The board of One97 Communications, the parent of Paytm, met on Friday where it is understood to have considered the country’s largest IPO.

Though there was no official comments as to the outcome of the board meeting, it is learnt that the board has approved the share float plan.

This comes amid reports that the SoftBank and Alibaba-backed firm is likely to file its draft red herring prospectus (DRHP) within the next couple of months. The company is expected to be listed by October-November this year.

The exact size of the offering has not yet been confirmed though informed sources had said that it may be worth $3 billion, making it the largest IPO, beating the record held by Coal India which had come up with a Rs 15,200 crore share float in 2010.

While Paytm is currently valued at $16 billion, the proposed IPO will see its valuation rising to over $25 billion. After the board approval, the company may have take nod of its shareholders as well.

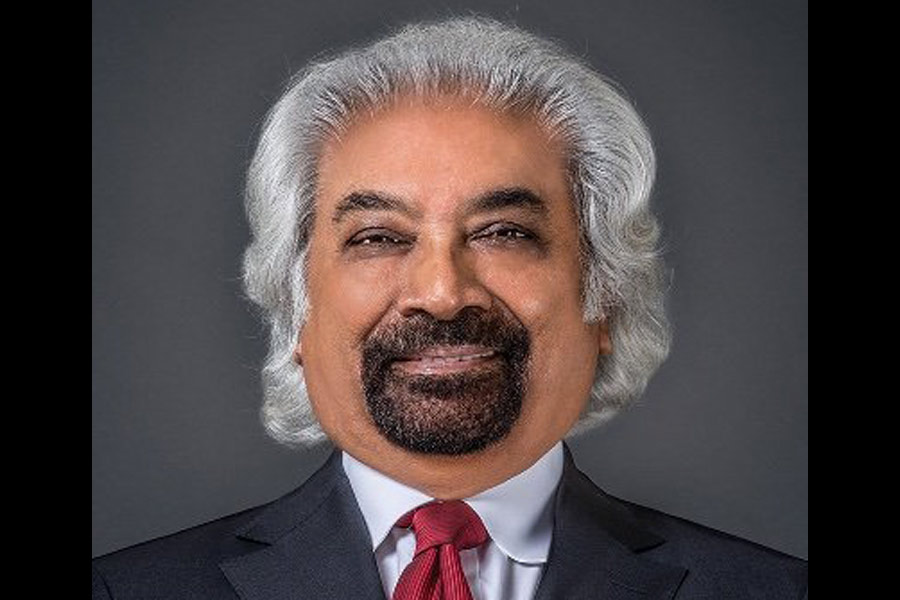

Founded by Vijay Shekhar Sharma, its investors include SoftBank, Ant Financial, AGH Holdings, SAIF Partners, Berkshire Hathaway, T Rowe Price, and Discovery Capital. Ant Financial is its largest investor with a stake of around 40 per cent.

Digital transactions in the country has seen a rapid rise since the demonetisation of 2016, benefitting players like Paytm which now has over 58 million account holders. The pandemic has resulted in the people preferring digital platforms for various transactions, thereby aiding the fintech companies.

After beginning as a mobile & DTH recharge platform, it later offered services like mobile wallet. It has now ventured into other financial services such as distribution of mutual funds and insurance products.