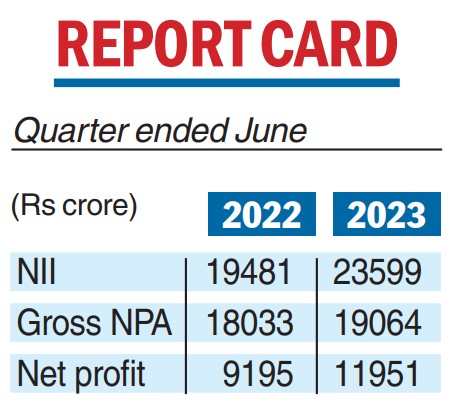

HDFC Bank on Monday reported a 30 per cent rise in its net profit for the quarter ended June 30 that topped Street estimates. The country’s largest private-sector lender posted a net profit of Rs 11,951.77 crore compared with Rs 9,195.99 crore in the same period of the previous year.

This was the first quarterly numbers from the lender after the recent reverse merger with parent HDFC. Analysts were expecting HDFC Bank to clock net profits between Rs 11,000 crore and Rs 11,500 crore for the quarter. On a consolidated basis, HDFC Bank saw its bottomline rising 29 per cent to Rs 12,370.38 crore compared with Rs 9,579.11 crore in the year-ago period.

During the quarter, the lender’s core net interest income (interest earned less interest expended) rose 21.1 per cent to Rs 23,599 crore from Rs 19,481 crore in the quarter ended June 30, 2022, while the consolidated net revenue was up 25.9 per cent to Rs 35,067 crore for the quarter ended June 30, 2023, from Rs 27,844 crore last year.

Total balance sheet size as of June 30, 2023 was Rs 25,01,693 crore against Rs 21,09,772 crore as of June 30, 2022, a growth of 18.6 per cent.

There was a marginal dip in its asset quality with the ratio of gross non-performing assets to gross advances standing at 1.17 per cent, up from 1.12 per cent as on March 31, 2023 and 1.28 per cent as on June 30, 2022. The lender’s net non-performing assets stood at 0.30 per cent of net advances as on June 30, 2023, against 0.27 per cent on a sequential basis. In absolute terms, the gross NPAs were at Rs 19,064.12 crore against Rs 18,033.67 crore in the same period of the previous year.

HDFC Bank said that during the quarter, its total advances stood at Rs 16,15,672 crore, an increase of 15.8 per cent over June 30, 2022 period at Rs 13,95,068 crore.

Central Bank of India reported robust numbers for the quarter with net profits surging nearly 78 per cent to Rs 418 crore from Rs 235 crore in the year-ago period on better asset quality. The percentage of its gross NPAs showed an improvement of 995 basis points on a year-on-year basis, even as its NII rose 48.27 per cent over the corresponding period of the previous year to Rs 3,176 crore.