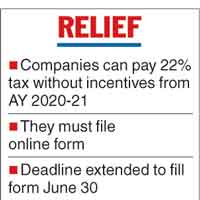

The Central Board of Direct Taxes (CBDT) has given companies extra time till the end of June to file a key form that is crucial for availing a lower corporate tax rate of 22 per cent without tax incentives

The tax department had offered the businesses the option of choosing a lower tax rate without tax incentives in 2019. This was applicable for the income earned from 2020 onwards. As per a CBDT statement, the deadline has now been extended till June 30 this year to get tax rebate.

However, to avail this lower rate, businesses have to opt for it by submitting form 10-IC in electronic form before filing the tax returns.

“Many companies though have opted for a new lower rate of 22 per cent tax in AY 2020-21 but have not filed this form which was a statutory requirement to switch over to the new rate. ”

“While processing the return of AY 2020-21, huge demands were created as a higher rate of 30 per cent was applied in processing. This will be a big relief to these companies,” Ved Jain, former president of the Institute of Chartered Accountants of India, said.

The form is required to be filled only if a domestic company chooses to pay tax at the concessional rate of 22 per cent under Section 115BAA of the Income Tax Act, 1961.

As per Section 115BAA of the Income Tax Act, domestic companies have the option to pay tax at a concessional rate of 22 per cent (plus applicable surcharge and cess) provided they do not avail specified deductions and incentives.

Companies can opt for the concessional rate from the Assessment Year 2020-21 onwards only if they file Form 10-IC within the prescribed time limit.

If businesses exercise the option for one year, the rule will follow in the subsequent years too. Businesses have to fill in the form in online mode only. Tax returns for income earned in FY20 were to be filed the assessment year starting 1 April 2020 (AY2020-21).

Many Indian businesses which claimed the benefit of lower rate in their corporate tax returns have not filed the specified form separately in this regard, leading to hardships.

The CBDT said in a statement that failure to submit this form would lead to denial of the concessional 22 per cent tax rate and in view of the representations received for relief, extra time is being given.

“Representations have been received by the board stating that form 10 IC could not be filed along with the return of income for assessment year 2020-21, which was the first year of filing of this form. It has been requested that the delay in filing of form 10 IC may be condoned," the CBDT said in the circular.

It said that “with a view to avoid genuine hardship to the domestic companies in exercising the option” of the lower tax rate, CBDT has directed that the delay in filing this form for 2020-21 assessment year is condoned in cases where certain conditions are met.

The conditions say that the business that seeks this rate should have filed tax returns for assessment year 2020-21 on or before the due date and have opted for the benefit in the return form and form 10 IC is filed on or before 30 June 2022.