Equities continued to drift lower on Thursday weighed by concerns over faster monetary policy tightening in the US amid firm treasury yields there.

The policymakers of the US Federal Reserve will be meeting early next week — with the strong possibility that they will set the timetable for multiple rate hikes later this year.

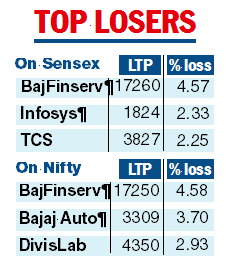

The benchmark Sensex fell for the third straight session and crashed 634 points to end below the 60000-mark following losses in heavyweights such as Reliance and TCS apart from financial and pharma sector stocks. At the NSE, the broader Nifty fell 1.01 per cent or 181.40 to end at 17757.

With prices flaring globally and central banks inclined towards sucking out liquidity by raising rates, investors fear the tide will turn against riskier assets such as stocks.

In trading on Thursday, yields on the 10-year US treasury was trading firm at 1.83 per cent compared with the previous close of 1.827 per cent. Moreover, firm crude oil prices have come as another headwind for stocks. Brent is ruling at $88.73 on Thursday an increase of 0.33 per cent at 16:06GMT.

Market circles added that although there has not been any major shocks from quarterly results, factors such as firm input prices are a major concern.

The lower close was also attributed to strong selling by foreign portfolio investors (FPIs). Provisional data showed they sold stocks worth Rs 4,700 crore on Thursday. FPIs have been mostly selling this year.

Siddhartha Khemka of Motilal Oswal Financial Services said while shares fell victim to profit booking, major events such as the budget and the elections to five states could lead to higher volatility.

“Hence, we advise trader to remain cautious and keep positions light. Investors can use dip in the market as an opportunity to accumulate quality stocks for long term.’’

There are others who do not rule out the possibility of a pre-budget rally. However, they point out that once the event is over, the focus will shift back to interest rates as the RBI will announce its monetary policy on February 9 where it could hike the reverse repo rate now at 3.35 per cent.