Legendary investor Rakesh Jhunjhunwala, dubbed India’s Warren Buffett and Big Bull, passed away on Sunday at the age of 62. The eternal optimist of the India growth story, who was suffering from multiple health problems related to kidney and heart, was brought to the Breach Candy Hospital in South Mumbai early this morning where he was declared dead on arrival by the authorities, as per reports.

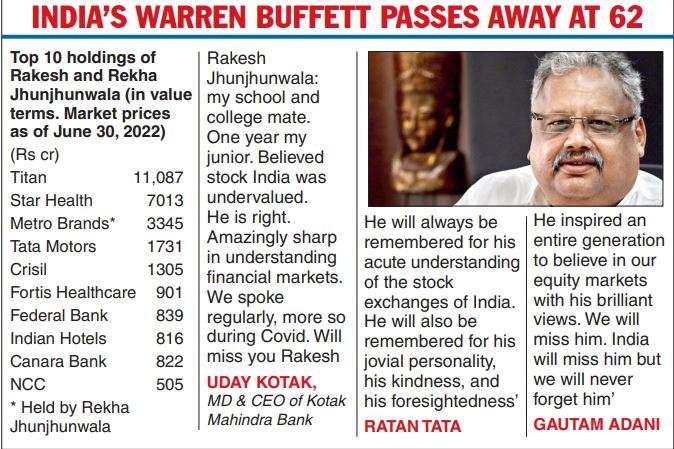

His untimely death sent shockwaves through the investing, business, and political community and tributes poured from every quarter on his contribution to the financial world. His wife and three children survive Jhunjhunwala, who had an estimated net worth of around $6 billion.

His death comes just a week after budget carrier Akasa Air, which was backed by him, commenced operations. Jhunjhunwala’s foray into the highly challenging aviation industry in many ways depicted his nature of taking risks. When asked why he started an airline when it is confronted by multiple headwinds, he replied, “I’m prepared for failure’’. The airline, which is also backed by former IndiGo president Aditya Ghosh and the former CEO of Jet Airways Vinay Dube, said in a statement that it would honour his legacy, values and belief by striving to run a great airline.

Observers said that though the airline is professionally run and Jhunjhunwala’s death is unlikely to have any impact on its operations, it remains to be seen how it raises capital (in Jhunjhunwala’s absence) to meet its future expansion plans.

Born on July 5, 1960 to a Rajasthani family, Jhunjhunwala graduated from the Sydenham College and subsequently enrolled at the Institute of Chartered Accountants of India. He debuted in the stock market with Rs 5,000 in 1985, and his portfolio grew to include companies such as Titan, Star Health & Allied Insurance (which he also backed), Crisil, Federal Bank, Fortis Healthcare, Tata Motors, Rallis India, Karur Vysya, Jubilant Ingrevia, Nazara Technologies and Aptech.

As per the latest data available, Jhunjhunwala and his associates that include his wife Rekha Jhunjhunwala hold stakes in 32 companies. He also founded stock trading firm Rare Enterprises that derives its name from the first two letters of his name and that of his wife. “What the market will lose is a street-smart investor, a well-known TV face, a strong bull market supporter and a savvy participant. He has also helped many companies reach the market with his early-stage investing and has also been a ruthless speculator in the markets. Jhunjhunwala was a one-of-a-kind person whose void may be difficult to fill,’’ Arun Kejirwal, director, KRIS an investment research firm, told The Telegraph.

“Nobody can predict the weather, death, market and women. Market is like a woman, always commanding, mysterious, uncertain and volatile. You can never really dominate a woman and likewise you cannot dominate the market,’’ he had famously said at a CII event earlier this year.

Another hallmark that separated him from several other investors was the tendency to grill company managements with tough questions at their quarterly earnings call. Jhunjhunwala’s death comes at a time the stock markets are in a recovery mode with the Sensex only short of 537 points from the 60,000 mark.

Market mavens say that though his demise will not impact its direction or sentiment, the domestic capital markets will miss a powerhouse who stood by equities even in bearish times. “The market is above individuals. The market is rational. An individual can never be smarter than the market,’’ is one such famous quote that will be remembered by investors. Another equally strong mantra related to keeping the faith in equities. “Then there is doom and gloom, don’t forget there is darkness before dawn,’’ is another quote that will be remembered by investors.