Interest rates on home loans and other products will harden over the next few days after the Reserve Bank of India (RBI) raised the repo rate by 50 basis points to 4.90 per cent in a desperate attempt to cool inflation.

The impact will be almost immediate on floating rate loans that are linked to the external benchmark lending rate (EBLR) where there will be a complete transmission of the policy rate.

The interest rate hike will impact both existing and new borrowers.

Bankers added that deposit rates would also go up but that could happen with some lag.

Observers added that after the second repo rate hike within a month, the marginal cost of funds-based lending rate (MCLR) will also turn expensive but it may not be as sharp as in the case of loans linked to the EBLR.

Currently, lenders like ICICI Bank charge interest rates ranging from 7.55-7.8 per cent for salaried borrowers. This is for home loans that are linked to the repo rate. The current EMI for a Rs 35 lakh home loan (7.55 per cent) over a 20-year tenure is Rs 28,303. This will go up to Rs 29,384 following the repo rate hike.

As of December 31, 2021, almost 58.2 per cent of the home loans given by commercial banks were linked to external benchmark while 33.1 per cent were under the MCLR framework.

During the period, a little over 49 per cent of the outstanding floating rate housing loans came under the EBLR regime while 41.9 per cent came under the MCLR regime.

In the case of vehicle loans, this ratio stood at 38.2 per cent and 57.3 per cent respectively while it was 58.5 per cent and 35 per cent for MSMEs.

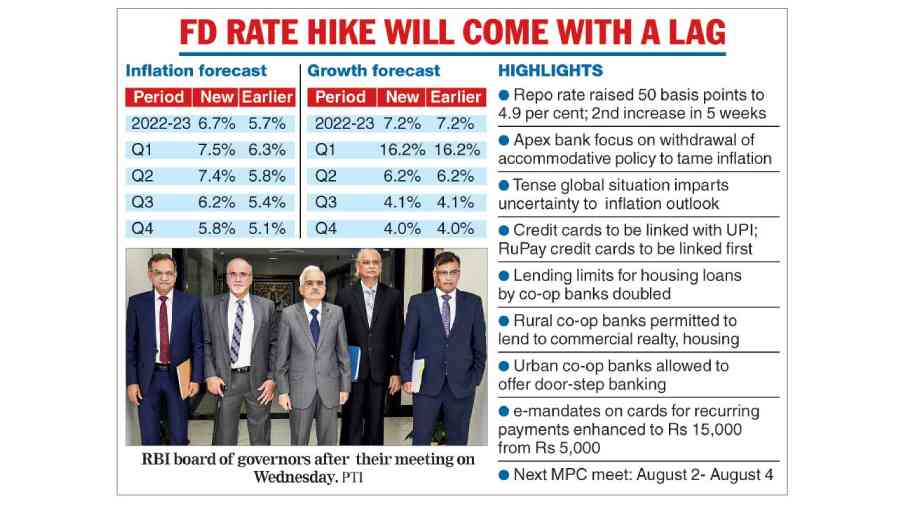

Many experts expect the RBI to raise rates aggressively over the next few months even though it has indicated that it is fighting a losing battle while wrestling with inflation which rose to an eight-year high of 7.79 per cent in April and is expected to close at 6.7 per cent this year.

This has ignited fears that demand in the real estate sector could suffer — just after it had started to show signs of coming out of the dark shadow of the pandemic. However, bankers feel that this is unlikely to happen for now given the salary increases. There are others who see only a partial impact.

“The rate hike will push up home loan interest rates, which had already begun creeping upward after the surprise monetary policy announcement last month. Interest rates will remain lower than during the global financial crisis of 2008, when they went as high as 12 per cent and above.

“Nevertheless, the current hike will reflect in residential sales volumes in the months to come, more so in the affordable and mid-segments,” said Anuj Puri, chairman at Anarock.

He, however, added that the silver lining is that the Indian housing market is still largely end-user driven, and there is no investor mindset seeking the lowest possible entry point.

Since October 1, 2019, all new floating rate personal or retail loans (housing, auto and others) and floating rate loans to MSMEs are linked to external benchmark like the policy repo rate, or Government of India three-months treasury bill yield published by the Financial Benchmarks India Private Ltd (FBIL), Government of India 6-months treasury bill yield published by the FBIL, or any other benchmark market interest rate published by the FBIL.

However, most of the banks peg it to the policy repo rate.