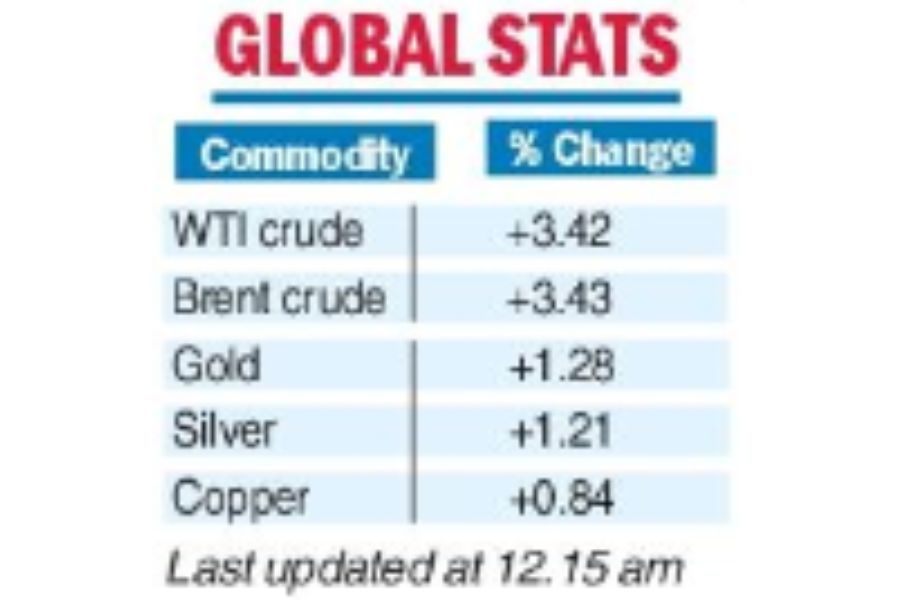

After a surge this summer when oil prices approached $100 a barrel, the cost of crude was tumbling again. Now a West Asian war has sent it right back up.

Traders drove up the price of oil as much as 5 per cent as fighting escalated between Israel and Hamas after the terrorist group attacked the Jewish state from Gaza over the weekend. Prices stabilised on Monday morning, but the global Brent oil benchmark appeared to be grinding back up toward $90 a barrel in the afternoon.

No oil is produced in the Gaza area, and Israel produces only a small amount of oil for its own use, energy analysts noted. But experts warned that prices could go higher if the fighting were to spread around the region, especially if Iran becomes actively involved in the war.

“Market sentiment could react swiftly to the tragedy in West Asia as far as oil prices are concerned,” said Kang Wu, an energy analyst at S&P Global Commodity Insights.

Israeli retaliation to the Hamas attacks, including an invasion of Gaza, could pull Iran and other Persian Gulf countries into the conflict. Oil traders were waiting to see if Israel would explicitly blame Iran for the weekend attacks, a sign that an escalation could be imminent.

Traders are worried that Iran might then seek to interrupt oil tanker traffic in the Strait of Hormuz, the primary passage for Gulf oil to the rest of the world.

Energy prices had been slumping over the past week in part because of recent unexpectedly strong growth in the output of oil from several countries, including some in the Organization of the Petroleum Exporting Countries, the oil cartel. Two main reasons were that economic growth in China remained weak, keeping demand muted, and that high interest rates had spurred concerns over growth in Europe and the US.

Copper prices rose to a one-week high but further gains were seen unlikely due to generally weak demand in top consumer China, a strong dollar and rising inventories.

Benchmark copper on the London Metal Exchange (LME) traded 0.5 per cent higher at $8,085 a metric ton in official rings after earlier touching $8,142, the highest since October 2.

“Things don’t seem to be improving in China. The property market is still in trouble,” a copper trader said.

Wheat prices on the Chicago Board of Trade were also buoyed by fears the conflict could spread and were up 0.75 per cent at $5.72-1/4 a bushel.

“Conflicts in West Asia generally mainly hit energy markets but we are seeing an impact on other commodities,” said Matt Ammermann, StoneX commodity risk manager. Raw sugar prices rose by about 1 per cent to 27 cents per lb.

Sugar prices are often influenced by trends in energy markets as cane is used to produce sugar and ethanol.

US natural gas futures rose to an eight-month high with the conflict among several bullish factors which also included a possible strike by workers at LNG export plants in Australia.