“We had initiated with a ‘Buy’ in February with a price target of Rs 220. We had avoided upgrading Yes Bank preferring to hear the new management before next rating action. We are turning ‘sell’ with a price target of Rs 176, our initiation price,” IndiaNivesh added..

International credit rating agency Moody’s, too, had a bearish outlook. It said the balance sheet clean-up by the lender will strain its profitability in the next 12-18 months as it makes provisions for stressed assets.

“We estimate that the bank’s overall stressed assets are about 8 per cent of its gross loans... The balance sheet clean-up will strain the bank's profitability in the next 12-18 months as it provides for the stressed assets,' Moody's said in a report.

The loss was driven by higher credit costs for the non-performing loans (NPLs) and creation of a contingent provision against a pool of identified stressed assets. “Despite near-term weakness, we expect the change in corporate behaviour under the new bank leadership will be credit-positive after the de-risking is complete,” Moody’s said.

The stocks of NBFC also had a bad on Tuesday over fears of a liquidity squeeze hurting their businesses after the downgrade of the papers of Anil Ambani-entities Reliance Home Finance, Reliance Commercial Home Finance and Reliance Capital.

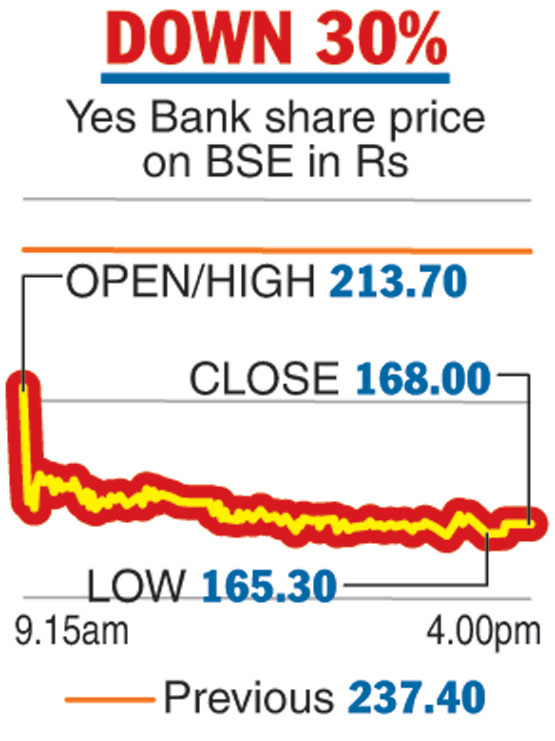

The Yes Bank stock tanked almost 30 per cent on Tuesday, the first day of trading after the bank reported a huge loss of Rs 1,506 crore on Friday that triggered a raft of brokerage downgrades. The markets were closed on Monday on account of the Lok Sabha voting in Mumbai.

Market valuation fell Rs 16,048.56 crore to Rs 38,909.44 crore on the BSE as the stock ended 29.23 per cent lower at Rs 168 on the BSE. Yes Bank dipped 29.70 per cent on the NSE to close at Rs 166.75.

In terms of volumes, 206.47 lakh shares were traded on the BSE during the day and over 21 crore shares on the NSE.

The disappointing results of the bank saw various brokerages downgrading the stock, including Macquarie which “double downgraded” the scrip to underperform.

“The latest quarterly results do not exactly bring good tidings and the recovery path for the bank’s battered valuations appear set for a tough and elongated period of recovery despite some glimmer of hope for fresh equity infusion,” brokerage IndiaNivesh said.

The Telegraph