It’s almost the end of the financial year. Therefore, it’s also time to finish buying your tax-saving investments in order to secure your deductions under various sections of the Income Tax Act. The deadline is March 31. That said, we’re too close to the finishing line. And let’s face it — if you didn’t work to a financial plan in the last 11 months, you’re unlikely to do so now. Therefore, you now need a sensible, quick plan immediately.Wouldn’t it make your life easy if you could instantly buy some essential tax savers without having to step out of your office on a busy weekday? Or what about simply buying it sitting on your couch on a weekend? Let’s examine some tax-saving options that you can quickly buy online and be done with your tax-saving needs.

(Telegraph)

Health insurance

No matter who you are, how old you are, and what your income is, you must absolutely have health insurance. It’s your most basic line of defence against the steep costs of hospitalisation. A hospitalisation, a surgery, or the treatment of critical illness can easily cost you several lakh rupees, thus depleting your hard-earned savings.

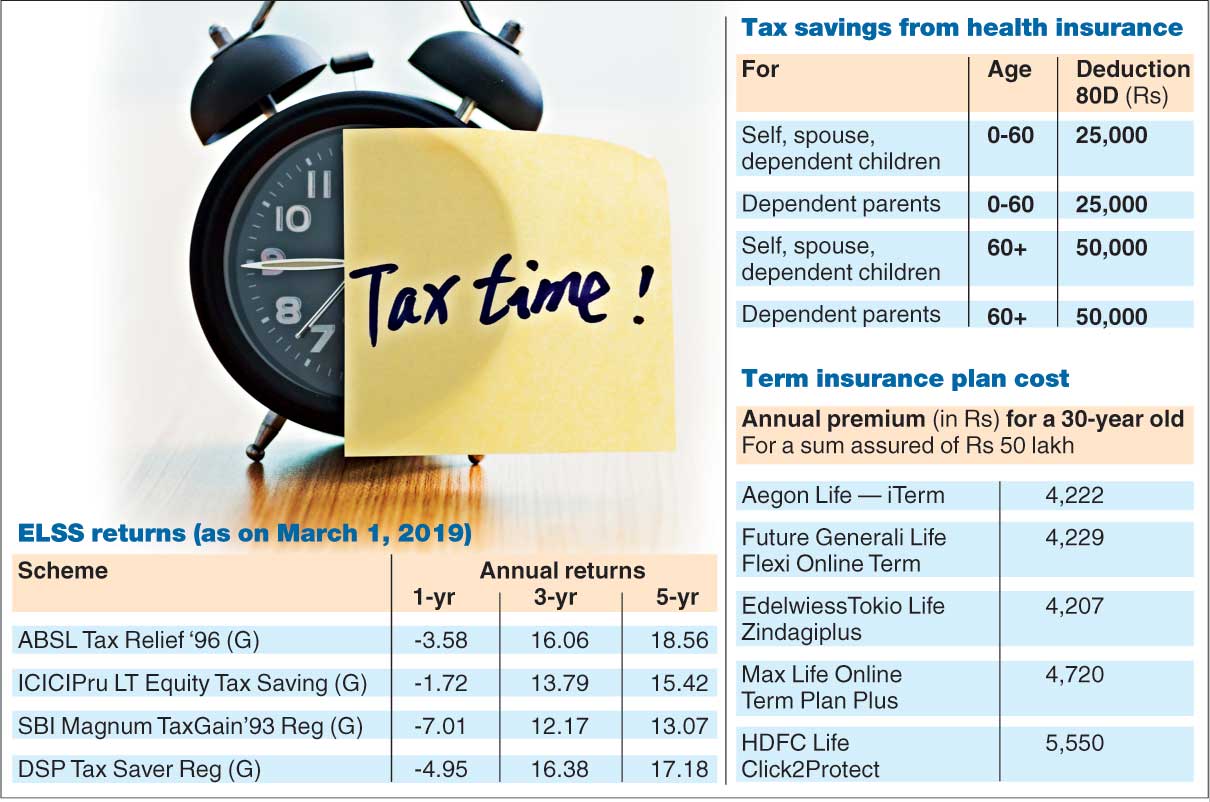

But a health insurance policy can protect your family’s finances. It provides you tax deductions under Section 80D. If you are not inclined to walk into your insurer’s branch office, just buy the policy online. If you need help with the features of the policy, ask the policy seller to call you back. If this will be your first health cover, try to go for a sum assured of at least Rs 3-5 lakh.

You also have the option of buying a family floater policy where the policy’s benefits are shared among your family members. You can pay for this policy through your netbanking, card, or other digital means provided by the insurer.

ELSS option

Equity linked savings schemes (ELSS) are one of the best ways to save tax under Section 80C, which provides you a total deduction limit of Rs 1.5 lakh.

ELSS are diversified equity mutual fund schemes. They are advisable for several reasons. They have the lowest lock-in of all section 80C investments, of just three years. You can buy them in monthly instalments, or simply do a lump-sum purchase at any point in the year. They have high long-term returns generating potential.

According to a mutual fund research website, the ELSS marketplace has delivered three-year returns of 15.09 per cent per annum, and five-year returns of 15.23 per cent per annum — far more than small savings schemes such as PPF and NSC.

Bear in mind these are past returns and not a guarantee of future returns, as your money is being invested in a volatile asset class.

ELSS trumps other forms of investment because of the comparatively lower investment charges. You can purchase ELSS funds online. If you are in doubt about which ELSS fund to buy, or which fund house to pick, consult an investment adviser.

Once decided, you can simply go online and purchase the fund using a KYC-compliant bank account. Ensure you complete this process well before March 28, so your fund units are allotted before the final working day of the month without pushing the investment into April.

Term plan

If you are a person with financial dependants such as spouse, children, and parents, you absolutely must cover your life risks adequately. Life cover is also useful for persons servicing debt who want their family to inherit debt-free assets. Like the above-mentioned options, a term plan too can easily be purchased online. Simply select one from the plethora of options available online, make your payment digitally, and receive your policy document in a few days.

Term plans provide you substantial life coverage at affordable costs but no investment benefits. For example, a 30-year-old salaried tobacco non-user male can buy a cover of Rs 50 lakh for an annual premium as low as Rs 4222, subject to conditions.

Your sum assured should be at least 10-20 times your current annual income. So if your income is Rs 5 lakh for example, aim for a cover of Rs 50 lakh to Rs 1 crore, as this would adequately replace your income for your family after your death. You can also pay a little extra for add-ons such as accidental death benefit, critical illness benefit, monthly income, and premium waiver. Premium paid towards life insurance will add up in your deductions under Section 80C, whose limit is Rs 1.5 lakh.

Ensure that these transactions are completed before March 31 so that you can claim your deductions for this financial year. As a lesson learnt, start the next financial year with a well-defined tax plan that helps you earn higher returns, ensure better coverage and save the maximum amount of tax.

The writer is CEO, `BankBazaar.com`