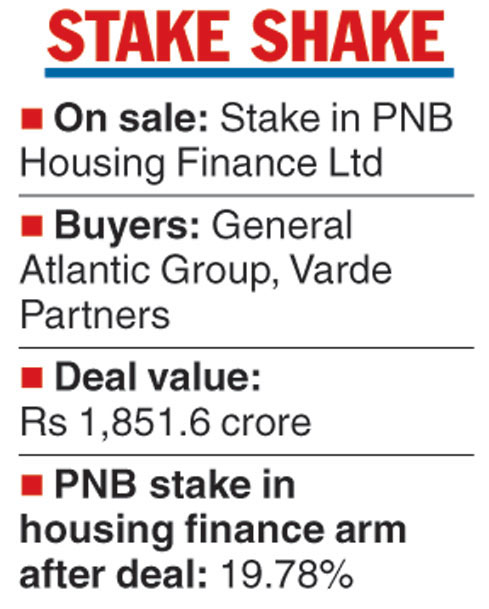

Punjab National Bank (PNB) is selling a part of its stake in PNB Housing Finance Ltd to global private equity firm General Atlantic Group and alternative investment firm Varde Partners for Rs 1,851.6 crore.

The public sector bank on Friday announced it has entered into agreements for these independent transactions.

According to the agreement, PNB will sell 1,08,91,733 equity shares held in PNB Housing to General Atlantic Group at a price of Rs 850 per share, totalling Rs 925.80 crore.

The lender has also entered into an agreement to sell 1,08,91,733 equity shares held in PNB Housing to Varde Partners at a price of Rs 850 per share, aggregating to Rs 925.80 crore.

After these transactions, PNB said it would continue to hold a stake of 19.78 per cent of the paid-up capital in its housing finance arm and shall continue as a promoter and strategic shareholder.

The transactions are subject to “customary conditions, including the receipt of applicable regulatory approvals”.

As on December 31, 2018, PNB held a 32.79 per cent stake in PNB Housing Finance.

Shares of the bank were largely unmoved as it ended at Rs 95.40. However, the PNB Housing scrip advanced 4.36 per cent, or Rs 36.20, to end at Rs 865.70 on the BSE.

The Telegraph

During the third quarter ended December 31, 2018, PNB Housing Finance saw its net interest income grow 35 per cent to Rs 558.2 crore from Rs 412.2 crore.

Profit after tax during this period showed an improvement of 32 per cent to Rs 303 crore from Rs 229.5 crore.

On the other hand, disbursements rose 13 per cent to Rs 27,517.6 crore during the nine months of this fiscal from Rs 24,455.3 crore over the same period in 2017-18. Its asset quality was strong as gross non-performing assets (NPAs) stood at 0.47 per cent of the loan assets as on December 31 2018.

PNB Housing Finance offers its retail customers housing and non-housing loans. It also gives construction loans to real estate developers for residential housing.

During the April-December period, the company continued with its expansion as 16 branches were made operational, taking the total number to over 100.