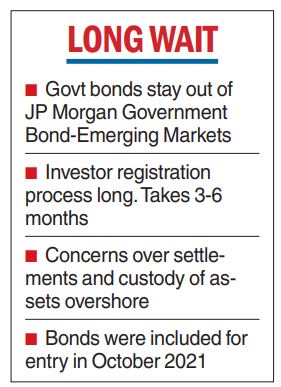

Domestic bond market hopes of being added to a global index was dashed on Tuesday when JP Morgan held back the inclusion of Government of India bonds in the JP Morgan Government Bond Index-Emerging Markets.

Bond prices had rallied in recent times on hopes that sovereign India bonds will be included in this calendar year after the exclusion of Russia because of its invasion of Ukraine.

The latest development may put pressure on domestic bond prices in the near term. On Tuesday, yields on the benchmark 10-year security closed at 7.36 per cent against the previous close of 7.47 per cent.

The leading investment bank said in an announcement that India government bonds will remain on index watch for GBI-EM inclusion. Explaining the reasons for the postponement of India’s inclusion, JP Morgan said that investors have acknowledged recent improvements such as a more streamlined account opening process through the common application form (CAF), they cited "investment hurdles that need to be resolved, including a lengthy investor registration process and the operational readiness required for trading, settlement and custody of assets onshore’’.

The investors said that while the process has improved, a new account set-up takes around 3-6 months on average JP Morgan added that if included, India will likely reach the maximum 10 per cent allocation in the index.

It was in October 2021 that India government bonds designated as fully accessible route (FAR) were placed by JP Morgan on positive index watch.

The investment bank added that India will continue to remain on watch at this time based on investor feedback.

The Reserve Bank of India, in consultation with the Government of India had introduced the separate channel, called FAR in 2020, to enable non-residents to invest in specified Government of India dated securities.

Eligible investors can invest in specified government securities without being subject to any investment ceilings. Goldman Sachs had projected that the inclusion of India in a global bond index would lead to passive inflows of about $30 billion.