The Telegraph

InterGlobe Aviation, the parent of budget carrier IndiGo, saw its net profits rise five-fold in the fourth quarter ended March 31, 2019, as the airline benefited from the higher fares triggered by Jet Airways limiting its operations.

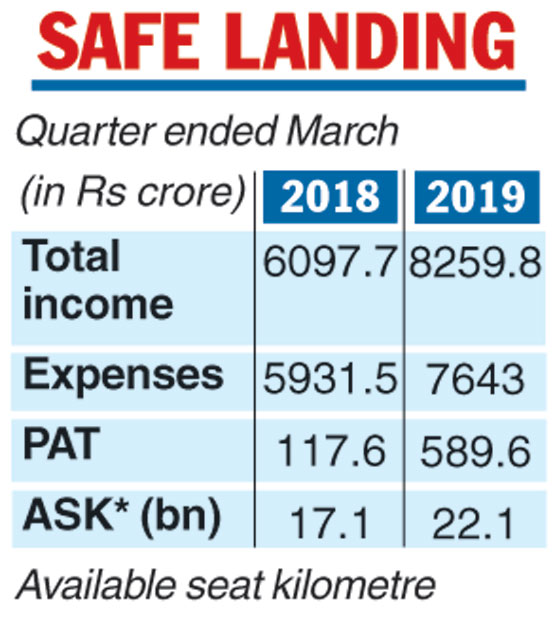

The company reported a profit after tax of Rs 589.6 crore in the January-March quarter of 2018-19 compared with Rs 117.6 crore in the corresponding period a year ago. InterGlobe saw its revenue from operations rising almost 36 per cent to Rs 7,883.3 crore during the quarter against Rs 5,799 crore in the year-ago period.

While the other income came in at Rs 8,259.8 crore, the total income rose 35.5 per cent to Rs 8,259.8 crore from Rs 6,097.7 crore in the same period last year. Of this, passenger ticket revenues stood at Rs 7,037.3 crore, a growth of 40.2 per cent. The yield, which is a measure of the airfares passengers pay, rose to Rs 3.70 in the quarter from Rs 3.31, an increase of almost 12 per cent.

Analysts had expected the airline to report strong numbers as rival Jet Airways had to ground flights during the period, leading to a spike in fares. The quarter saw its fuel cost rising 19 per cent to Rs 2,781.3 crore from Rs 2,338 crore in the year-ago period. Its cost per available seat kilometers rose almost 6.7 per cent.

The low-cost carrier said its annual net profit for 2018-19 stood at Rs 156.1 crore, 93 per cent less than Rs 2,242.4 crore for the 2017-18 financial year.

“Fiscal 2019 was a tough year for the airline industry in India because of high fuel prices, weak rupee and intense competitive environment. However, it is a tale of two halves for IndiGo, with the first half of the year incurring losses and the second half of the year experiencing a sharp recovery,’’ Ronojoy Dutta, CEO of InterGlobe, said.

While the results came after market hours, the InterGlobe shares settled with gains of over 2.50 per cent, or Rs 40.85, at Rs 1,663.

According to an Icra note, the increase in airfares because of the demand-supply imbalance created by the grounding of Jet impacted the passenger load factors of airlines.

During the fourth quarter, the load factor at IndiGo was 86 per cent, a drop of three per cent over the year-ago period.