stake in Reliance Retail Ventures Ltd, India’s largest retail chain owned by billionaire Mukesh Ambani-led Reliance Industries Ltd.

The Qatar Investment Authority is in early discussions to buy a 1 per cent stake in the company for about $1 billion (Rs 8,200 crore) valuing the high fashion to grocery retailer at $100 billion, London’s Financial Times reported.

The sovereign fund is keen on tapping the fast-growing Indian market even as the talks are at a preliminary stage and may not finally yield into a transaction.

If the talks fructify, QIA will follow in the footsteps of sovereign wealth funds of other oil-rich Gulf nations which picked up stakes in RRVL in 2020.

Saudi Arabia’s Public Investment Fund (PIF) invested $1.3 billion for a 2.04 per cent stake in RRVL, Abu Dhabi Investment Authority (ADIA) put in Rs 5,513 crore for a 1.2 per cent stake and UAE’s Mubadala invested Rs 6,248 crore for a 1.4 per cent stake then.

The sovereign funds were part of an array of global investors who ploughed in Rs 47,265 crore in a span of two months to buy 10.09 per cent in Reliance Retail. Others include New York-based private equity firm KKR, Silver Lake Partners, General Atlantic, GIC and TPG.

If the Qatari fund does pick up 1 per cent for a $1 billion, it would translate to over 70 per cent jump in valuation in just about three years for RRVL which is widely expected to be listed on the bourses in the next 18-24 months.

Gross revenue of the retail arm Reliance Retail Ltd stood at Rs 69,948 crore for the April-June quarter, up 19.5 per cent from the same period a year ago. Earnings before interest, tax, depreciation and amortisation — a benchmark for operating performance — stood at Rs 5,139 crore, up by 33.9 per cent in Q1FY24 compared with the same period last year.

The company has 18,446 outlets, spanning over 70.6 million square foot retail space as on June 30,2023. It added 25.1 million sq ft retail space during the previous 12 months.

Earlier this month, Reliance Retail decided to reduce the share capital of the company by cancelling shares except owned by holding company RRVL, which owns a 99.91 per cent stake in RRL. RIL, in turn, owns 85 per cent of Reliance Retail Ventures Ltd (RRVL).

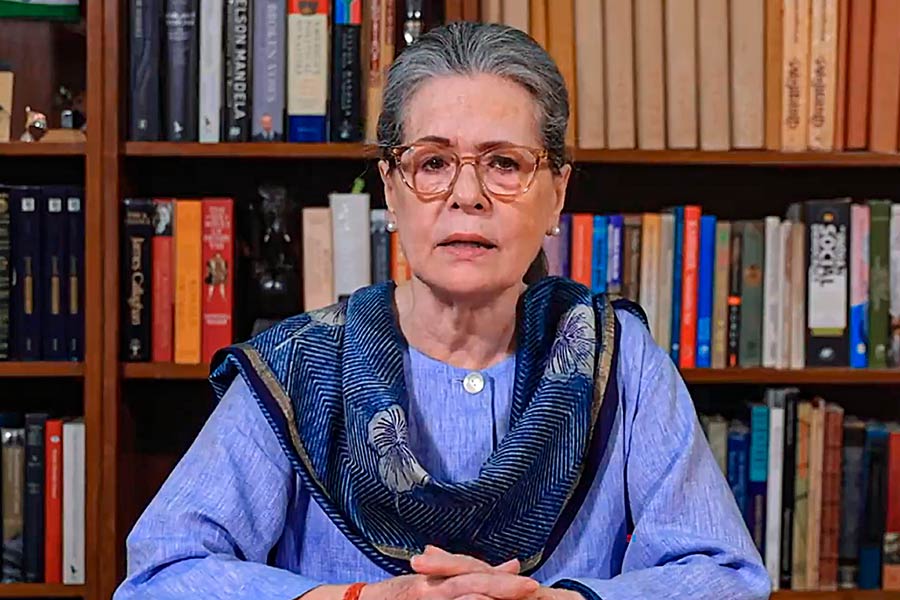

Reliance Retail, led by Isha Ambani, daughter of Mukesh and Nita Ambani, has been aggressively expanding its business by acquiring companies and getting into deals for franchise rights of leading international brands for the Indian market.

When contacted, a Reliance Retail spokesperson said, “The company evaluates various opportunities on an ongoing basis. As a principle, we do not comment on market speculations and rumours.”

Multiple options

Commenting on talks with Qatar's wealth fund, JP Morgan said the discussions highlight the multiple stake sale optionality that exists across Reliance's multiple businesses, reports PTI.

"For Reliance to double its value over the next four years (comments in last year's annual shareholder meeting), this would involve value unlocking from the substantial investments the company has made across segments (retail, Jio) and would make (New Energy)," it said adding it would also require selling stakes/listings of some of these businesses.

Over the years, Reliance has sold strategic stakes in its oil and gas exploration and production (E&P) business, financial stakes in retail, and large stake sales to multiple investors in telecom arm Jio.