The Aramco deal is off — at least for now.

Mukesh Ambani, the sixth richest man in the world, has seen everything go swimmingly well at a time every other industrialist has moaned about how the dreadful pandemic has gutted their businesses.

Ambani has left everyone gobsmacked by the astonishing ease with which he has sewn up a string of transactions in Jio Platforms and then topped that with a blowout rights issue, enabling him to raise an eye-popping Rs 2.12 lakh crore and turn the company into a net debt-free entity.

But there is a wrinkle in the fabric.

The tycoon hasn’t been able to close the one deal that he has doggedly chased for the greater part of the past year: the $15 billion investment by Aramco of Saudi Arabia for a 20 per cent stake in the oil-to-chemicals business that he intends to spin off.

Elusive deal

The deal — which was announced with a lot of fanfare at last year’s AGM — has proved to be elusive and the only blot on an otherwise extraordinary record that proclaims him as one of the biggest dealmakers in the world.

On Wednesday, Ambani did not come straight out and say that the Aramco deal was dead — and even tried to suggest that he might be keeping his doors open. After all, at $15 billion, the deal with Aramco will dwarf all the others that he has managed to knit in an incredible 84 days since the Facebook deal on April 22.

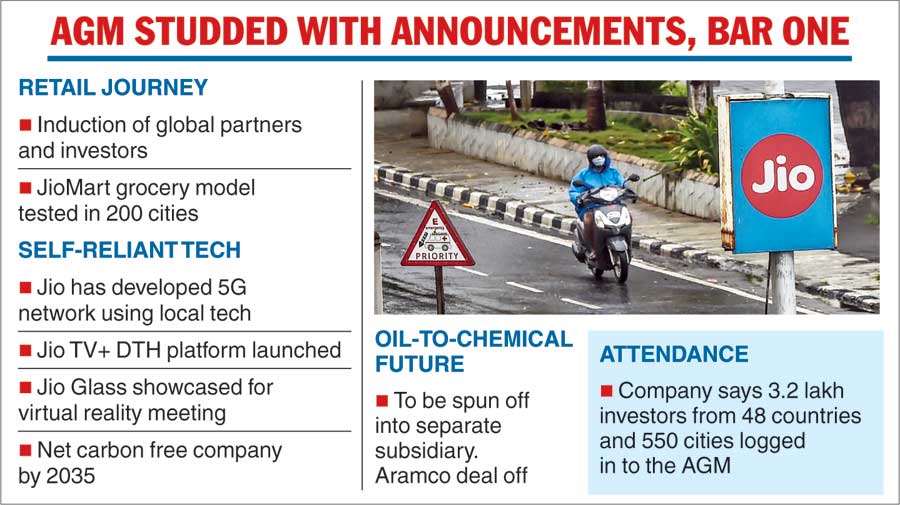

“Due to unforeseen circumstances in the energy market and the Covid-19 situation, the (Aramco) deal has not progressed according to the original timeline,” Ambani told shareholders at the virtual AGM but he hastened to add, “our equity requirements have already been met”.

The Aramco deal would have been his crowning glory. The fact that it didn’t happen took some of the shine off the other big announcement of the day: Google’s Rs 33,737 crore investment in Jio Platforms for a 7.7 per cent stake. Shareholders had been primed for the Google deal because of the speculation that had swirled around for a couple of days and the morning’s newspapers that had anticipated it.

The deal with Aramco, which was supposed to be completed by March this year, started to face a few niggles late last year. But company officials insisted that the deal was “on track” while presenting the third quarter

results for fiscal 2019-20 in January. That assurance was necessary for the company to give as some analysts had started to worry that the $75 billion valuation for the O2C business might have to be reworked.

O2C spinoff

The O2C business has the largest slice of RIL’s revenues and profits and accounts for 50 per cent of India’s exports.

Ambani said the company would press ahead with its plans to spin off the O2C business and would approach the National Company Law Tribunal to seek necessary approvals to turn it into a separate subsidiary.

Ambani’s disappointment was palpable but he tried to gloss over it by saying that the partnership with Aramco would continue.

Doors open

“We at Reliance value our over two-decade relationship with Saudi Aramco and are committed to a long-term partnership,” he said and added that the decision to turn the business into a separate subsidiary was designed “to facilitate this partnership opportunity (with Aramco)”. That comment left everyone wondering whether he was deliberately leaving the door open for another round of deal-making negotiations when things get better.

The stock markets were, however, quick to react to the failure to tie up the deal. The RIL stock had been surging all through the morning and hit a record Rs 1,978.50 on the BSE ahead of the AGM. But after the announcement, the stock tumbled to close at Rs 1,845.60, 3.71 per cent lower than Tuesday’s close.