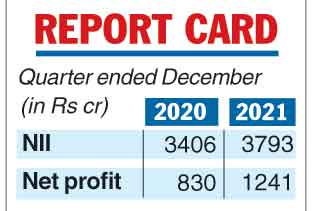

IndusInd Bank on Saturday reported a 50 per cent growth in consolidated net profits for the third quarter ended December 31, 2021. Net profit of the private sector lender rose to Rs 1,241.55 crore from Rs 830.39 crore in the corresponding period of the previous fiscal.

This jump came on the back of a strong growth in its net interest income (NII-income earned minus interest paid) and lower provisions.

Provisions at the lender declined to Rs 1,654.05 crore compared with Rs 8,153.52 crore in the year ago period. The NII of IndusInd Bank stood at Rs 3,793 crore, up 11 per cent from the previous year’s figure of Rs 3,406 crore. Other income at Rs 1,877 crore also showed a growth of 14 per cent.

The asset quality of the bank also improved during the period with gross non-performing assets (NPAs) in absolute terms declining to Rs 5,779.27 crore from Rs 6,245.04 crore on a sequential basis.

The percentage of gross NPAs softened to 2.48 per cent from 2.77 per cent during the same period while the net NPA ratio was at 0.71 per cent against 0.80 per cent. During the quarter, slippages were lower at Rs 2,598 crore compared with Rs 2,658 crore in the July-September period.

“The country saw resurgence of the Covid wave during the third quarter. The economic impact, however, has not been as severe due to effective policy responses as well as the vaccination programme.

“The bank saw continued traction on operating performance metrics… While Covid remains a risk to watch out for, the implications of the recent wave on our businesses have been limited. We are thus committed to executing our strategy quarter on quarter,’’ Sumant Kathpalia, managing director & CEO, IndusInd Bank, said.

IndusInd Bank said its deposits as on December 31 last year totalled Rs 2,84,484 crore against Rs 2,39,135 crore, an increase of 19 per cent over the previous year period. Of this, the low-cost CASA (current & saving account) deposits rose to Rs 1,19,894 crore with current account deposits at Rs 33,279 crore and saving account deposits at Rs 86,615 crore. The CASA deposits comprised 42 per cent of its total deposits.