India’s largest bulk tea producer McLeod Russel posted a 6.6 per cent rise in consolidated profit in the second quarter of the fiscal despite a 14 per cent lower income, underlining improving operational performance.

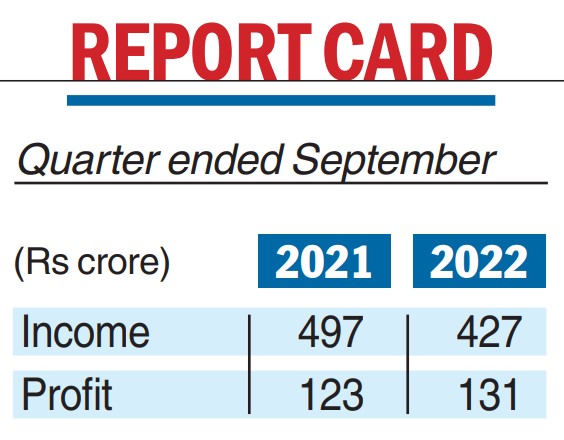

The company, promoted by the Khaitan family of Calcutta, posted a profit of Rs 130.76 crore in Q2FY23 compared with a profit of Rs 122.62 crore in the same period a year ago, on the back of higher realisation from sale of tea from India and a turnaround in the Uganda plantation.

Total income stood at Rs 426.71 crore compared with Rs 496.86 crore in the same three-month period of FY22 primarily due to lower volume in India. McLeod sold 5 million kg less bought leaf (tea leaf procured from third party) during the period.

Even on a half yearly basis, the company’s profit stood at Rs 92.56 crore, up by 66.5 per cent from Rs 55.59 crore in H1FY22. The second quarter usually is the best period for a tea company as it gets the higher volume from the second flush tea as well as revenue from export.

McLeod chairman Aditya Khaitan had told the shareholders the planter planned to focus on producing quality tea which can fetch a premium in the market. Moreover, it is also increasing the share of orthodox tea which is exported.

Debt restructuring

The improved operational performance may aid McLeod to close the long pending debt restructuring plan as it demonstrates the viability of the inherent business operation, a source in McLeod, argued.

A resolution plan under the RBI’s guideline has been prepared by SBI Capital Market and is being examined by the lenders of the bulk tea producer. The plan to pare down debt would include cash infusion by sale of assets, equity contribution by promoters and induction of a financial investor.