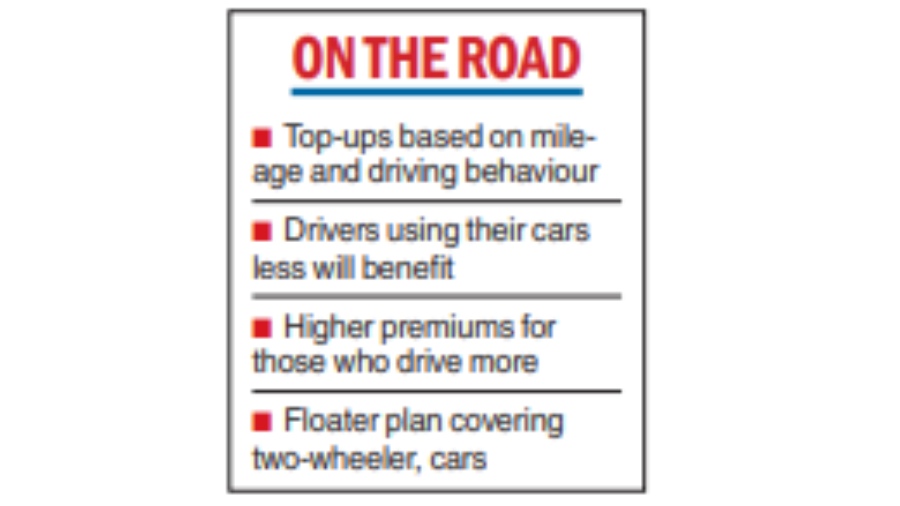

Insurance industry regulator IRDAI has permitted tech-based add-ons such as mileage and driving behaviour to own damage cover in motor insurance.

The regulator has also allowed the scope of a floater policy for individuals who own both two-wheelers and cars.

The add-ons can be opted by the user at the time of purchase or renewal of the policy. Vehicle use parameters such as mileage and driving pattern will be factored in while calculating the premium for the first time through the use of technology.

The premium will be effective for low use customers, especially those who drive less than 10,000 kilometres a year,” said Susheel Tejuja, principal officer, founder and MD, PolicyBoss.com.

“On the flip side, such a move will eliminate the cross-subsidy currently enjoyed by high use customers, possibly resulting in slightly higher premiums for this set.”

The add-ons will enable insurers to identify their liabilities. A person who drives the car more frequently is more exposed to the risk of accidents and has a higher chance of insurance claim than the one who drives less, said Ashwini Dubey, head, motor insurance renewals, Policybazaar.com

“These add-on covers will definitely appeal to those customers who are working from home more often, thus making car insurance cost more effective to them,” said Udayan Joshi, president, underwriting and reinsurance, Liberty General Insurance.

Rakesh Jain CEO of Reliance General Insurance said AI and data analytics would play a major role and will help insurers track trends that will lead to greater product innovation.

“The objective with such covers is that motor insurance essentially becomes more affordable, especially for those customers who primarily opt for only third-party covers and overlook the benefits of own damage covers,” said T.A Ramalingam, chief technical officer, Bajaj Allianz General Insurance.

Teluja said the floater plan for two-wheelers and private cars would eliminate the need to hold individual vehicle policies and track their renewals.