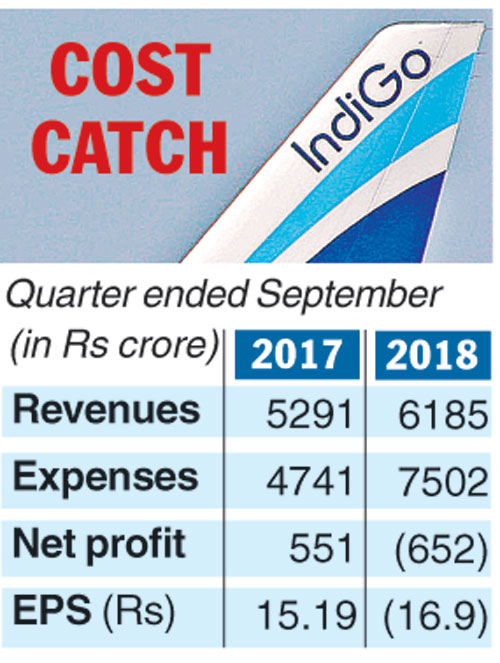

InterGlobe Aviation, the parent of IndiGo, has suffered a loss of Rs 651.2 crore ($89.1 million) for the September quarter — its first since listing on the stock exchange in November 2015 — while revenue from operations rose 16.9 per cent.

Total expenses soared 58.2 per cent to Rs 7,502.3 crore with aircraft fuel expenses surging 84.3 per cent and foreign exchange losses widening over seven-fold.

IndiGo’s revenue per available seat kilometre fell 8.1 percent to Rs 3.23 during the quarter from a year ago, while cost per available seat kilometre, excluding fuel, rose 13.5 per cent.

“Aviation in India is facing significant pressures from high fuel costs, rupee depreciation and intense competition, all of which have impacted our profitability this quarter,” chief executive officer Rahul Bhatia said in a statement.

“Despite this difficult environment, IndiGo remains well-positioned, thanks to our low-cost structure and strong balance sheet,” he said.

However, IndiGo has pushed back plans to own Airbus A320neo planes to preserve cash and will continue to lease them, Bhatia said on Wednesday.

“At times when there is a little uncertainty we want to be prudent with cash, so right now we are holding off buying any A320s with cash and continuing to rely on sale and leaseback,” he said on an analyst call.

IndiGo already owns ATR planes using free cash and had plans to own some A320neo aircraft as well but has now put the decision on hold and will review it in future, Bhatia said.

IndiGo has also put on hold plans to launch low-cost long haul flights and will increase its international presence using its existing fleet of A320neo aircraft. This is likely to help the airline that is looking at a 30 per cent increase in passenger carrying capacity in the current fiscal year.

IndiGo is taking deliveries of Airbus planes that were previously delayed because of problems with the engines manufactured by United Technologies’ Pratt & Whitney.

“Even if we have somewhat of a bubble in our capacity during these two quarters we are still comfortable with our long term capacity plans,” said the carrier’s senior adviser, Greg Taylor.

The Telegraph

Revenues up 17%

Revenues rose to Rs 6,185.31 crore, up 17 per cent from Rs 5,290.9 crore reported a year ago as IndiGo flew more passengers.

The airline reported a fall of 86 per cent in its earnings before interest, taxes, depreciation, amortisation and rent (EBITDAR) at Rs 220.4 crore against Rs 1,581.1 crore year-on-year. Fuel expenses surged 84.3 per cent to Rs 3,035 crore. Foreign exchange loss stood at Rs 335.4 crore.

The airlines at the end of September had a total cash balance of Rs 13,163.7 crore and ended the quarter with a net debt of Rs 2,641.1 crore.

IndiGo would have posted a bigger loss in the second quarter had it not been for finance income, income from sale and leaseback of aircraft, and compensation for engine snags, which led to the grounding of A320neo jetliners powered by Pratt & Whitney engines during the quarter.