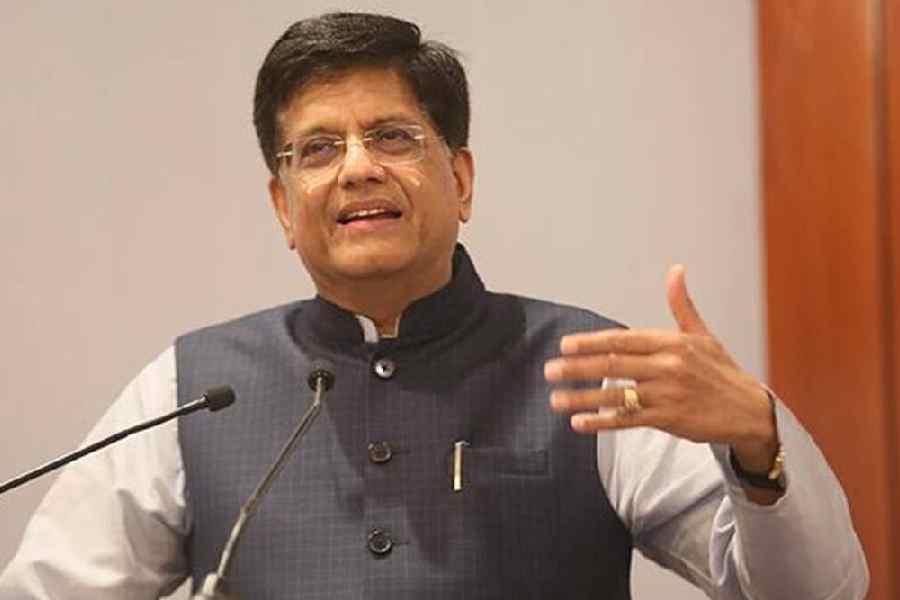

India will not accept the EU’s carbon tax on its exports and will fight to get a fair deal for producers and exporters, trade minister Piyush Goyal said on Tuesday.

He said India has already flagged its concerns over the carbon tax with the European Union (EU) and the WTO (World Trade Organization).

The CBAM (Carbon Border Adjustment Mechanism) or carbon tax (a kind of import duty) will come into effect from January 1, 2026. It will affect companies in carbon-intensive sectors such as steel, cement, fertiliser, aluminium and hydrocarbon products.

“I will assure you that we are extremely concerned about CBAM...We are taking it up with the WTO very seriously. We shall try to work and fight to get a fair deal for the Indian producers and exporters and nobody is complacent about CBAM,” he said.

The minister said the world will have to take a view on this tax and India would try to rally other countries to join the fight on the issue.

“We will always find innovative solutions but I can assure you that India will not be accepting unfair taxes or levies being put on the Indian steel or aluminium industry or any other industry,” he said, adding “let us not be scared of it and find solutions which will be to our advantage going forward”.

He said the EU would have to allow “common but differentiated responsibility” to India on the issue as New Delhi is a developing economy.

According to a report of the think tank Global Trade Research Initiative (GTRI), CBAM will translate into a 20-35 per cent tax on select imports into the EU starting January 1, 2026. More than a quarter of India’s exports of iron ore pellets, iron, steel and aluminium products worth more than $7 billion go to the EU.

Steel dumping

The government is looking into issues surrounding the dumping of certain categories of steel products into the Indian market, steel secretary Nagendra Nath Sinha said at the conclave.

The statement comes amid the industry raising concerns over the rise in steel imports.

In October India remained the net importer of steel.

Goyal said the government is working to provide better access to its steel industry in different countries through free trade agreements (FTAs).

At the same time, anti-dumping provisions for steel are being strengthened. India is including provisions like “high” value-added norms and “melt and pour” in FTAs.

“We are looking at both the options so that our steel industry gets protected from any dumping from the developed world,” he said adding the provisions would deter countries from the misuse of FTAs.

Wee Jin Yeoh, secretary-general, Southeast Asia Iron & Steel Institute, warned

every country will eventually have its version of the carbon tax, gradually reducing the export potential of steel.

He suggested the steel industry would benefit in the future if it focused

on the domestic markets.

Moderating the session, Michel V. Hoey, senior partner, Luxembourg, McKinsey, said the number of trade restrictions related to steel imports globally has steadily grown to 11,000 in 2022 from from 8,300 in 2018.

“In the future, because of overcapacity and a different pace of decarbonisation, more protectionist measures are expected to come,” Hoey added.