IndusInd Bank on Wednesday reported a lacklustre five per cent growth in net profits for the third quarter ended December 31, 2018 as provisions jumped because of a loan exposure to infrastructure financier IL&FS.

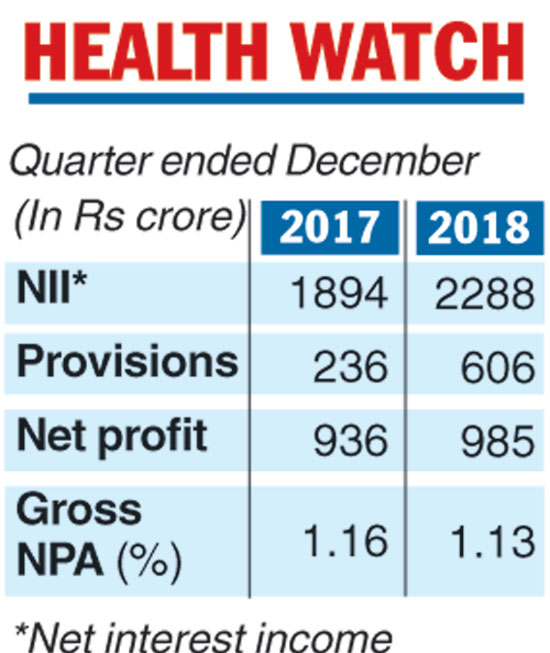

The private sector lender said it had made a “contingent provision” of Rs 255 crore on these loans. Though the IL&FS asset continues to be standard in its books, it resulted in provisions at the bank rising to Rs 606.68 crore compared with Rs 236.16 crore in the same period of last year. However, on a sequential basis, the provisions rose marginally from Rs 590.27 crore.

IndusInd Bank reported a net profit of Rs 985.03 crore during the third quarter compared with Rs 936.25 crore in the year-ago period, showing a growth of 5.21 per cent.

So far this fiscal, the bank has made a provision of Rs 530 crore on its IL&FS exposure, which includes Rs 275 crore in the July-September quarter.

IL&FS, under a new government appointed board since October, owes Rs 3,000 crore to the bank and is now classified as an SMA-2 account, which means if the dues are not cleared within 90 days, the bank will have to classify it as an NPA.

Speaking to the press, managing director and chief executive Romesh Sobti said the bank has adequate “securities” with regard to the account even as it has already built a buffer of over Rs 500 crore to cushion any negative surprises.

He said as much as Rs 2,000 crore of the Rs 3,000 crore lent to the IL&FS group have been to the parent. The bank is now assessing the value of the securities to ascertain the extent it will have to hold as an additional buffer.

The IL&FS group owes banks close to Rs 60,000 crore of its overall Rs 94,000 crore-plus outstanding debt. The Reserve Bank of India (RBI) has turned down the banks’ request that they continue to classify the account as standard till a moratorium imposed by the NCLAT is lifted.

Sobti said if one were to exclude the IL&FS exposure, the bank was performing well as reflected in the 27 per cent jump in operational profit at Rs 2,117 crore for the period.

Despite the Rs 255-crore provisioning, the stock markets gave a thumbs-up to the results with the IndusInd Bank stock gaining almost 1.50 per cent to Rs 1,600.80.

During the quarter, the bank witnessed a 35 per cent growth in credit with deposit growth coming in at 20 per cent, which were above the industry growth. Similarly, net interest income (interest earned minus interest expended) grew 21 per cent to Rs 2,288 crore.

The bank’s overall exposure to the MSME sector stands at Rs 32,000 crore and there is no demand for a loan recast, Sobti said, when asked about the impact of the special dispensation to the sector by the RBI.

The Telegraph