The earnings season got off to a slow start on Thursday with the net profit of Tata Consultancy Services (TCS) trailing Street estimates for the third quarter ended December 31, 2023.

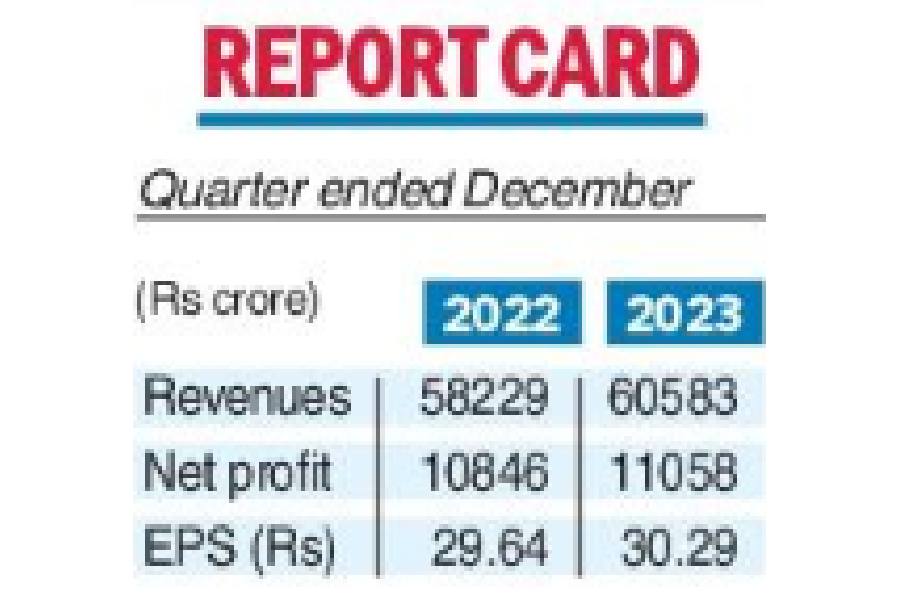

Net profits of the country’s largest IT service provider rose 2 per cent to Rs 11,058 crore from Rs 10,846 crore in the year-ago period.

Brokerages were expecting the Tata group firm to report net profits between Rs 11,100 crore and 11,500 crore. TCS, however, had to absorb an “exceptional item’’ of Rs 958 crore in the quarter as balance punitive damages amount.

In November, TCS said that it would make a provision of $125 million related to a trade secret lawsuit filed by US-based Epic Systems.

While the outlook was muted ahead of the numbers, it did not improve going by

the commentary from the TCS top management after the results.

K. Krithivasan, chief executive officer and managing director, TCS, said the situation has not changed much from the second quarter. He told the media it was too early to say whether there would be a recovery in the present quarter or April-June 2024.

The October-December quarter is a seasonally weak period for IT companies as it has fewer working days because of furloughs and holidays.

IT services firms such as TCS are facing a weak demand environment as budget-conscious clients hold back on big or discretionary spending amid elevated interest rates.

Reflecting the soft conditions, the TCS order book stood at $8.1 billion during the quarter against $11.2 billion in the second quarter.

TCS posted revenues of Rs 60,583 crore, a rise of 4 per cent over Rs 58,229 crore in the same period last year, slightly above the estimates of brokerages such as Axis Securities of Rs 60,570 crore.

In geographical performance, North America continued to lag with revenues from the region falling 3 per cent, while India showed a growth of 23.4 per cent. It stood at 8.1 per cent for the UK and 0.5 per cent for Continental Europe. On the other hand, within business verticals, BFSI showed a drop of 3 per cent, while it fell nearly 5 per cent in the communication & media segment.

As of December 31, 2023, the total workforce at TCS stood at 603,305. Employee attrition, however, trended lower as it declined to 13.3 per cent from 14.9 per cent in the preceding three months.

Despite the weak numbers, TCS had good news for its shareholders at it declared a special dividend of Rs 18 per share and an interim dividend of Rs 9 per share. This is part of its policy to return 80-100 per cent of free cash flow back to shareholders.