Infrastructure Leasing & Financial Services (IL&FS) on Monday said it had received more than a dozen responses to its proposal for stake sale in IL&FS Securities Services (ISSL) and ISSL Settlement & Transaction Services (ISTSL).

On November 12, the company had initiated the process to divest its stake in both these arms. The group has 348 subsidiaries, nearly half of which are overseas. “More than a dozen expressions of interest (EOIs) towards acquiring IL&FS’s stake in ISSL and ISTSL have been received, which the board is scrutinising for eligibility,” the company said in a statement. The last date for submitting responses was November 23.

The infrastructure financier disclosed that a mix of banks, private equity players and other financial services firms showed interest in buying its stake in the two subsidiaries.

A statement from IL&FS went on to add the group will shortly be launching the asset monetisation process for sale of many other assets as part of an ongoing resolution process.

In October, the board at IL&FS led by Uday Kotak had submitted to the ministry of corporate affairs (MCA) and the National Company Law Tribunal (NCLT) a report on “Progress and the Way Forward”.

The board had said in the report that it will look at one or more plans for resolution of the group. This may include various measures such as asset divestments. According to the board, the resolution options could involve significant capital infusion either individually or in a combination, divestments, and debt restructurings at the group level and at a business vertical or platform level. It may also cover an asset level resolution.

The Telegraph

Resolution plan

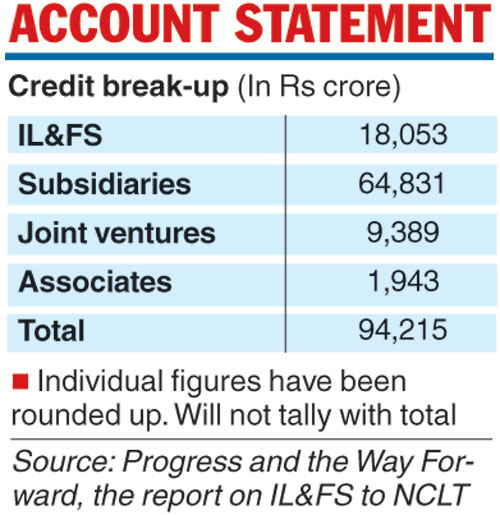

In the resolution plan submitted to the NCLT on October 31, the board said it expects to complete the resolution process, in stages, over the next two-three quarters. The board had then set the total debt of the group at Rs 94,215.6 crore as of October 8.

In the resolution plan, the management had said the new board was facing significant challenges arising from lack of reliable information and gaps in the data in working towards a resolution plan for the group.