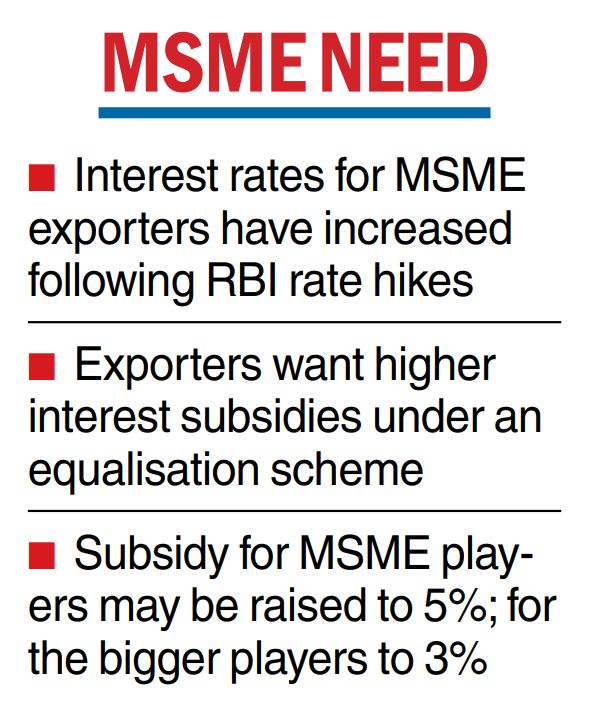

The government is considering a proposal to offer higher subsidy on interest rates to MSME exporters to protect them from the high cost of capital.

Under the interest rate equalisation scheme, the government is looking to raise the subsidy to 5 per cent from 3 per cent for micro, small and medium manufacturers and 3 per cent from 2 per cent for manufacturer-exporters and merchant-exporters under 410 tariff lines.

In the scheme, the Centre reimburses the banks for the subsidy.

Commerce ministry officials said they were calculating the higher expenditure on account of the subsidy hike prior to submitting their request to the finance ministry to release the sum.

The government has budgeted Rs 2,621 crore for the scheme in FY23, against Rs 3,151 crore in FY22.

A. Sakthivel, president of Fieo, said with increasing global competition coupled with a slowdown, it is necessary to ensure that the increase in credit rates does not blunt the competitive edge of exporters.

“The government should increase interest subvention under the Interest Equalisation Scheme from 3 per cent and 2 per cent respectively to 5 per cent to all MSME manufacturers and 3 per cent to all other eligible categories as interest rates have already crossed the pre-Covid level,” he said.

K.M.Subramanian, president of the Tiruppur Exporters’ Association, wrote to finance minister Nirmala Sitharaman to enhance the interest subsidy on packing credit to 5 per cent mainly to help the knitwear garment manufacturers.

The exporters fear high inflation and the threat of global recession will reduce demand for their products in the key markets.

Exporters have been pressing the government to restore the interest equalisation benefits amid a series of interest rate hikes by the central bank.

The government reduced the interest equalisation benefit to 3 per cent from 5 per cent for MSME manufacturers over the last two years as overall interest rates had come down and MSMEs were getting loans at 7-7.5 per cent interest.

However, exporters said the rates have gone up to nearly 10 per cent, which is higher than the pre-Covid level, and the interest burden is only expected to rise.

The interest equalisation scheme mostly covers labour-intensive and employment-generating sectors such as readymade garments, toys, handicrafts auto components and processed food.

The RBI has already increased the repo rate four times since May to check inflation. The last increase was on September 30 when the repo rate was pushed up 50 basis points to 5.9 per cent.

The WTO has forecast a slowdown in growth in world trade to 1 per cent in 2023, down from the previous estimate of 3.4 per cent, due to global uncertainties.